Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

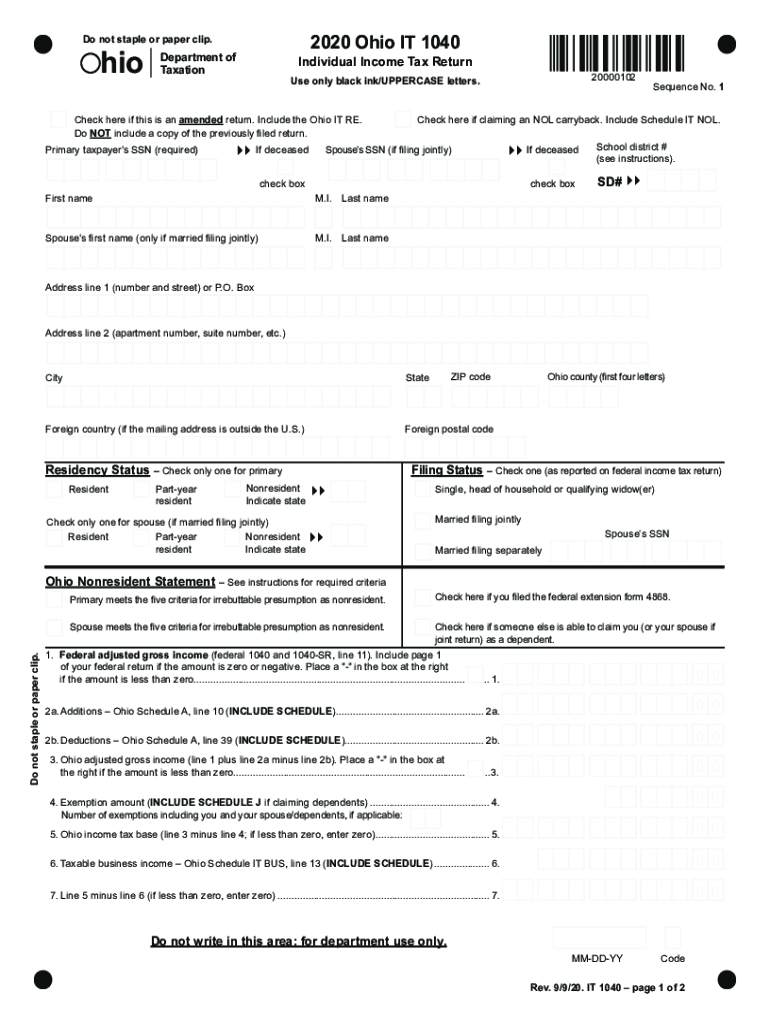

What is ohio state tax forms?

Ohio State Tax Forms are the forms used to file your state income taxes in the state of Ohio. These forms can be found on the Ohio Department of Taxation website.

How to fill out ohio state tax forms?

