IRS 1040 - Schedule 2 2020 free printable template

Show details

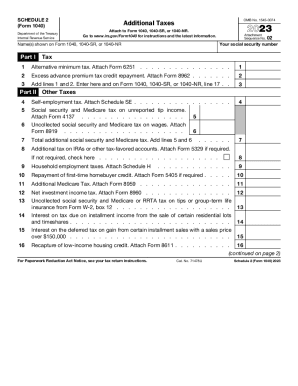

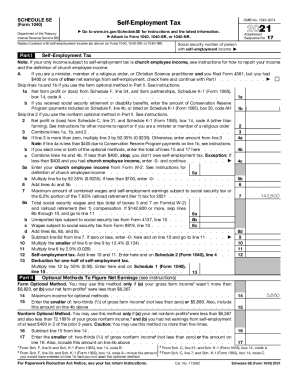

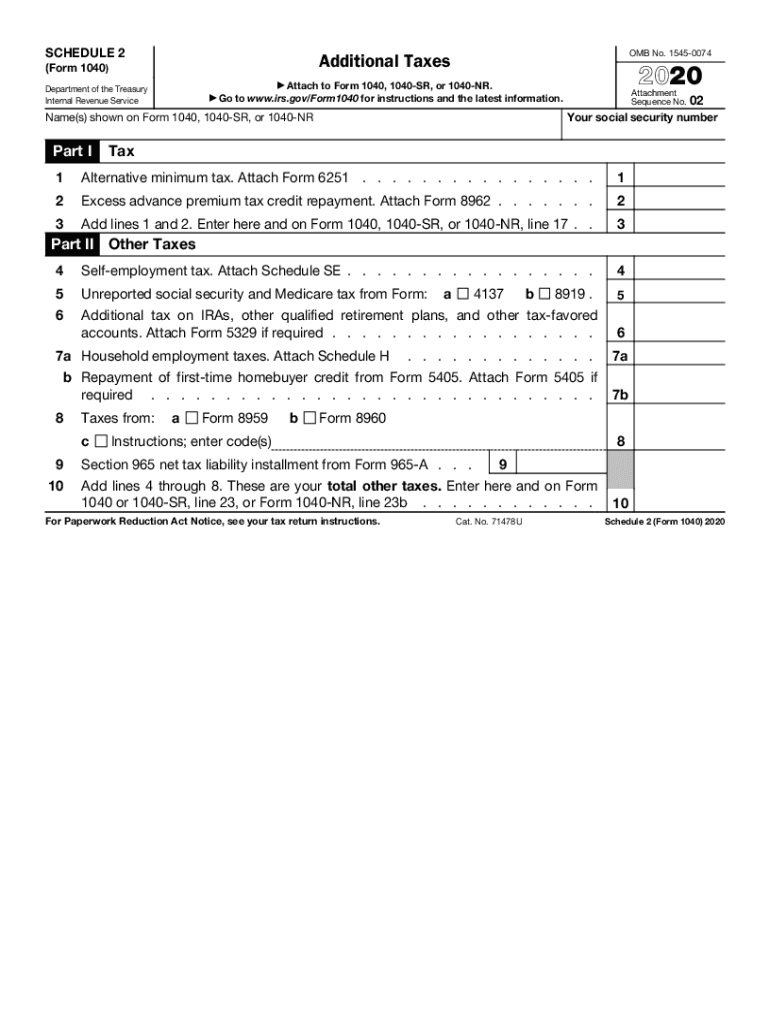

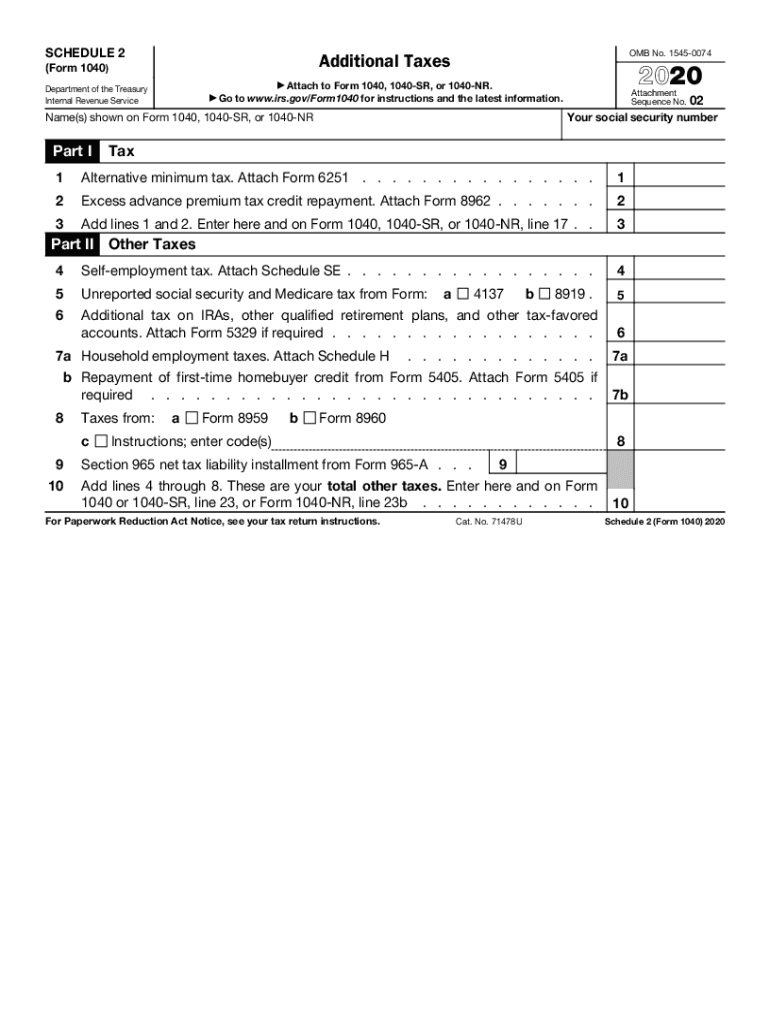

SCHEDULE 2OMB No. 15450074Additional Taxes(Form 1040) Department of the Treasury Internal Revenue Service Attachment Sequence No. 02Your social security cumbersome(s) shown on Form 1040, 1040SR, or

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your irs schedule 2 2020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs schedule 2 2020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs 2020 schedule 2 online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule 2 1040 2020 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

IRS 1040 - Schedule 2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs schedule 2 2020

How to fill out 2020 1040 schedule 2:

01

Gather all necessary documents and information such as income statements, deductions, and credits.

02

Start by providing your personal information including name, address, and social security number.

03

Proceed to Part I of the form where you will report any additional tax owed such as self-employment tax or household employment taxes.

04

In Part II, report any amounts related to the Alternative Minimum Tax (AMT) if applicable.

05

If you have any excess advance premium tax credit repayment, fill out Part III accordingly.

06

