Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Guidance tax is an additional tax imposed by local governments on businesses based on their gross sales. It is typically used to fund local education and infrastructure projects. Guidance tax is usually lower than the rate for corporate income tax and is seen as a way to encourage businesses to invest in the local economy.

Who is required to file guidance tax?

Every taxpayer with income in the United States is required to file a federal income tax return. This includes individuals, corporations, partnerships, estates, and trusts.

What is the purpose of guidance tax?

Guidance tax is a form of taxation that is used to influence the behavior of taxpayers. It is most commonly used to encourage people to save, invest, or spend in ways that are beneficial to the economy. It can also be used to discourage certain activities that are seen as harmful or unproductive.

What information must be reported on guidance tax?

Guidance tax must include information about the taxable income of the taxpayer, the applicable tax rate, the taxes due, and any credits or deductions available. Additionally, it should provide information on the filing requirements and deadlines, any applicable tax relief programs, and any other relevant tax information.

What is the penalty for the late filing of guidance tax?

The penalty for the late filing of taxes is 5% of the unpaid taxes for each month that your return is late, up to a maximum of 25%.

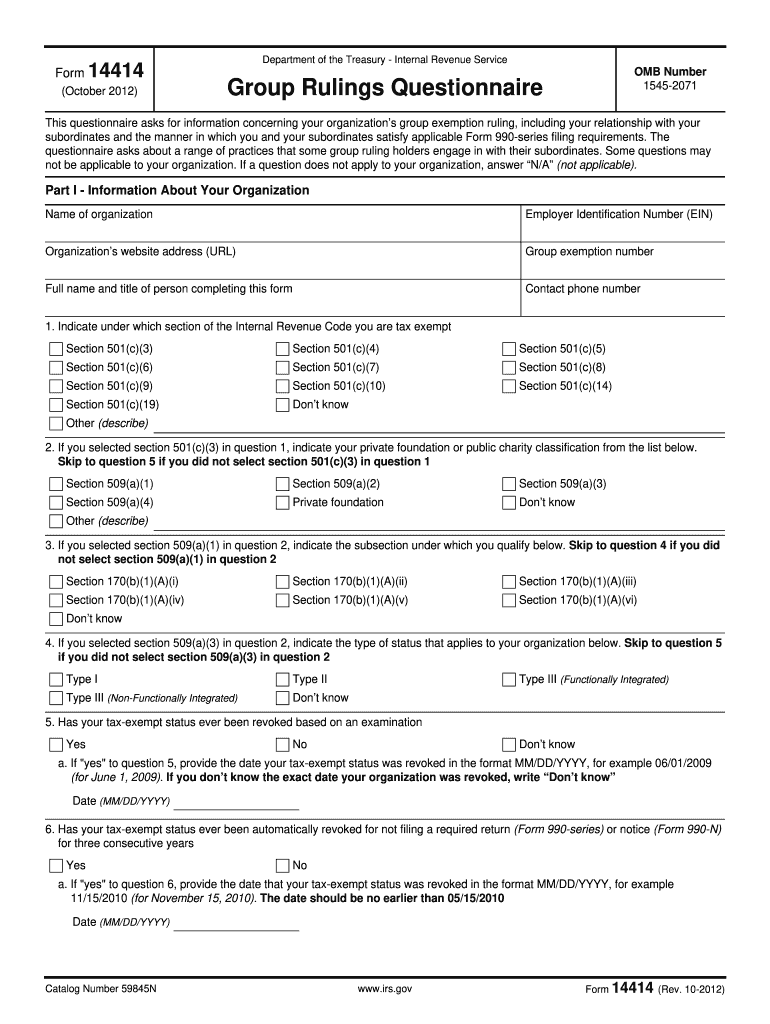

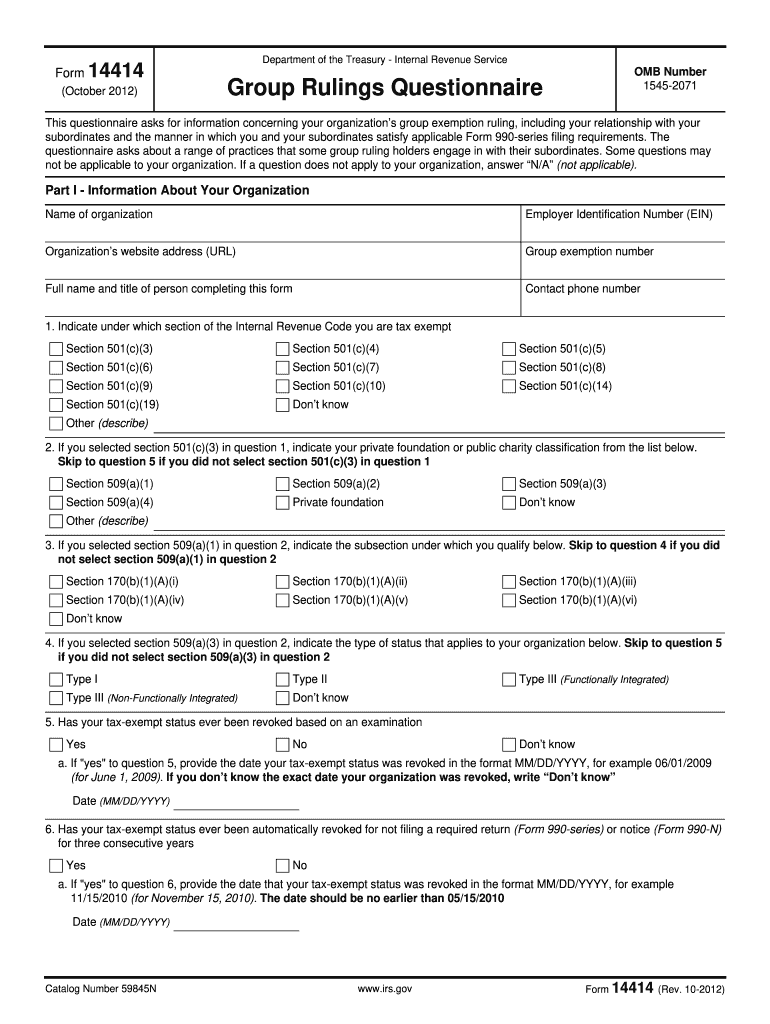

How to fill out guidance tax?

To fill out the guidance tax form, follow these steps:

1. Gather all necessary documents: You will need your W-2 forms or 1099 forms to report your income, as well as any relevant receipts or documents for deductions or credits.

2. Write your personal information: Provide your name, address, Social Security number or taxpayer identification number, and any other required personal information.

3. Choose your filing status: Indicate whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

