Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

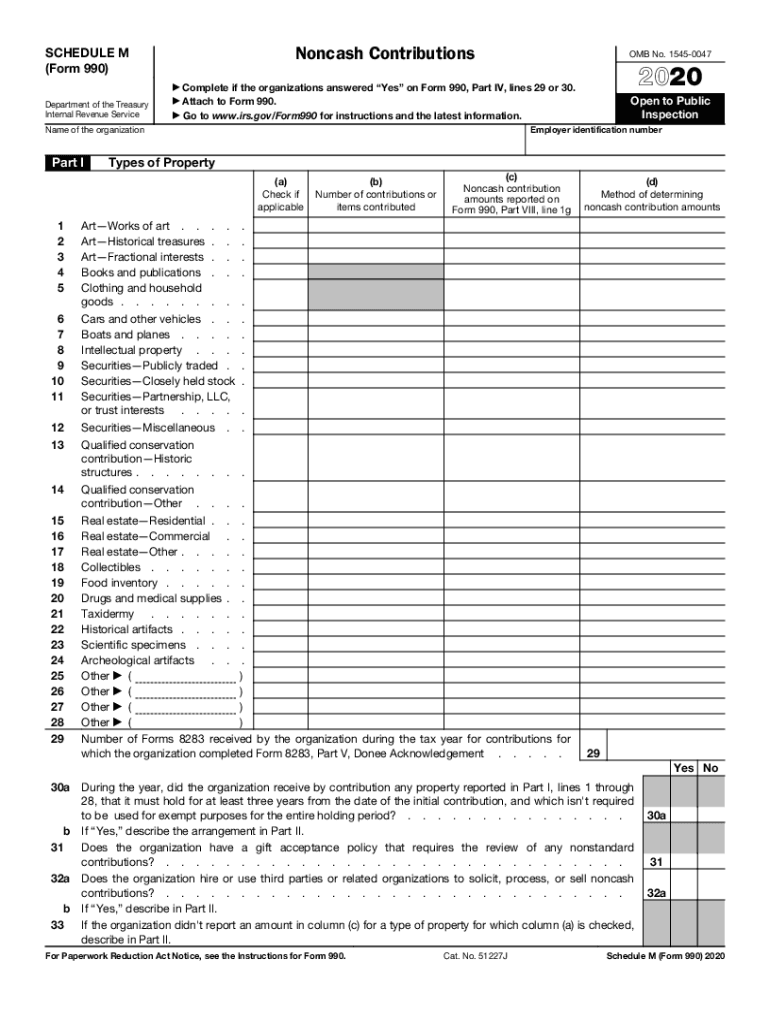

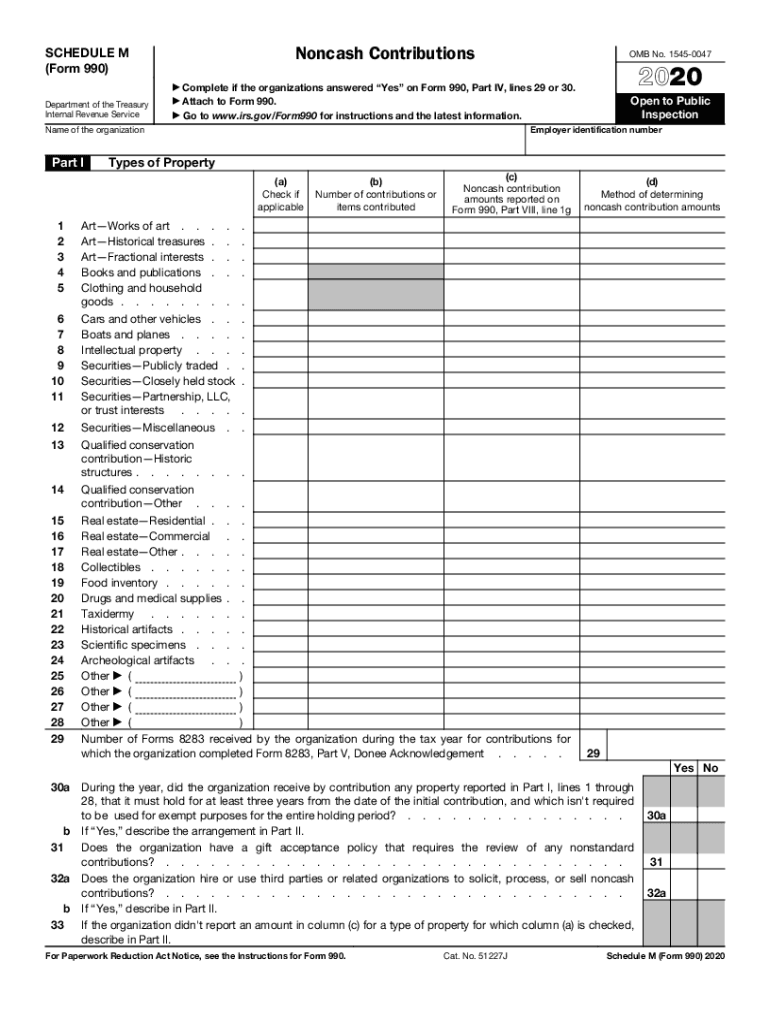

What is irs schedule m form?

