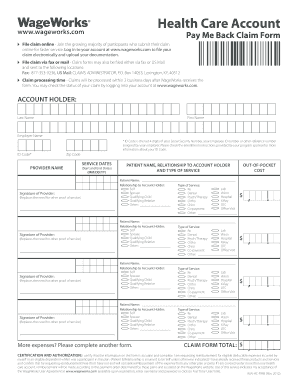

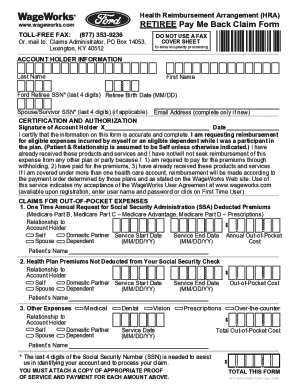

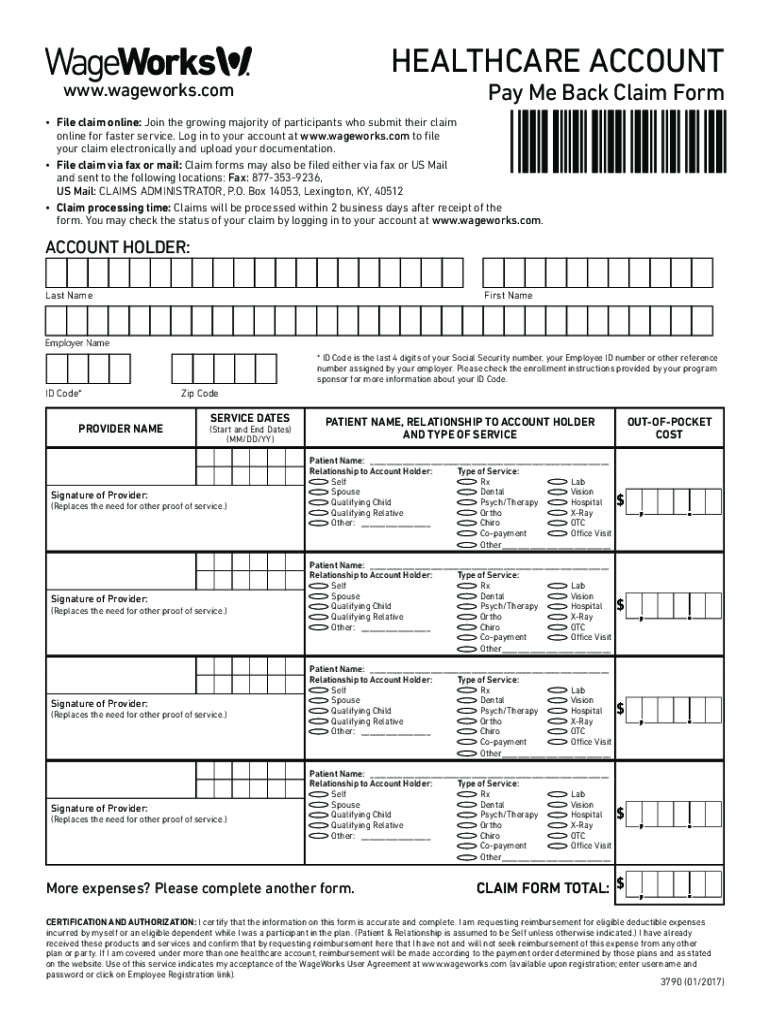

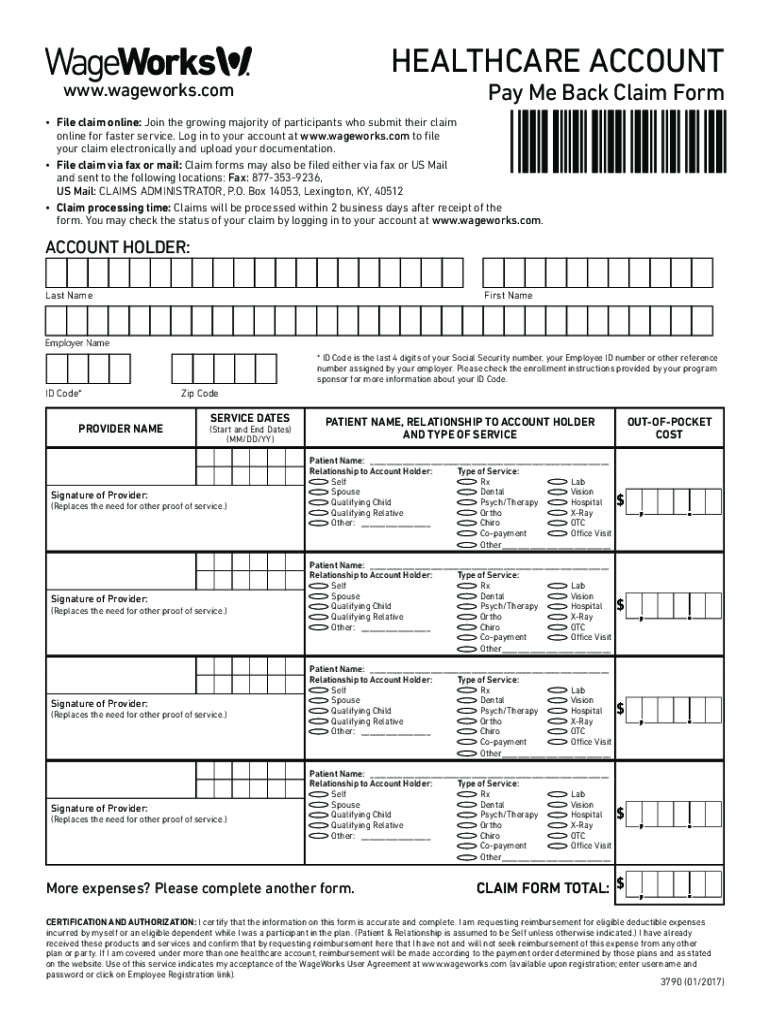

WageWorks HealthCare Account Pay Me Back Claim Form 2017-2024 free printable template

Show details

HEALTHCARE ACCOUNT How to File a Claim for Approval www.wageworks.com Claim Filing Options: File claim online: Log in to your account at www.wageworks.com to submit your claim electronically. File

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

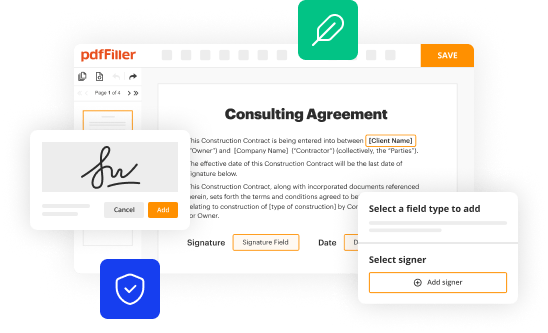

Edit your wageworjs forms 2017-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

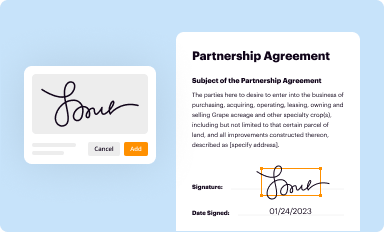

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

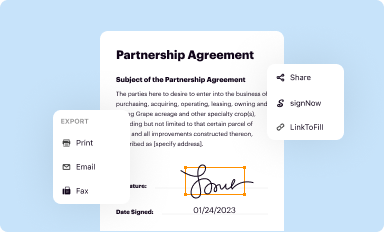

Share your form instantly

Email, fax, or share your wageworjs forms 2017-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wageworjs forms online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wageworks claim form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

WageWorks HealthCare Account Pay Me Back Claim Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wageworjs forms 2017-2024

How to fill out wageworks forms:

01

Start by gathering all the necessary information and documents. This may include your personal details, employment information, and any supporting documents required by the form.

02

Carefully read through the instructions provided on the form to understand the specific requirements and sections that need to be completed.

03

Begin filling out the form by entering your personal information accurately. This may include your full name, address, social security number, and contact details.

04

Provide your employment information, such as your employer's name, address, and contact information. Include details about your job title, start date, and any other relevant employment information.

05

If the form requires you to provide information about your wages, carefully enter the necessary details. This may include your hourly rate, weekly or monthly salary, or any additional income from bonuses or commissions.

06

If applicable, fill in any sections related to tax withholding, retirement contributions, or other benefits that may be offered by your employer.

07

Review the completed form for any errors or missing information. Make sure all sections are filled out accurately and completely.

08

Sign and date the form as required. Some forms may also require a witness or notary signature.

09

Keep a copy of the filled-out form for your records before submitting it to the appropriate recipient.

Who needs wageworks forms:

01

Employees who need to access or manage their healthcare or dependent care expenses through a Flexible Spending Account (FSA) may need to complete wageworks forms.

02

Employers who offer FSA benefits to their employees may require them to fill out wageworks forms to enroll in or make changes to their FSA.

03

Individuals who want to participate in a Commuter Benefits program, which allows them to use pre-tax dollars for eligible transportation expenses, may need to complete wageworks forms.

Please note that the specific forms and requirements may vary depending on the organization and the type of benefits offered. It is always a good idea to consult with your employer or benefits provider for accurate and up-to-date information on filling out wageworks forms.

