Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

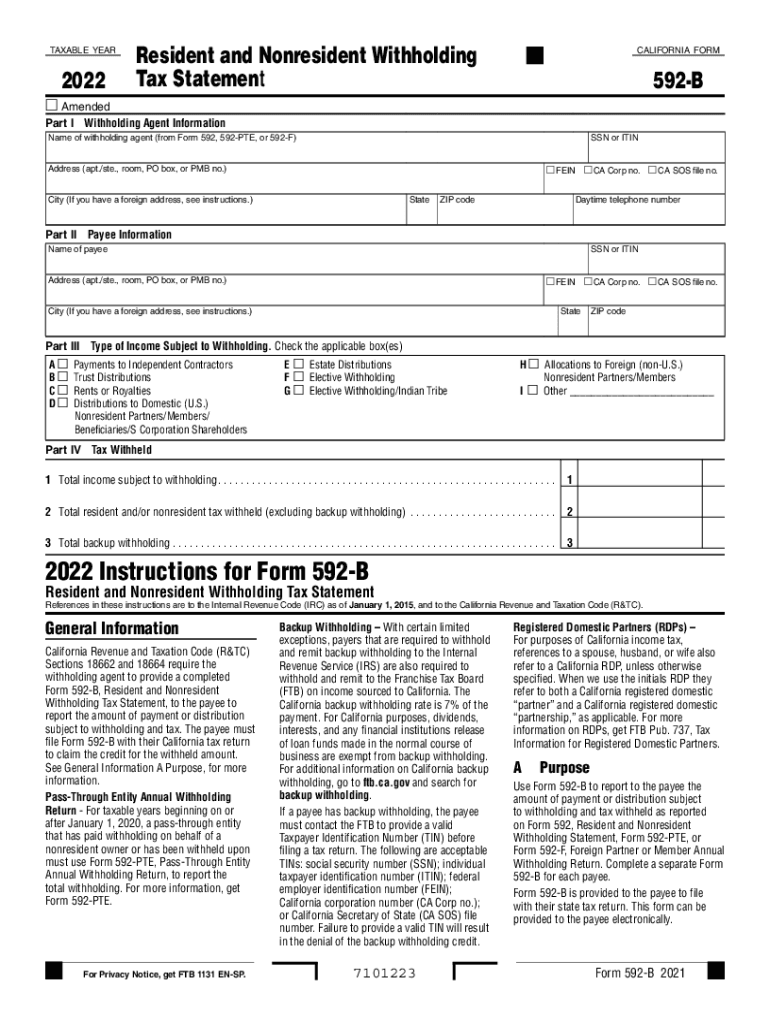

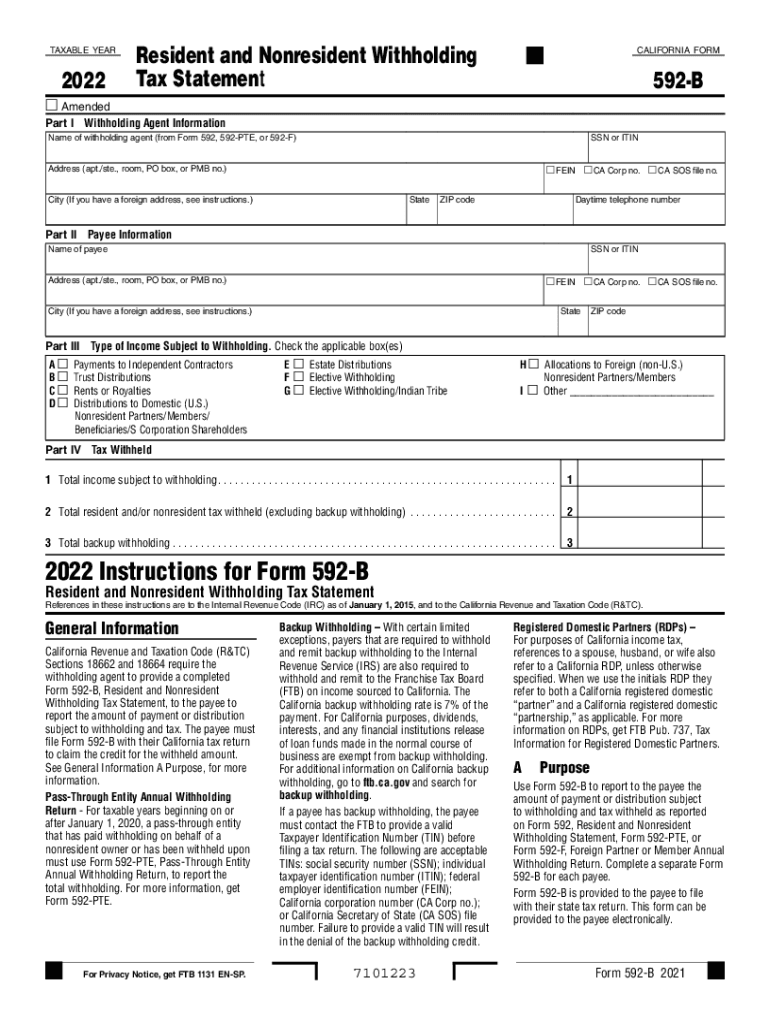

Who is required to file ca form 592 b?

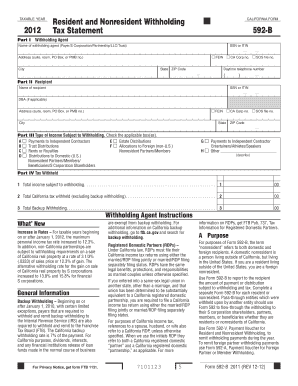

California Form 592-B is a tax form required to be filed by residents of California who are required to pay nonresident taxes on income earned from sources within the state. Nonresident taxes are taxes on income earned by a person who is not a resident of the state in which the income was earned.

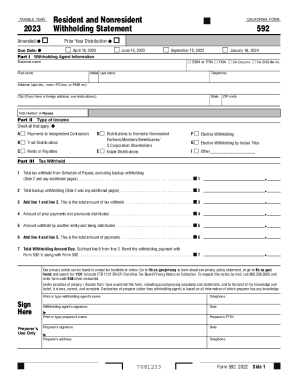

When is the deadline to file ca form 592 b in 2023?

The due date for filing California Form 592-B in 2023 is April 15, 2023.

CA Form 592-B is a document used by the State of California Franchise Tax Board (FTB) to report withholding tax on individual partners or members of partnerships or limited liability companies (LLCs).

This form is required when a partnership or LLC withholds California income tax on behalf of its partners or members who are not residents of California. The partnership or LLC must complete and file a separate Form 592-B for each nonresident partner or member.

The purpose of Form 592-B is to report the amount of income withheld and remitted to the FTB on behalf of the nonresident partner or member. This form helps the FTB track and ensure proper income tax withholding for nonresident partners or members and is used to reconcile the tax liability when the individual files their tax return.

It is important for partnerships and LLCs to carefully comply with the requirements of Form 592-B to avoid potential penalties or issues with the FTB.

How to fill out ca form 592 b?

To successfully fill out form CA 592 B, California Substitute or an Estate- 593-E, Military Spouses Residence Relief Act Election, follow these steps:

1. Obtain the form: Visit the California Franchise Tax Board (FTB) website at www.ftb.ca.gov and navigate to the "Forms & Publications" section. Search for form 592 B and download it.

