FL DR-15AIR 2021-2024 free printable template

Show details

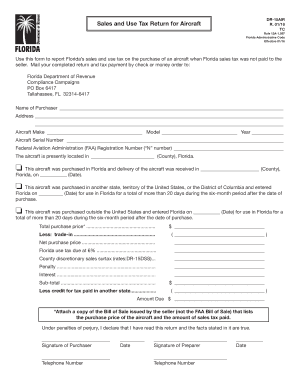

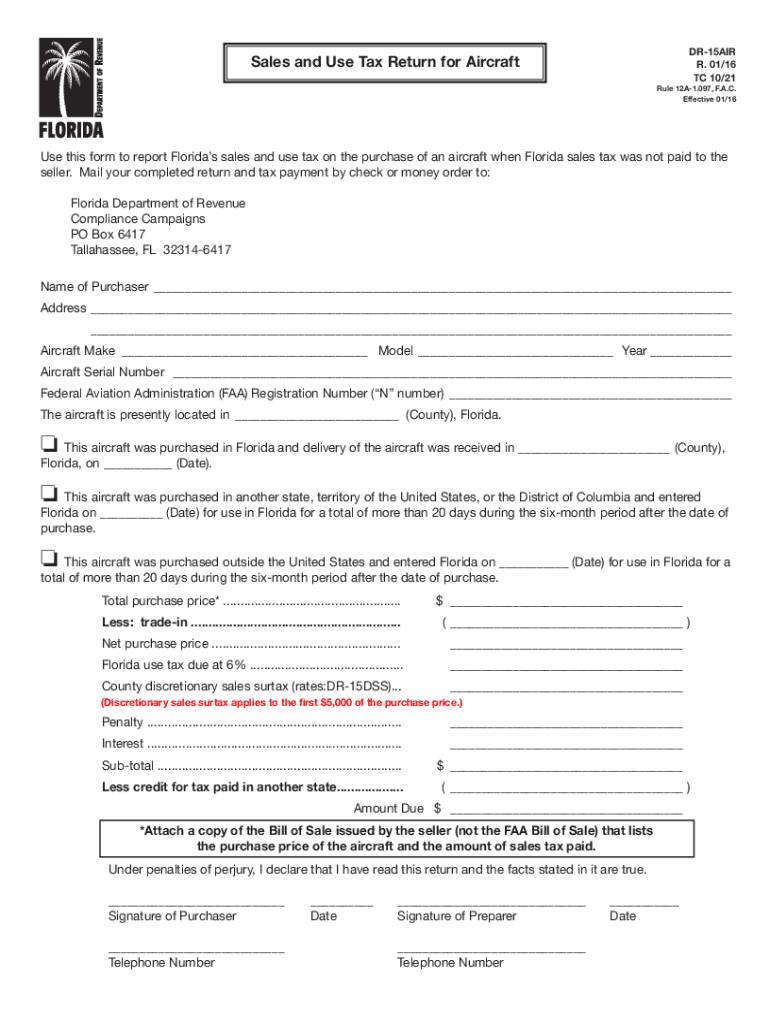

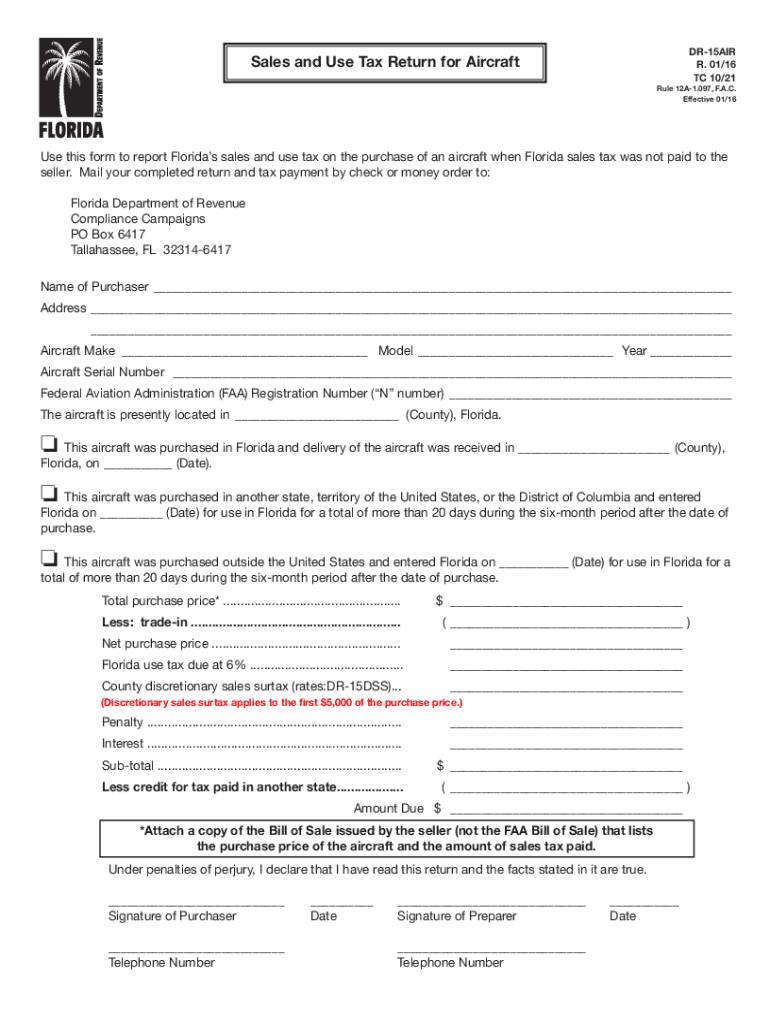

DR15AIR R. 01/16 TC 10/21Sales and Use Tax Return for AircraftRule 12A1.097, F.A.C. Effective 01/16Use this form to report Florida's sales and use tax on the purchase of an aircraft when Florida sales

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your florida dr sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida dr sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida dr sales tax online

To use the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fl dr sales tax form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

FL DR-15AIR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out florida dr sales tax

How to fill out florida dr sales tax?

