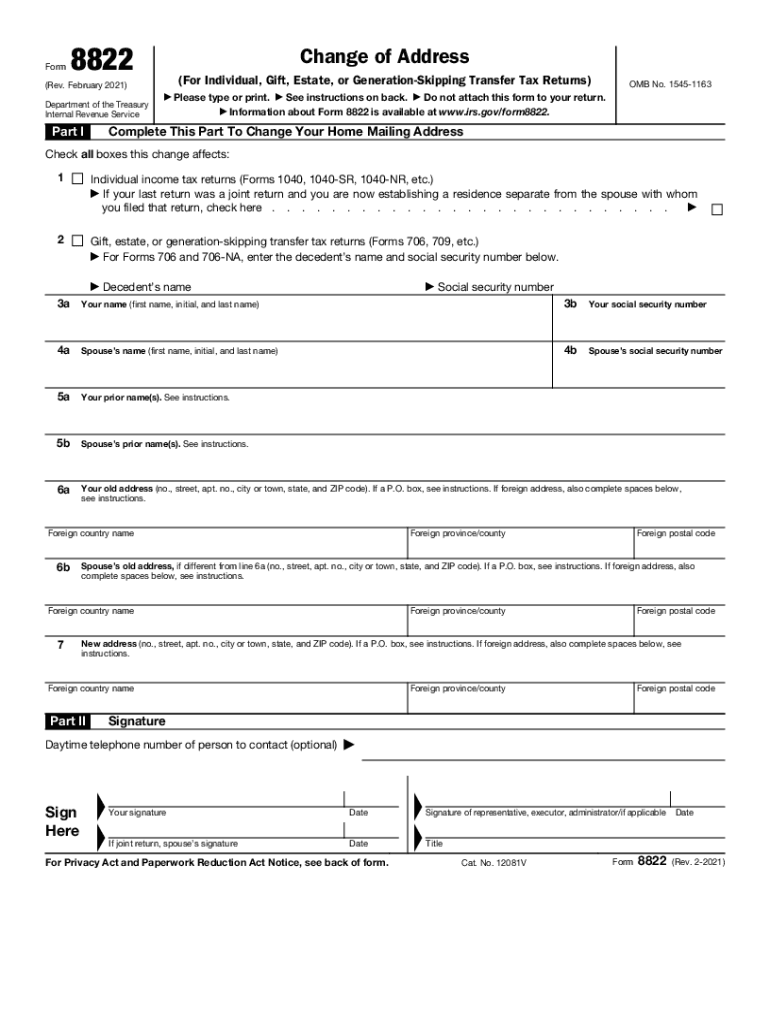

What is form 8822?

A taxpayer uses form 8822 to notify the Internal Revenue Service of a change of the taxpayer’s home mailing address. If the taxpayer’s children filed their income tax returns, and the change in question affects the mailing address of the children, the taxpayer should complete and file a separate form 8822 for each child.

Who should file form 8822?

A taxpayer with a new home mailing address should file form 8822 to notify the IRS about their updated address and ensure they receive IRS correspondence.

What information do you need when you file form 8822?

You should provide the following information: your name, social security number, your spouse's name, spouse’s social security number, any previous names for you or your spouse, your old address, your spouse's old address, your new address, and your signature.

How do I fill out form 8822 in 2024?

Page 2 of the form contains instructions on how to complete it and where to file form 8822. Please read the form 8822 instructions before you fill it out.

The change of your home mailing address may affect any of the following:

- individual tax returns;

- other tax returns such as forms 706, 709, etc.

You should check each box on lines 1 and 2, corresponding to your circumstances.

Finally, you may sign and date the document. With a joint return, your spouse should sign and date as well. If you sign it on behalf of the taxpayer, you should also add your title.

You can use a convenient online service to file form 8822 online in just a few minutes. Take the following steps to complete it in pdfFiller:

- Click Get Form to open a template in pdfFiller.

- Fill in the text fields providing relevant information and sign the document.

- Click Done and Send via USPS.

- Fill in the required mailing information.

- Click the Send button.

After completing these steps, your form will be printed and delivered to the post office. The recipient will receive it within the selected period of time. Alternatively, you can fill out the form in pdfFiller, print the document, and then sign and mail it yourself.

Is form 8822 accompanied by other forms?

There are no other requirements for submitting a change of address IRS form 8822. If a representative signs the form on behalf of the taxpayer, they must attach a copy of a power of attorney document. To do this, the representative can use form 2848.

When is form 8822 due?

The use of IRS form 8822 is voluntary, so there is no deadline to meet. However, it is advisable to file it. Suppose you fail to notify the Internal Revenue Service of your new mailing address. In that case, you may not receive an important notice from the agency, for instance, a demand for tax or a deficiency notice. Please remember it may take up to six weeks to process your request for a change of home address.

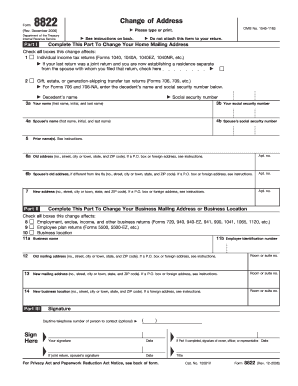

Where do I send form 8822?

If your address changes affect forms 706, 709, etc., you will need to send your form 8822 to the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0023.

If your home mailing address change does not affect the returns mentioned above, you will need to send the 8822 IRS form to one of the places specified in the table on page 2 of the form. Find the state of your old address in the left column, and use the corresponding address from the right column to send the form.