If you are claiming a refundable credit, such as the American opportunity credit or the additional child tax credit, fill out Part IV.

07

Finally, calculate the total amount of tax due or refundable and provide your signature and date to complete the form.

Who needs 2020 1040 schedule 2:

01

Individuals who need to report additional tax owed or claim refundable credits on their 2020 federal income tax return.

02

Those who have self-employment income or household employment taxes to report.

03

Individuals who have excess advance premium tax credit repayment.

04

Taxpayers who are claiming refundable credits such as the American opportunity credit or the additional child tax credit.

Fill irs schedule 2 2020 : Try Risk Free

People Also Ask about irs 2020 schedule 2

What is the Schedule 2 for the IRS Form 1040?

Where to find income tax on 1040 for 2020 without schedule 2?

Can I still file a 2020 1040?

How do I fill out a 2020 tax form 1040?

How do I fill out a 1040 for dummies?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out 1040 schedule 2?

1. Gather your tax forms and documents. You will need your Form 1040 and any other related tax forms, such as a W-2 or 1099.

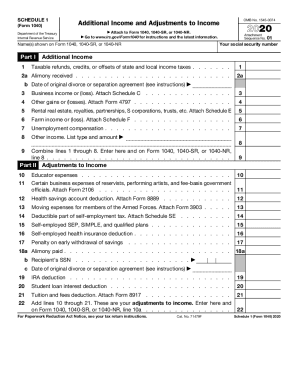

2. Enter your taxable income from Form 1040, line 6. This includes any wages, salaries, tips, and other taxable income.

3. Enter any adjustments to income listed on Form 1040, line 24. This includes deductions for student loan interest, educator expenses, alimony payments, and more.