Fill wageworks me back form : Try Risk Free

People Also Ask about wageworjs forms

How do I check my WageWorks balance?

How do you get reimbursed from FSA?

How does WageWorks pay back work?

What items can I purchase with my WageWorks card?

How does WageWorks pay back?

What can I use my WageWorks healthcare card on?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wageworjs forms?

Wageworks Forms is a platform or collection of various forms used by the company Wageworks. Wageworks is a provider of consumer-directed benefits such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), and commuter benefits. The Wageworks Forms may include enrollment forms, reimbursement forms, claims forms, and other documents necessary to manage and process these types of benefits.

Who is required to file wageworjs forms?

Employers are required to file wage and tax-related forms, such as Form W-2 for reporting employee wages and Form 941 for reporting employer’s quarterly federal tax return.

How to fill out wageworjs forms?

To fill out Wageworks forms, follow these steps:

1. Obtain the required forms: You can usually find the necessary forms on the Wageworks website or through your employer's HR department.

2. Read the instructions: Carefully review the form's instructions to familiarize yourself with the information required and any specific guidelines for completion.

3. Provide personal information: Write your full name, address, phone number, and email address in the designated sections.

4. Specify your employer or plan details: Indicate your employer's name, your job title, and the start date of your employment. If necessary, provide your plan or account number.

5. Select your benefits or services: Tick the boxes or write in the appropriate fields to indicate the benefits or services you wish to enroll in or use. This may include dependent care, commuter benefits, or medical expenses.

6. Establish your contribution amounts: Specify the contribution amounts you want to allocate towards each benefit or service. This could involve a percentage of your salary or a specific dollar amount per paycheck.

7. Sign and date the form: Add your signature and insert the current date at the bottom of the form. Ensure that you have complied with any additional requirements, such as obtaining a witness or entering the date in the correct format.

8. Return the completed form: Once you have filled out the form, submit it as directed by your employer or Wageworks. This may involve returning it to your HR department, mailing it to a specific address, or uploading it through an online portal.

Remember to keep a copy of the completed form for your records.

What is the purpose of wageworjs forms?

It appears that "Wageworjs" is not a commonly known term or service. There is no specific information available about "Wageworjs forms." It is possible that you may be referring to a specific company or service that is not widely recognized. Without more context or information, it is difficult to determine the purpose of "Wageworjs forms."

What information must be reported on wageworjs forms?

The information that must be reported on wage and tax forms can vary depending on the specific form and the jurisdiction. However, generally, the following information is commonly required:

1. Employer information: This includes the name, address, and federal employer identification number (FEIN) of the employer.

2. Employee information: This includes the name, address, social security number (SSN), and other identifying details of the employee.

3. Wage and salary information: This includes the amount of wages, salaries, tips, and other compensation paid to the employee during the tax year. This information is typically reported on a Form W-2 for employees.

4. Income tax withholding: This includes the amount of federal income tax withheld from the employee's wages during the tax year.

5. Social Security and Medicare taxes: This includes the amount of Social Security and Medicare taxes withheld from the employee's wages. These taxes are reported on Form W-2 as well.

6. State and local tax withholding: If applicable, the amount of state and/or local income taxes withheld from the employee's wages should also be reported.

7. Additional compensation details: There may be other types of compensation or benefits provided to employees, such as bonuses, commissions, fringe benefits, etc., which may need to be reported separately.

It is important to note that specific forms and reporting requirements can vary based on factors such as the size of the employer, the type of employment, the jurisdiction, and any applicable laws or regulations. Employers should consult with tax professionals or refer to the relevant tax forms and instructions to ensure accurate and compliant reporting.

When is the deadline to file wageworjs forms in 2023?

I apologize, but there doesn't seem to be any specific information available about a form called "wageworjs" or any deadline related to it in 2023. Could you please provide more details or confirm the correct name of the form?

What is the penalty for the late filing of wageworjs forms?

The penalties for late filing of wage works forms can vary depending on the specific form and country or region. Generally, late filing penalties can include fines, interest charges, and potential audits or enforcement actions by tax authorities. To get accurate and up-to-date information on the penalties associated with late filing of wage works forms, it is advisable to consult the relevant tax authorities or speak with a tax professional.

How do I edit wageworjs forms in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing wageworks claim form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the wageworks claim in Gmail?

Create your eSignature using pdfFiller and then eSign your wageworks pay me back form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit wageworks form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing pay claim form make.

Fill out your wageworjs forms 2017-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wageworks Claim is not the form you're looking for?Search for another form here.

Keywords relevant to wageworks pay claim form

Related to wageworks pay me back claim form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.