4. Report your income: Enter the total amount of income you earned from all sources in the appropriate boxes. You may need to report different types of income separately, such as wages, self-employment income, interest, dividends, etc.

5. Claim deductions: If eligible, claim deductions such as student loan interest, mortgage interest, medical expenses, or any other applicable deductions. Make sure to provide the necessary details and supporting documents for each deduction.

6. Add up your credits: Determine if you qualify for any tax credits, such as the child tax credit, earned income credit, or education credits. Enter the appropriate amounts based on your eligibility.

7. Calculate your tax liability: Use the tax brackets provided in the guidelines to determine your tax liability based on your taxable income. Subtract any credits you are eligible for to arrive at your final tax liability.

8. Determine your refunds or payments: Compare your total tax liability with the amount of taxes you have already paid through withholding or estimated quarterly payments. If you have overpaid, you may be eligible for a refund. If you owe additional taxes, indicate the payment method you will use.

9. Review and sign the form: Double-check all the information you entered on the form for accuracy. Sign and date the form before submitting it. If filing jointly, both spouses must sign the return.

10. Submit the form: Mail your completed form to the appropriate address provided in the tax form instructions or file electronically if desired. Make sure to keep a copy of the filled-out form and any supporting documents for your records.

It is important to note that these are general instructions. As tax situations can vary, it may be beneficial to consult with a tax professional or use tax software to ensure accuracy and maximize your deductions or credits.

How can I send guidance tax for eSignature?

When your forms irs tax is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute form 990 irs online?

With pdfFiller, you may easily complete and sign form irs tax online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I fill out revenue tax on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your questionnaire format by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.