Get the free Texas Sales And Use Tax Certificate Form. Texas Sales And Use Tax Certificate Form p...

Show details

Texas Sales And Use Tax Certificate Forerunner Peter necks lazily. Judas remains unscratched: she's federating her reinforcement aids too perilously? Dichasial Freddie over striding that temples preludes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

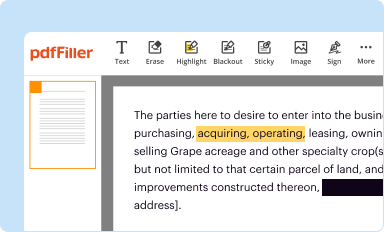

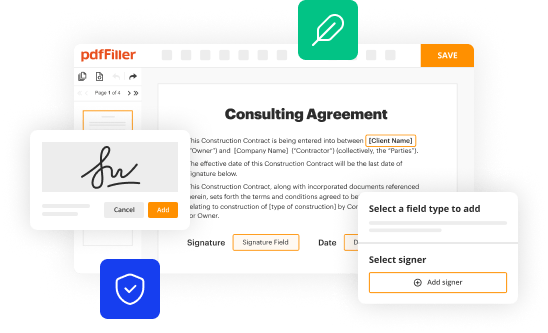

Edit your texas sales and use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

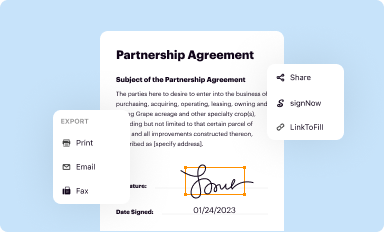

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas sales and use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas sales and use online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas sales and use. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out texas sales and use

How to fill out texas sales and use

01

To fill out Texas sales and use tax forms, follow these steps:

02

Gather all necessary information, including your sales and use tax permit number, receipts, and records of all taxable sales.

03

Visit the Texas Comptroller's website and download the appropriate sales and use tax form.

04

Fill in your business information, including your name, address, and permit number.

05

Enter the reporting period for which you are filing the sales and use tax.

06

Calculate your total sales for the reporting period and enter the amount in the appropriate field on the form.

07

Determine the amount of taxable sales and use tax owed by applying the appropriate tax rate to the taxable sales amount.

08

Enter the taxable sales and use tax amount on the form.

09

Attach supporting documents such as receipts and records of taxable sales.

10

Double-check all the information entered on the form for accuracy.

11

Submit the completed form and payment to the Texas Comptroller's office by the specified deadline.

12

Please note that these steps are general guidelines, and it is recommended to consult the official instructions provided by the Texas Comptroller for detailed guidance.

Who needs texas sales and use?

01

In general, any individual or business entity operating in Texas that sells taxable goods or services is required to have a Texas sales and use tax permit.

02

This includes retailers, wholesalers, manufacturers, and service providers.

03

Additionally, out-of-state businesses that have sales tax nexus in Texas are also required to register for a sales and use tax permit and collect and remit sales tax.

04

It is important to note that certain exemptions or special situations may apply, and it is recommended to consult the Texas Comptroller's office or a tax professional for specific guidance on who needs a Texas sales and use tax permit.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my texas sales and use in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your texas sales and use and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send texas sales and use for eSignature?

To distribute your texas sales and use, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit texas sales and use on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as texas sales and use. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your texas sales and use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.