4. Enter any tax-exempt interest income you earned on Form 1040, line 2a.

5. Enter any taxable refunds, credits, or offsets you received on Form 1040, line 10. This includes any state or local tax refunds, credits, or offsets.

6. Enter any estimated tax payments you made for the current year on Form 1040, line 11.

7. Enter any excess advance premium tax credit repayment you made on Form 1040, line 12.

8. Enter any foreign tax credit you are claiming on Form 1040, line 13.

9. Enter any credit for federal tax on fuels you are claiming on Form 1040, line 14.

10. Enter any credit for residential energy property you are claiming on Form 1040, line 15.

11. Enter any childcare credit you are claiming on Form 1040, line 16.

12. Enter any retirement savings contributions credit you are claiming on Form 1040, line 17.

13. Enter any self-employment tax you are claiming on Form 1040, line 18.

14. Enter any self-employment health insurance deduction you are claiming on Form 1040, line 19.

15. Enter any other taxes you are claiming on Form 1040, line 20.

16. Enter your total tax liability from Form 1040, line 22.

17. Enter any tax payments you have already made on Form 1040, line 23.

18. Calculate your total tax liability after any credits, adjustments, and payments. This is your final tax liability for the year.

19. Enter the amount of taxes you owe on Schedule 2, line 1.

20. Enter any payments you have already made on Schedule 2, line 2.

21. Enter the balance due on Schedule 2, line 3.

22. Sign and date your return.

23. Submit your return to the IRS.

What information must be reported on 1040 schedule 2?

Schedule 2 of Form 1040 is used to report certain taxes including:

-Additional taxes on IRAs, other qualified retirement plans, etc.

-Alternative minimum tax

-Unreported Social Security and Medicare tax from Form 4137

-Excess Social Security and tier 1 RRTA tax withheld

-Tax on a qualified plan, etc.

-Tax on unearned income of certain children

-Household employment taxes

-First-time homebuyer credit repayment

-Self-employment tax

-Self-employment health insurance deduction

-Uncollected social security and Medicare tax on tips

-Additional tax on health savings accounts

-Additional tax on Archer MSAs

-Recapture of certain credits

-Net investment income tax

-Additional tax on distributions from certain retirement plans

What is the penalty for the late filing of 1040 schedule 2?

The penalty for late filing of 1040 Schedule 2 is 5% of the unpaid taxes for each month or partial month that the return is late, up to a maximum of 25% of the unpaid taxes.

What is 1040 schedule 2?

Schedule 2 is a tax form used by individuals to report additional taxes owed, such as the Alternative Minimum Tax (AMT), repayment of excess Advanced Premium Tax Credit, self-employment tax, or household employment taxes. It is an addendum to the main tax form 1040 and provides a way to report any additional tax liabilities or adjustments that are not covered in the main form.

Who is required to file 1040 schedule 2?

Taxpayers who need to report additional taxes owed or to claim additional tax credits, such as the alternative minimum tax or the residential energy credit, are required to file Schedule 2 along with their Form 1040.

What is the purpose of 1040 schedule 2?

The purpose of Schedule 2 (Form 1040) is to report additional taxes owed or payments made that were not entered on the main Form 1040. It is primarily used to report certain types of income, such as taxable refunds, unemployment compensation, or other income not reported on Form W-2. Additionally, it is used to claim certain tax credits or deductions, report additional taxes owed, or make additional tax payments. By filling out Schedule 2, taxpayers ensure that all their income, deductions, and tax liabilities are accurately accounted for in their overall tax return.

When is the deadline to file 1040 schedule 2 in 2023?

The deadline to file Form 1040 Schedule 2 in 2023 would be on the same date as the deadline to file your federal income tax return for that year. Generally, the deadline for filing taxes in the United States is April 15th. However, if April 15th falls on a weekend or a holiday, the deadline may be extended. It's always recommended to check with the Internal Revenue Service (IRS) or a tax professional for the specific deadline in any given year.

How can I modify irs 2020 schedule 2 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your schedule 2 1040 2020 form into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find schedule 2 2020 form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 1040 schedule 2 2020 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out 2020 irs 1040 schedule 2 on an Android device?

Use the pdfFiller Android app to finish your 2020 schedule 2 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your irs schedule 2 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule 2 2020 Form is not the form you're looking for?Search for another form here.

Keywords relevant to 2020 schedule 2 tax form

Related to form 1040 sch 2

If you believe that this page should be taken down, please follow our DMCA take down process

here

.