01

You will need to obtain a DR-15 sales and use tax return form from the Florida Department of Revenue's website or by visiting their local office.

02

Provide your business information, including your name, address, and taxpayer identification number (TIN).

03

Report the total sales subject to Florida sales tax for the reporting period. This includes all tangible personal property sold or rented to customers in Florida.

04

Deduct any allowed exemptions or deductions from your total sales, such as sales for resale or sales to tax-exempt customers.

05

Calculate the amount of sales tax due by multiplying your taxable sales by the current sales tax rate in Florida.

06

Make sure to include any additional taxes or surcharges that may apply, such as discretionary sales surtax or the rental car surcharge.

07

Fill out the rest of the required information on the form, including your contact information and the reporting period.

08

Sign and date the form, and keep a copy for your records. File the completed form with the Florida Department of Revenue by the specified due date.

Who needs florida dr sales tax?

01

Individuals or businesses that sell tangible personal property in Florida are generally required to collect and remit sales tax to the Florida Department of Revenue.

02

Florida sales tax must be collected on all sales of tangible personal property unless a specific exemption or deduction applies.

03

Businesses that operate in Florida, even if they are located outside the state, may still be responsible for collecting and remitting sales tax if they have sales or a physical presence in Florida.

Fill florida sales tax aircraft form : Try Risk Free

People Also Ask about florida dr sales tax

Do foreigners pay taxes in Dominican Republic?

What is a DR-15 form in Florida?

How does sales tax work in Florida?

When did Florida sales tax go to 7?

How do I calculate Florida collection allowance for sales tax?

Is Florida sales tax accrual or cash basis?

What state has a 7 percent sales tax?

What are the taxes in the Dominican Republic?

Is Florida origin or destination based sales tax?

Is sales tax based on origin or destination?

How much is customs duty in Dominican Republic?

What is Florida's sales tax rate 2022?

Does Dominican Republic have sales tax?

Do you have to pay sales tax in Dominican Republic?

How is Dr-15 calculated?

What is a Florida DR 15?

Is FL sales tax 7%?

Does Florida have 7% sales tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is florida dr sales tax?

The sales tax rate in Florida is 6%.

How to fill out florida dr sales tax?

To fill out the Florida DR-15 Sales Tax Return, you will need to include information such as the date, your business name, location, and Federal Employer Identification Number (FEIN). You will also need to provide the total sales, taxable sales, and tax collected for the period. After completing the form, you must sign it and submit it to the Florida Department of Revenue.

What information must be reported on florida dr sales tax?

In Florida, all sales of tangible personal property that are subject to sales tax must be reported on a Sales and Use Tax Return. This includes taxable sales of items such as clothing, furniture, electronics, toys, jewelry, and appliances. Sales tax must also be reported on services that are taxable in Florida, such as installation, repair, and maintenance services.

Who is required to file florida dr sales tax?

In Florida, individuals and businesses that sell tangible personal property must collect and remit sales tax. This includes retailers, wholesalers, service providers, and vendors who conduct sales in the state. Florida sales tax returns are filed with the Florida Department of Revenue. It is important to note that there may be certain exemptions and thresholds for small businesses, but generally, anyone engaged in selling taxable goods or services must file Florida sales tax.

What is the purpose of florida dr sales tax?

The purpose of Florida's sales tax is to generate revenue for the state government. The sales tax is applied to most goods and certain services purchased within the state. The revenue generated from the sales tax is used to fund various government programs, infrastructure development, public services, and other essential functions of the state government.

When is the deadline to file florida dr sales tax in 2023?

The specific deadline for filing Florida DR (Discretionary Sales Surtax) in 2023 has not been provided. Tax filing deadlines are typically set by the government and can vary depending on the specific tax and jurisdiction. It is recommended to consult the Florida Department of Revenue or a tax professional for the most accurate and up-to-date information regarding tax filing deadlines.

What is the penalty for the late filing of florida dr sales tax?

The penalty for the late filing of Florida D.R. (Dealers of Registered Vehicles) sales tax depends on the amount of tax owed and the number of days late. The penalty structure is as follows:

1. 5% of the tax due for each month or portion of a month that the return is late, up to a maximum of 25%.

2. If the return is more than 30 days late, an additional penalty of 15% of the tax due is imposed.

Therefore, if the return is filed more than 30 days late, the total penalty will be 40% (25% + 15%) of the tax due.

It's important to note that interest is also charged on the late tax amount, which accrues monthly at a rate set by the Florida Department of Revenue.

How do I modify my florida dr sales tax in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your fl dr sales tax form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the fl dr 15air use tax form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your florida dr sales tax form.

How do I fill out dr 15air using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign florida dr sales use tax return form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your florida dr sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fl Dr 15air Use Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to dr 15air tax form

Related to fl dr 15air

If you believe that this page should be taken down, please follow our DMCA take down process

here

.