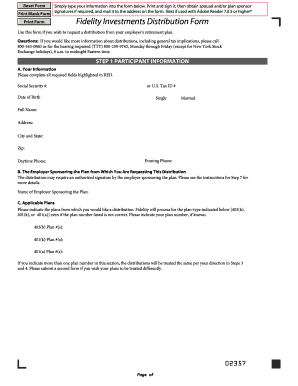

Get the free fidelity 401k rollover to another company form

Get, Create, Make and Sign

How to edit fidelity 401k rollover to another company online

How to fill out fidelity 401k rollover to

How to fill out Fidelity 401k rollover to:

Who needs fidelity 401k rollover to:

Video instructions and help with filling out and completing fidelity 401k rollover to another company

Instructions and Help about fidelity 401k distribution form

— What we're going to be talking about in this video today is how to roll over your 401k A lot of people are clueless when it comes to retirement accounts and the different things that you can do They have these old 401ksthat may be sitting around that they just don't know what to do with One of the options that you have is to roll over your 401k either into your new 401k or you can actually roll this over into a couple of different retirement accounts That's what we're going to explain in this video Is what you can do with that old 401k from a previous job and also why you may wanna actually rollover a 401k in the first place The first thing that we have to understand here is that not all 401ks are created equally Some 401ks are perfect investments that hold low fee index funds or low fee investments Other 401ks are loaded with fees, and they are just not good investments That is one of the problems with the 401k is that there all kinds of different plans out there Unfortunately what ever provider your employer picks you are stuck with that particular plan If it's a good plan then you are in good luck But if it's not a good plan there's pretty much nothing you can do except for rollover that 401k into a different type of retirement account that you may have more control over One of the things that you can do with a 401k is to roll over a bad or old 401k into a different type of low fee IRA I'll show you guys couple of examples of that or options in a little You basically have to transfer the funds from this old 401k into a new IRA or another 401k within 60 days to fall into the IRS limit here Otherwise you will get charged a penalty and the taxes associated with dipping into that 401k early So you definitely want to make sure that you do this in a timely manner to fall within that 60-day window The very first thing you have to ask yourself when you are looking to roll over a 401k if you are going to reopening a new account is where are you going to open this new account I have two different recommendations I'm going to make to you guys Number one if you're looking for the best low fee retirement account option out there in my opinion that ingoing to be M1 Finance They offer completely fee free retirement accounts and the minimum balance to open an account with them is just 500 They also have a very easy rollover process if you do decide to rollover 401k to M1 Finance and open up an IRA over there That in my opinion is the best option for a fee free option for a 401k rollover If you are looking for a fully managed portfolio my second recommendations going to be Betterment which is actually a robo-advisor They charge a small asset management fee of 025 which is still a lot lower than what you're going to pay to a traditional in-personfinancial advisor The advantage to using Betterment is there are a number of different advantages such as tax coordinated portfolios They also fully manage your portfolio automate it they rebalance it They take care...

Fill fidelity form rollover pdf : Try Risk Free

People Also Ask about fidelity 401k rollover to another company

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your fidelity 401k rollover to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.