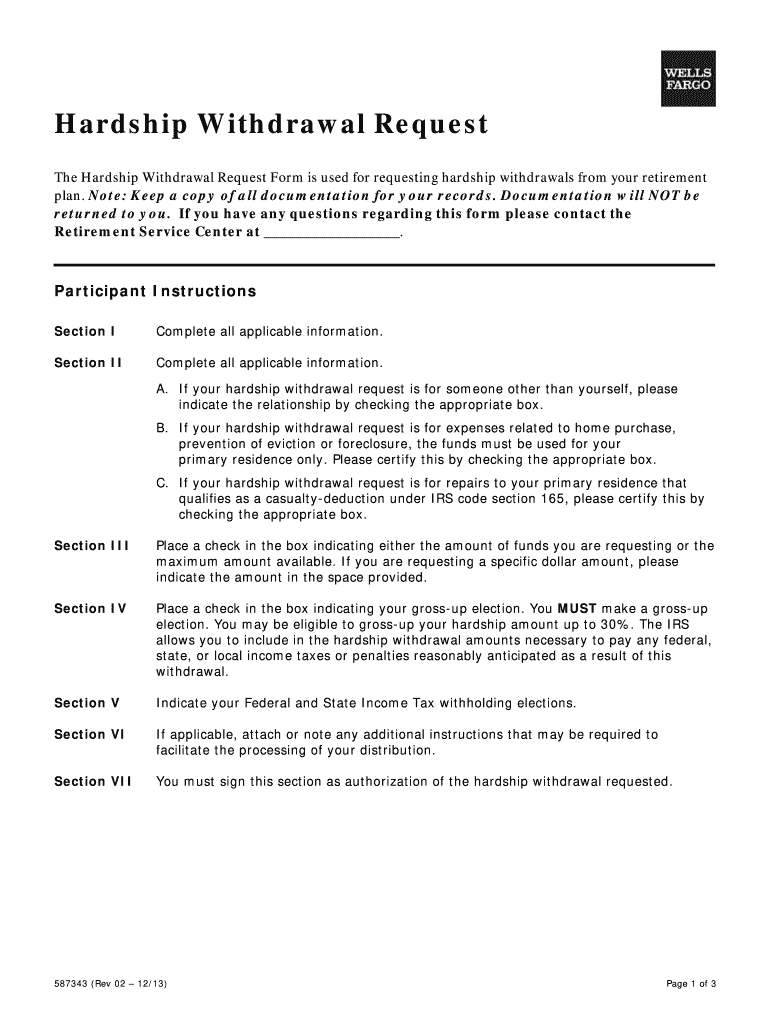

Wells Fargo 587343 2013-2024 free printable template

Get, Create, Make and Sign

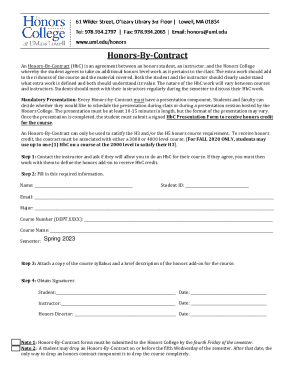

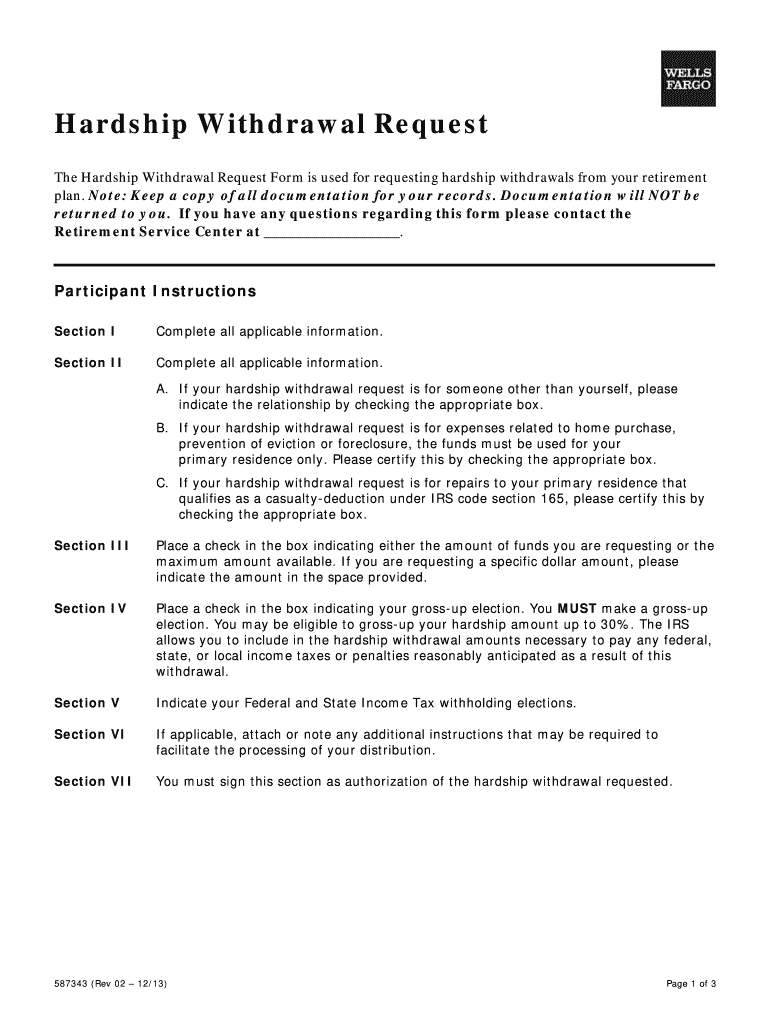

How to edit hardship withdrawal request form online

Wells Fargo 587343 Form Versions

How to fill out hardship withdrawal request form

How to fill out form hardship withdrawal request:

Who needs form hardship withdrawal request:

Video instructions and help with filling out and completing hardship withdrawal request form

Instructions and Help about fargo hardship withdrawal form

Money you know the thing everyone likes to think they're good with despite the evidence provided in every episode of the Size Organ show Tina what do you want to buy hi Size thanks for taking my call I'd like to buy a Mercedes s550 it's about $1,400 a month that is true you are denied oh I want to get away the time to believe p.m. bag so Jena it's not even funny I'm going to deny you again I would like to buy a study abroad in Iceland I want to go to the famous elk school and weigh Kovacs and get a certification as an Elsa Potter here's the thing I'm denying you yeah of course is because no one should be spending $4,000 to get an elf spotting qualification in fact if you go to last week tonight calm right now you can print out a free official elf spotting certificate which I promise you are every bit as valid as the most expensive elf spotting education now go spot some elves now what one of the big reasons though Size Organ denies so many people are because she thinks we should all be saving for our retirement, and before we go any further it is important to acknowledge there are people who just do not have the money to do that for systemic reasons that we've addressed on this show before and will doubtless address again on Giannini sad tactic 'El circus of misery and math but tonight let's talk