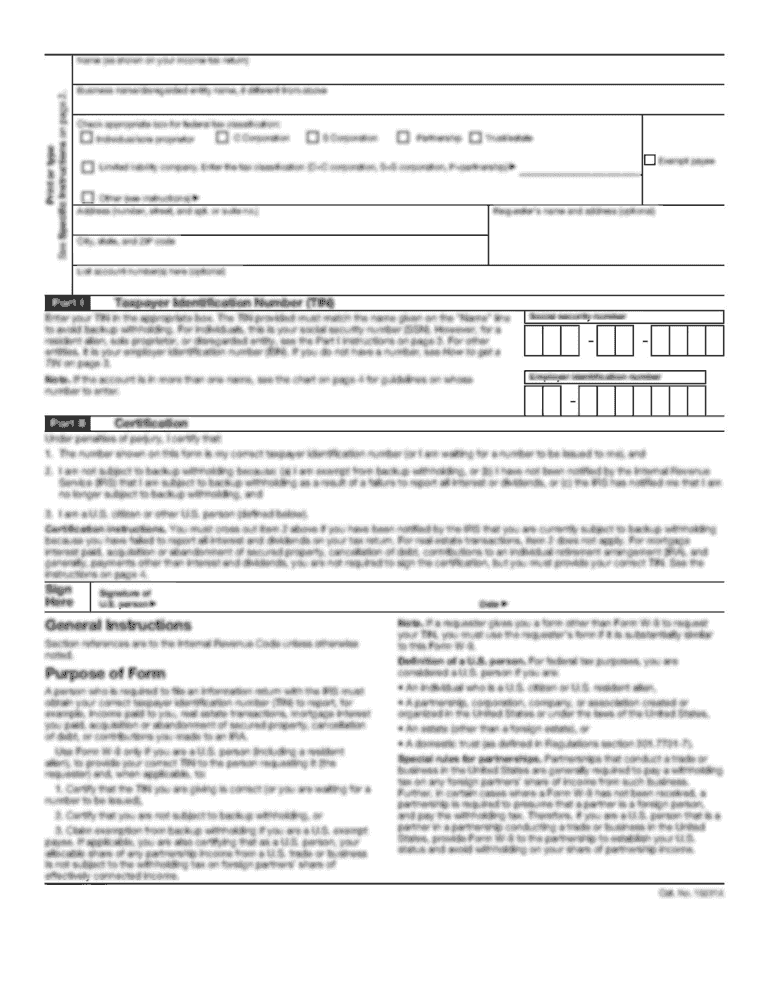

2. Provide general information: On the first page of the form, enter the name of the payer, recipient, address, social security or taxpayer identification number (TIN), and the total amount to be reported on the form.

3. Complete the entity classification: If the payer is an entity, check the appropriate box indicating the entity type, such as C corporation, S corporation, partnership, limited liability company (LLC), or trust.

4. Complete the recipient details: For each recipient receiving payments, fill in their name, address, social security or TIN, California identification number (if applicable), and the total distribution amount.

5. Provide details of the withholding agent: If there is a separate withholding agent different from the payer, enter their name, address, and TIN. Additionally, provide a description of the relationship between the payer and the withholding agent.

6. Specify withholdings: Report the total California income tax withheld from all distributions on line 7. If applicable, complete lines 8 through 10 to detail federal withholdings, nonresident withholding, and other tax credits.

7. Allocate withholding: On lines 11 through 15, allocate the withholding to each recipient based on their share of California source income, if required. This section is usually applicable to partnerships or LLCs.

8. Calculate the total withholding credit: Use the instructions to ensure that you accurately calculate the total withholding credit for each recipient.

9. Sign the form: The payer or authorized person must sign and date the completed form.

10. Retain a copy: Keep a copy of the form for your records.

Please note that this is a general overview, and it is advisable to consult with a tax professional or visit the FTB website for detailed instructions and any updates specific to your situation.

What is the purpose of ca form 592 b?

The purpose of California Form 592-B is to report withholding tax on income sourced from California for foreign individuals or nonresident entities. This form is used by payers to report and remit withheld tax from nonresident individuals or entities to the California Franchise Tax Board (FTB). It is a requirement by the state to ensure that tax obligations on California-sourced income are fulfilled by nonresidents.

What information must be reported on ca form 592 b?

CA Form 592-B, also known as the Nonresident Withholding Tax Statement, must include the following information:

1. Taxpayer Information:

- Full name

- Social Security number (or individual taxpayer identification number)

- Address

2. Payer Information:

- Name of the withholding agent or payer

- Identification number (e.g., federal employer identification number)

3. Income Type and Amounts:

- The type of income subject to withholding (e.g., rental income, royalties, pass-through entity distributions)

- Total amount of income paid or credited

- The portion of income subject to withholding

4. Withholding Information:

- Total amount of withholding (including backup withholding if applicable)

- Withholding rate applied

- Total amount withheld during the tax year

5. Calculation of Withholding:

- Certification of business activity conducted in California

- Determination of whether the income is effectively connected with a California business or any other California source

- Computation of withholding based on the nonresident's or foreign entity's taxable income

6. Certification:

- A statement declaring that the information provided is true, correct, and complete to the best of the taxpayer's knowledge and belief

It is important to consult the official instructions and seek advice from a tax professional or the California Franchise Tax Board (FTB) for specific guidance and requirements when completing Form 592-B.

What is the penalty for the late filing of ca form 592 b?

The penalty for the late filing of California Form 592-B is $15 for each information return submitted after the due date, up to a maximum penalty of $500 per filing.

How can I edit withholding tax statement from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ca form 592 b into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute withholding 592 online?

Filling out and eSigning ca resident is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the 592 b fillable form on my smartphone?

Use the pdfFiller mobile app to fill out and sign california form 592 b on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.