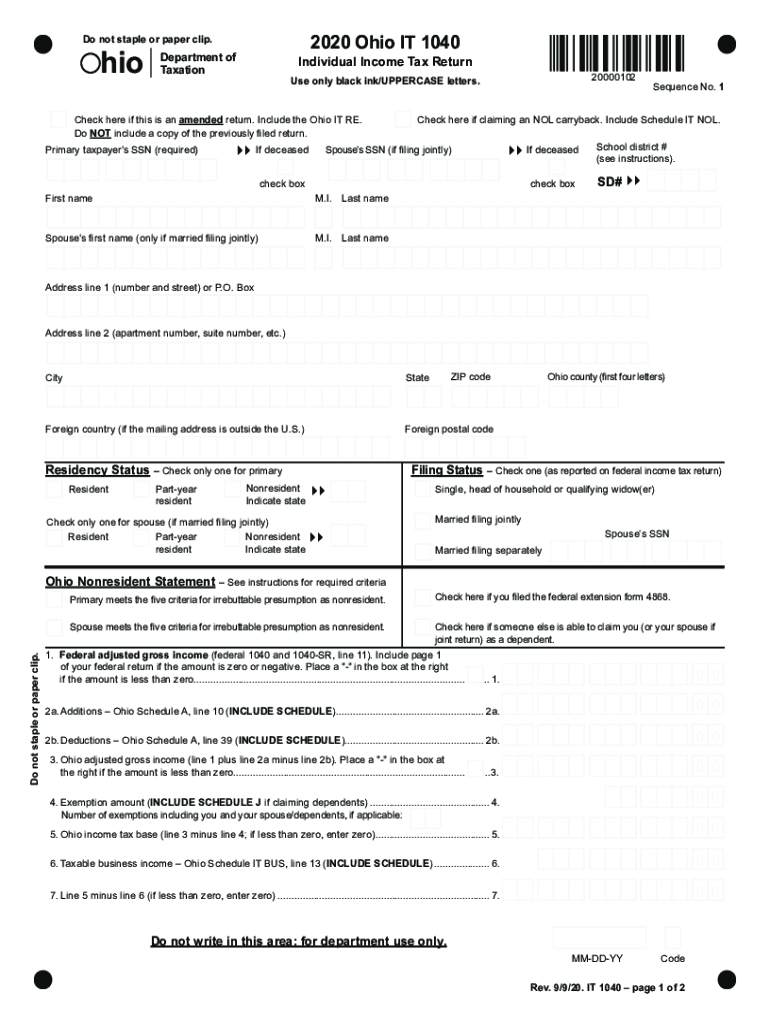

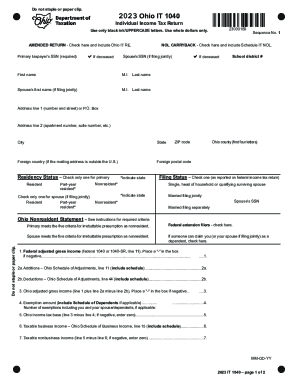

To fill out Ohio state tax forms, you must first determine the type of form you need. The Ohio Department of Taxation offers several different forms depending on your filing status and the type of taxes you need to pay. For example, individuals will need to use Form IT 1040 for their personal income taxes. Businesses may need to use Form ST 100 to file their tax returns.

Once you determine the correct form, you must gather the necessary documents and enter the required information. Common items you will need to provide include your Social Security number, income information, and deductions. After you complete the form, you must sign and date it and then submit it to the Ohio Department of Taxation.

What is the purpose of ohio state tax forms?

The purpose of Ohio state tax forms is to allow taxpayers to report their income and calculate their taxes owed to the State of Ohio. Ohio state tax forms are used to report income from wages, investments, and other sources such as business income, rental income, capital gains, etc. Additionally, taxpayers may be required to report other information related to their taxes, such as estimated taxes, tax deductions, and credits.

What information must be reported on ohio state tax forms?

Ohio state tax forms require taxpayers to report their income, deductions, credits, exemptions, and any other information necessary to calculate their tax liability. This includes reporting wages, salaries, interest, dividends, capital gains, pensions, annuities, and other forms of income. Taxpayers must also report any business or rental income they may have, as well as any deductions they may be eligible for, such as those related to charitable contributions or medical expenses. In addition, taxpayers must report any credits for which they are eligible, such as the earned income credit or a property tax credit.

What is the penalty for the late filing of ohio state tax forms?

The Ohio Department of Taxation may assess a penalty for late filing of state tax forms. The amount of the penalty depends on the type of form that was late filed. Generally, the penalty is 5% of the amount due for each month (or fraction thereof) the return is late, up to a maximum of 25%.

Who is required to file ohio state tax forms?

In general, any individual who earns income in Ohio is required to file Ohio state tax forms, including residents, part-year residents, and non-residents. However, specific filing requirements may vary based on factors such as income level, filing status, and age. Additionally, individuals who have Ohio income tax withheld but do not meet the filing requirements may still need to file tax forms to claim any refund due. It is advisable to consult the Ohio Department of Taxation or a tax professional for accurate and up-to-date information regarding filing requirements.

When is the deadline to file ohio state tax forms in 2023?

The deadline to file Ohio state tax forms for the year 2023 is April 18, 2023. This is the same deadline as the federal tax filing deadline, which is typically April 15th but may be extended due to weekends or holidays.

How can I get ohio state tax forms?

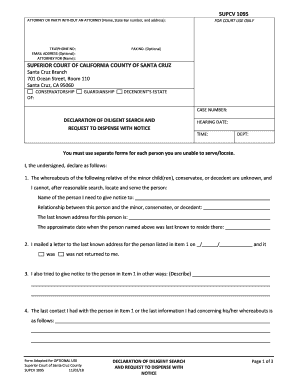

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ohio it 1040 form and other forms. Find the template you need and change it using powerful tools.

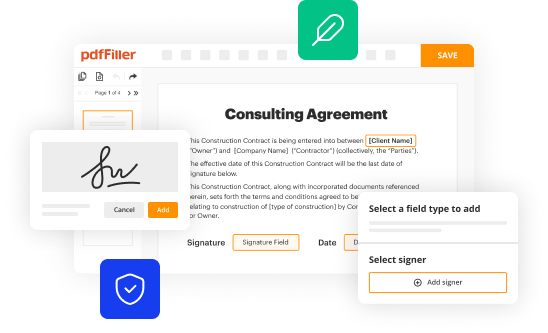

Can I sign the ohio tax return form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your ohio income tax.

How do I edit ohio 1040 form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign ohio tax form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.