about those who can save for retirement the target audience for ads like this we ask people a question how much money do you think you'll need when you retire then we gave each person a ribbon to show how many years that amount my last it's trying to like to pull it a little further yeah I was trying to stretch it a little more got me to 70 years old I'm going to have to rethink this thing that's that's actually a pretty creepy ad because it's basically people walking towards the date of their own death the only way could have been creepy is if at the end of their ribbons it said exactly how each person was going to die but look it is true it is true that as we all live longer you should absolutely say for retirement if you can and many do we currently have around 24 trillion dollars sitting in retirement assets and that figure doesn't even include the wealth we have in stockpiles beanie babies so let's call it 24 trillion and 32 dollars and a lot of that money is in the hands of financial services companies so let's talk a little about how they work which I know sounds boring but as a favor to your future self it is worth watching this for 20 minutes because you could easily make small mistakes which could seriously cost you down the line so let's start with financial advisors they are the wholesome friendly faced experts that you see in apps like this one think chase wait that is a clear example of deceptive advertising because nobody invites their financial advisor to a wedding if cousin Barbara finds out that she didn't get an invitation, but your chase guy did she's going to flip her shit on you, but there is something you should know about...

Fill wells 401k withdrawal : Try Risk Free

People Also Ask about hardship withdrawal request form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your hardship withdrawal request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.