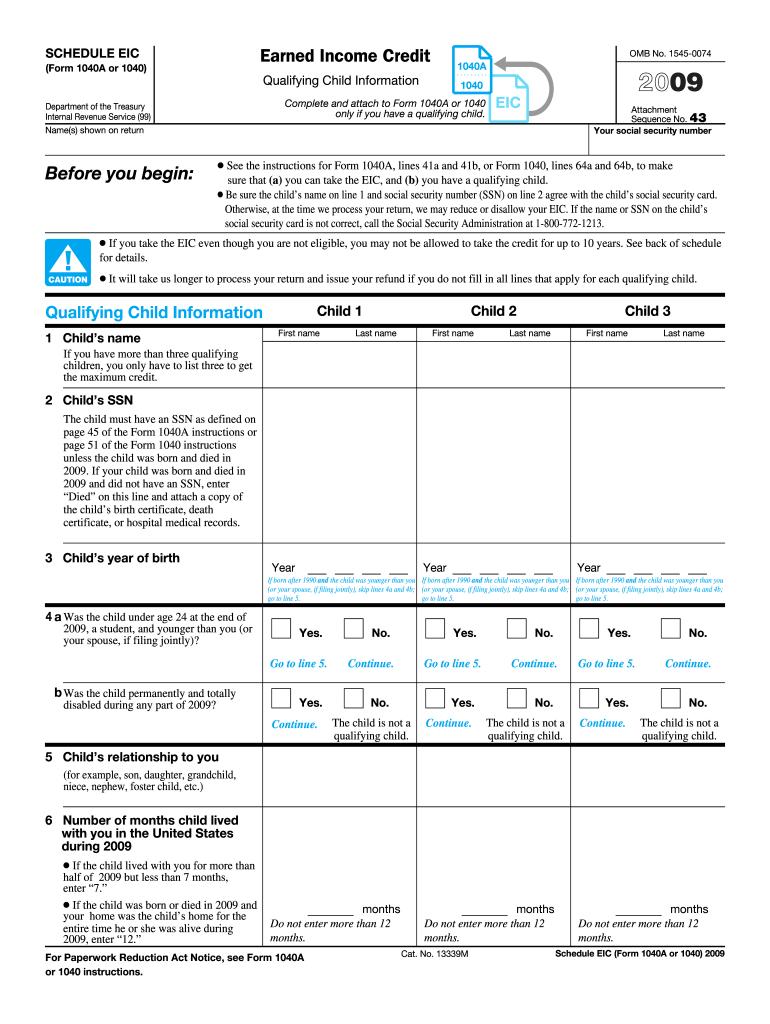

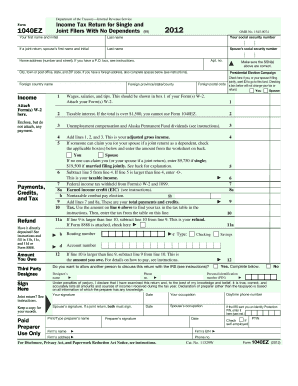

What is 1040 IRS schedule EIC 2009?

Form 1040 Schedule EIC serves to inform the IRS that you claim your qualifying child(ren) as part of your Earned Income Tax Credit.

Who Can Use Form 1040 Schedule EIC 2009?

If you’re a low- or moderate-income taxpayer, you may claim the Earned Income Tax Credit to lower the amount of taxes you owe and increase your refund. Credit is allocated if you meet specific criteria (family size, age, filing status, income threshold, investment income) and/or if you have children or dependent relatives. Use Form 1040 Schedule EIC to provide the IRS with your qualifying child's information to claim the EITC for them. Please note only one person can claim a qualifying child. For the latest information on other requirements for your child(ren) EITC eligibility, check the instructions on the second page of Form 1040 Schedule EIC.

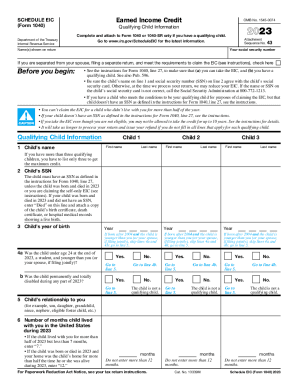

What information do I need to fill out IRS Schedule EIC in 2010?

The form 1040 Schedule EIC doesn’t require you to calculate the amount of your EIC. All you need to do is provide the information about your children: names, birthdays, Social Security Number, how they are related to you, and the amount of time they have been living with you. You can find more detailed information on how to fill out the form on the second page of the document.

How do I fill out IRS Schedule EIC in 2010?

Filling out 1040 Schedule EIC doesn’t have to be stressful and time-consuming. Use pdfFiller, a trusted PDF editing solution, to quickly complete the form.

- Open the form by clicking Get Form.

- Click on the required field and start to fill it out.

- Use the checkmark tool to complete sections 2a and 2b.

- Click Done when you finish completing the form.

You can use pdfFiller to complete other forms and take advantage of multiple annotation and editing tools and the built-in eSignature functionality.

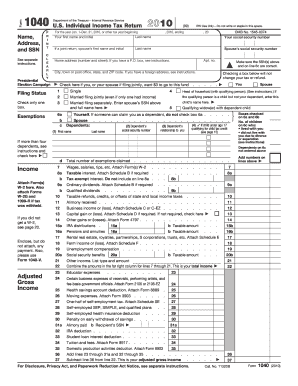

Do I need to attach1040 EIC Schedule to other forms?

You need to attach your 1040 Schedule EIC to 1040 or 1040-SR.

When is 1040 Schedule EIC due?

The deadline for filing is 1040 and 1040-SR in 2010 is April 18th. The Schedule EIC must be attached to the forms mentioned above and filed before this date.

Where do I send IRS Schedule EIC?

The Internal Revenue Service processes all the forms sent considering the earned income credit. You need to include your 1040 EIC Schedule Form in your tax return forms and send them to the IRS.