Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on irs form 2848?

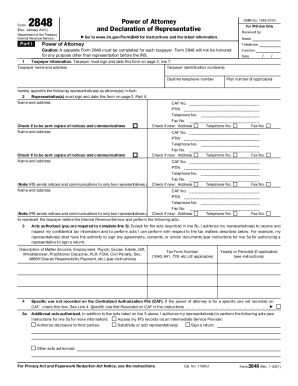

Form 2848 is a Power of Attorney and Declaration of Representative form used to allow an individual or business to authorize a representative to act on their behalf in dealing with the Internal Revenue Service (IRS). The form requires information about the taxpayer, the representative, and the type of authority the representative will have. The form also requires the taxpayer's signature and date.

When is the deadline to file irs form 2848 in 2023?

The deadline to file IRS Form 2848 in 2023 is April 15, 2023.

What is the penalty for the late filing of irs form 2848?

The penalty for the late filing of IRS Form 2848 is a fine of up to $250 or a penalty of up to 25% of the taxes due, whichever is greater.

IRS Form 2848 is a Power of Attorney and Declaration of Representative form. It allows an individual or organization to appoint another person or organization to represent them before the Internal Revenue Service (IRS). This form is commonly used when a taxpayer wants someone else to handle their tax matters, such as filing returns, responding to IRS inquiries, or negotiating on their behalf. By completing Form 2848, the taxpayer designates the representative(s) and authorizes them to act on their behalf in tax matters.

Who is required to file irs form 2848?

IRS Form 2848, also known as Power of Attorney and Declaration of Representative, is typically filed by individuals or entities who want to authorize someone else to represent them before the IRS. This form is commonly used by taxpayers who want to grant authority to an attorney, certified public accountant (CPA), enrolled agent (EA), or other tax professionals to act on their behalf. It allows the authorized representative to communicate with the IRS, access the taxpayer's tax information, and handle tax-related matters. It is important to note that both the taxpayer and the authorized representative should sign the form.

How to fill out irs form 2848?

To correctly fill out IRS Form 2848, Power of Attorney and Declaration of Representative, follow these steps:

1. Begin by entering your personal information in Part I, including your name, address, and contact information.

2. In Part II, provide the information of the person or organization you are granting power of attorney (POA) to. This includes their name, address, and contact information.

3. Indicate the tax matters for which you are authorizing representation in Part III. Check the appropriate boxes for individual income tax, gift tax, estate tax, partnership tax, corporate tax, etc. You can check multiple boxes if necessary.

4. In Part IV, specify any tax year or tax period limitations you want to impose on the authority granted. This section is optional, so you can leave it blank if there are no specific limitations.

5. Part V requires the representative's signature, acknowledging their willingness to act as your taxpayer representative. Make sure they sign and date the form.

6. Attach an executed copy of the power of attorney to the form if required.

7. Read and understand the Declaration of Representative in Part VI. By signing and dating it, you confirm that you are authorizing the representative(s) named in Part II to act on your behalf, and that you are providing true and correct information.

8. If you choose to receive notices and communications through a shared mailbox with your representative, provide the address in Part VII.

9. In Part VIII, enter the name, title, and phone number of the third party designee (if applicable).

10. Sign and date the bottom of the form in Part IX. If you are filing jointly, both you and your spouse must sign the form.

11. Send the completed Form 2848 to the appropriate IRS office as noted in the instructions.

Remember to retain a copy of the completed form for your records.

What is the purpose of irs form 2848?

The purpose of IRS Form 2848, also known as "Power of Attorney and Declaration of Representative," is to authorize an individual or organization to represent a taxpayer before the Internal Revenue Service (IRS). By completing this form, a taxpayer grants a representative the power to act on their behalf, access their tax information, receive confidential tax information, and perform various tasks related to their tax matters. This form is commonly used when a taxpayer wants someone else, such as an attorney or tax professional, to handle their tax affairs or communicate with the IRS on their behalf.

How do I modify my irs form 2848 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your form 2848 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit form 2848 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including irs power of attorney 2848 pdf, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out 2848 on an Android device?

Use the pdfFiller app for Android to finish your irs form 2848. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.