The IRS Schedule M form, also known as the Making Work Pay and Government Retiree Credits form, was used by individuals to calculate and claim the Making Work Pay tax credit or the Government Retiree credit. The Making Work Pay credit was introduced as part of the American Recovery and Reinvestment Act of 2009, and it allowed eligible individuals to claim a tax credit of up to $400 ($800 for married couples filing jointly) based on their earned income. The Government Retiree credit provided a one-time $250 credit to certain government retirees who did not receive Social Security benefits, Railroad Retirement benefits, or veterans' benefits. This form is no longer used as these credits expired after the 2010 tax year.

Who is required to file irs schedule m form?

The IRS Schedule M form is required to be filed by taxpayers who are claiming the making work pay credit or the government retiree credit on their federal tax return.

How to fill out irs schedule m form?

To fill out the IRS Schedule M form, which is used to calculate the Making Work Pay and Government Retiree Credits, follow these steps:

1. Download Schedule M: Visit the official website of the Internal Revenue Service (IRS) and search for Schedule M. Download the form and open it using a PDF viewer.

2. Enter personal information: At the top of the form, provide your full name, Social Security number, and filing status (e.g., Single, Married Filing Jointly, etc.).

3. Determine eligibility: Review the instructions on the form or consult a tax professional to determine if you are eligible for the Making Work Pay and Government Retiree Credits. These credits were available for specific tax years, and eligibility requirements may vary.

4. Calculate the Making Work Pay Credit: If eligible for the Making Work Pay Credit, follow the instructions to calculate the credit amount. Generally, this credit is 6.2% of earned income, subject to a maximum limit (e.g., $400 for single filers or $800 for married filing jointly).

5. Calculate the Government Retiree Credit: If eligible for the Government Retiree Credit, follow the instructions to calculate the credit amount. This credit was available for certain government retirees and depends on the number of months during the tax year that you received a qualifying government retirement or disability payment.

6. Add the credits: If you qualify for both credits, sum up the amounts determined in steps 4 and 5 to get the total credit amount.

7. Transfer the credit amount: On your main tax return (e.g., Form 1040 or 1040A), transfer the total credit amount found on Schedule M to the appropriate line on the tax return.

8. Attach Schedule M to your tax return: Once you've completed Schedule M, detach it from any instruction pages, and attach it to your federal tax return. Make sure to keep a copy for your records.

Note: It's important to read the Schedule M instructions thoroughly to ensure accurate completion, as tax laws and eligibility criteria may change over time. If you're unsure about any aspect, it's advisable to consult a tax professional for assistance.

What is the purpose of irs schedule m form?

The purpose of IRS Schedule M is to calculate the Making Work Pay Credit, which is a tax credit available to eligible individuals. This form is used to determine the amount of credit a taxpayer is eligible for based on their income, tax liability, and other factors. The Making Work Pay Credit was available for tax years 2009 and 2010 to incentivize work and boost the economy during times of economic downturn.

What information must be reported on irs schedule m form?

On IRS Schedule M form, the following information must be reported:

1. Amount of alternative minimum tax (AMT) adjustment related to depreciation taken for regular tax purposes but not allowed for AMT purposes.

2. Amount of adjustment related to depreciation taken for AMT purposes but not allowed for regular tax purposes.

3. Amount of passive activity losses and credits allowed for regular tax purposes but disallowed for AMT purposes.

4. Amount of tax preference items related to depreciation.

5. Amount of difference in basis for property between regular tax and AMT purposes.

6. Amount of gain or loss on the disposition of property.

7. Amount of adjustments related to incentive stock options.

8. Amount of adjustments related to tax-exempt interest.

9. Amount of adjustments related to foreign tax credits.

10. Any other adjustments required by the tax law.

The Schedule M form is used by individuals, estates, and trusts to report certain adjustments to calculate the alternative minimum tax liability.

When is the deadline to file irs schedule m form in 2023?

The specific deadline for filing IRS Schedule M for the tax year 2023 is not yet available, as it is subject to change. Typically, the deadline for filing Schedule M is the same as the deadline for the federal income tax return, which is April 15th. However, if April 15th falls on a weekend or holiday, the deadline may be extended. It is advised to consult the IRS website or seek professional assistance for the most up-to-date and accurate information regarding tax deadlines.

What is the penalty for the late filing of irs schedule m form?

The penalty for the late filing of IRS Schedule M form depends on the specific circumstances and provisions of the Internal Revenue Code. Generally, if a taxpayer fails to file Schedule M on time, they may be subject to a late filing penalty.

As of 2021, the penalty for late filing of Schedule M is $330 per month or part of a month, up to a maximum of 5 months. However, if the taxpayer can show reasonable cause for the delay, they may be able to avoid the penalty.

It is always advisable to consult with a tax professional or refer to the specific instructions provided by the IRS for accurate and up-to-date information regarding penalties for late filing of Schedule M or any other tax form.

How can I modify irs schedule m form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your schedule m form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send irs m form for eSignature?

Once your 990 schedule m is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the schedule m form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your irs schedule m form.