NY IT-213 2023-2024 free printable template

Show details

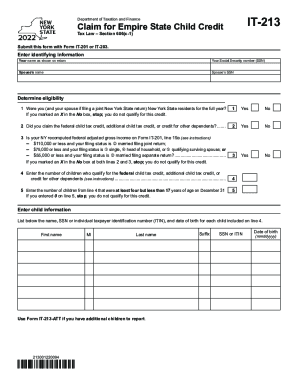

IT213Department of Taxation and FinanceClaim for Empire State Child Credit

Tax Law Section 606(c1)

Submit this form with Form IT201 or IT203.Enter identifying information

Your name as shown on returnYour

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form it-213 claim for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form it-213 claim for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form it-213 claim for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form it-213 claim for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

NY IT-213 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form it-213 claim for

How to fill out form it-213 claim for

01

Download form IT-213 claim for from the official website of the tax department.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information such as name, address, and social security number in the designated fields.

04

Include all relevant income and expenses related to the claim you are making.

05

Attach any necessary supporting documents such as receipts, invoices, or proof of payments.

06

Sign and date the form after completing all the required sections.

07

Double-check your form for any errors or missing information.

08

Make a copy of the filled-out form and keep it for your records.

09

Submit the form through the appropriate channel specified in the instructions, such as mail or online submission.

10

Wait for confirmation or further instructions from the tax department regarding your claim.

Who needs form it-213 claim for?

01

Form IT-213 claim for is needed by individuals who want to claim certain tax credits, deductions, or exemptions specified by the tax department.

02

These claims may include but are not limited to education tax credits, child and dependent care expenses, energy-saving home improvements, and medical expenses.

03

It is important to review the specific eligibility criteria and requirements for each claim before filling out the form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form it-213 claim for?

Form IT-213 claim is used by taxpayers to claim a credit for taxes paid to another jurisdiction.

Who is required to file form it-213 claim for?

Taxpayers who paid taxes to another jurisdiction and want to claim a credit for those taxes on their state tax return are required to file form IT-213 claim.

How to fill out form it-213 claim for?

To fill out form IT-213 claim, taxpayers need to provide their personal information, details about the taxes paid to another jurisdiction, and calculate the credit they are eligible for.

What is the purpose of form it-213 claim for?

The purpose of form IT-213 claim is to allow taxpayers to claim a credit for taxes paid to another jurisdiction, reducing their overall tax liability.

What information must be reported on form it-213 claim for?

On form IT-213 claim, taxpayers must report their personal information, such as name, address, and social security number, as well as details about the taxes paid to another jurisdiction, including the amount and the jurisdiction where the taxes were paid to.

When is the deadline to file form it-213 claim for in 2023?

The deadline to file form IT-213 claim for in 2023 is April 15th.

What is the penalty for the late filing of form it-213 claim for?

The penalty for the late filing of form IT-213 claim is a percentage of the unpaid taxes, which increases the longer the form is not filed.

How can I modify form it-213 claim for without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form it-213 claim for into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in form it-213 claim for?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your form it-213 claim for to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit form it-213 claim for on an iOS device?

Use the pdfFiller mobile app to create, edit, and share form it-213 claim for from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your form it-213 claim for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.