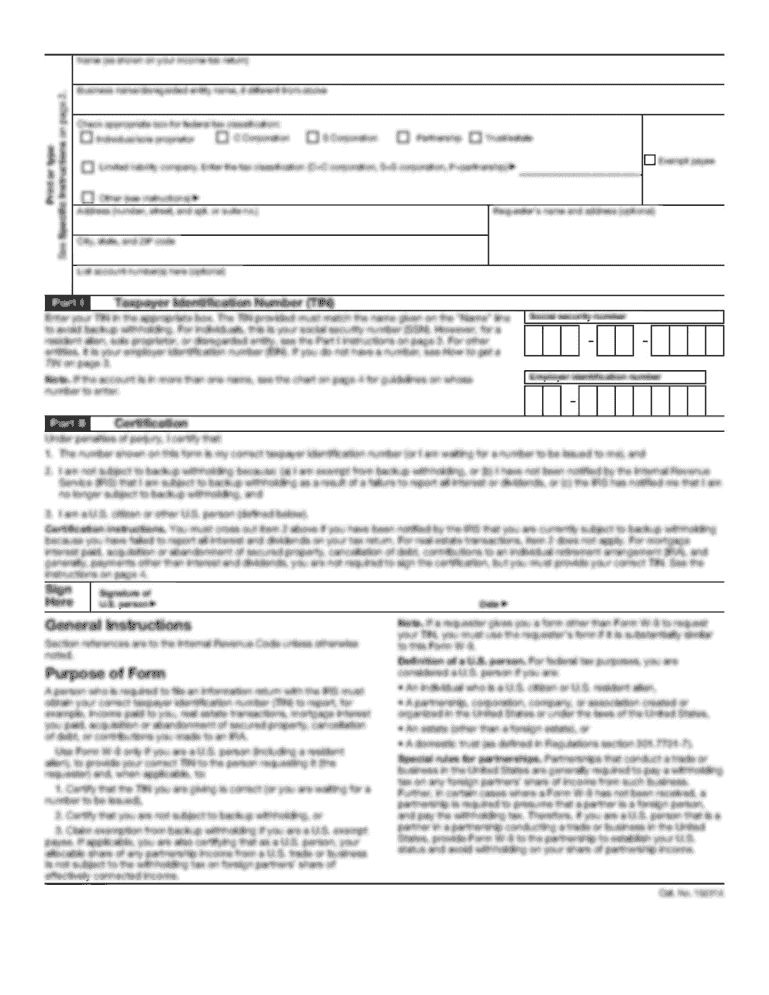

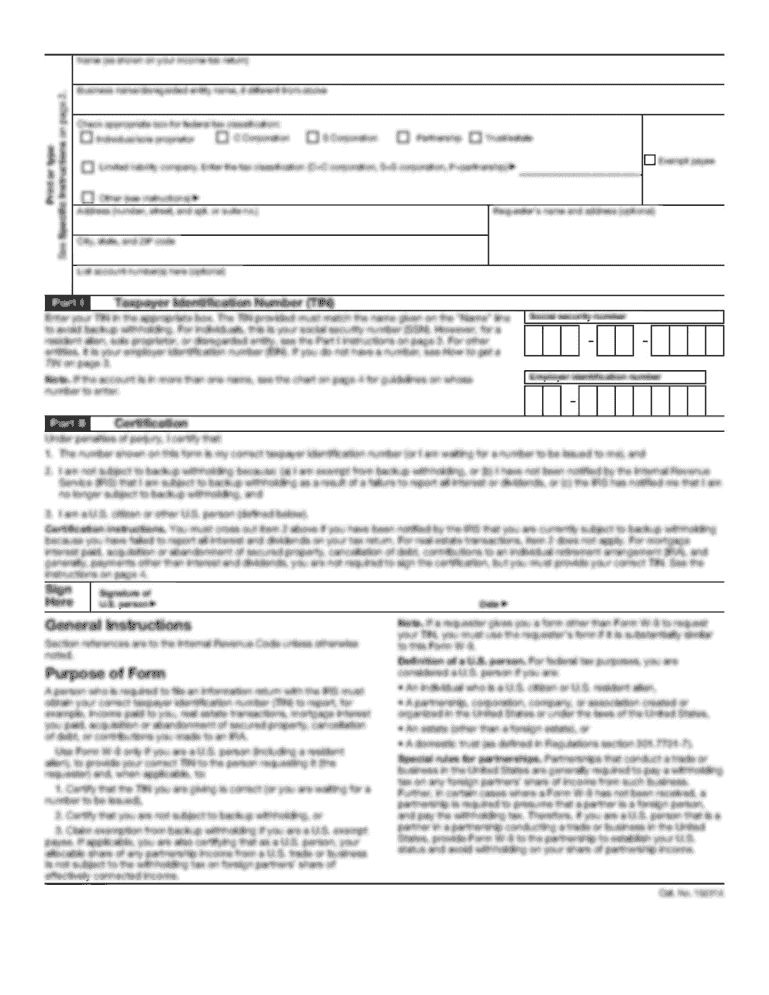

CA FTB 540 Instructions 2016 free printable template

Get, Create, Make and Sign

Editing where to attch check to ca form 540 online

CA FTB 540 Instructions Form Versions

How to fill out where to attch check

Video instructions and help with filling out and completing where to attch check to ca form 540

Instructions and Help about where to attch check

Kits available from one way meeting calm please note it#39’s important to do this with cartridges fresh out of a printer if the cartridge has been sat standing for a while outside a printer results may vary in this kit you will receive the following plus an additional sticker this kit and guide are suitable for the following ink cartridges before proceeding please check that yours is listed here to begin place the ink cartridge in the supplied priming tool ensuring it fits snugly next take the syringe and attach it to the base of the priming tool and remove as much ink as possible until empty or near empty donor reuse the ink from the cartridge and carefully dispose of it as we will reuse the syringe in a moment each Canon cartridge has dimpled area under the label please identify your cartridge from this list to find the exact location of this dimple as this is where we need to create a hole it is important to do this accurately you can neither use the supply drill a bit in the kit, or alternatively we recommend power drill with a similar size trilobite very careful to only drill through the plastic casing and not all the way into the cartridge you can now prepare the ink refill now attach the needle to the empty syringe and filled with the required amount of ink for your cartridge listed here do not overfill you will feel sponge inside the cartridge and it#39;important that the needle is just inside this but not all the way through it forcing the needle all the way down into the cartridge will damage it, so please be gentle once filled carefully wipe the top of the cartridge and place the supplied sticker directly over the original make sure to be as accurate as possible when doing so to avoid covering any vent snow take the empty syringe and reattach it to the base of the priming tool and pull out a small amount of ink to make sure that it#39’s flowing correctly take a piece of kitchen roll or paper towel and press the cartridge down onto it if you filled the cartridge correctly you should see a clear black line lepton the paper your ink cartridge is now ready to use you

Fill form : Try Risk Free

People Also Ask about where to attch check to ca form 540

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your where to attch check online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.