IRS 8844 2020-2024 free printable template

Show details

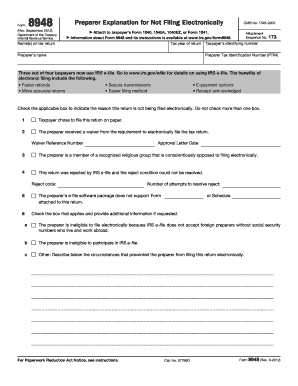

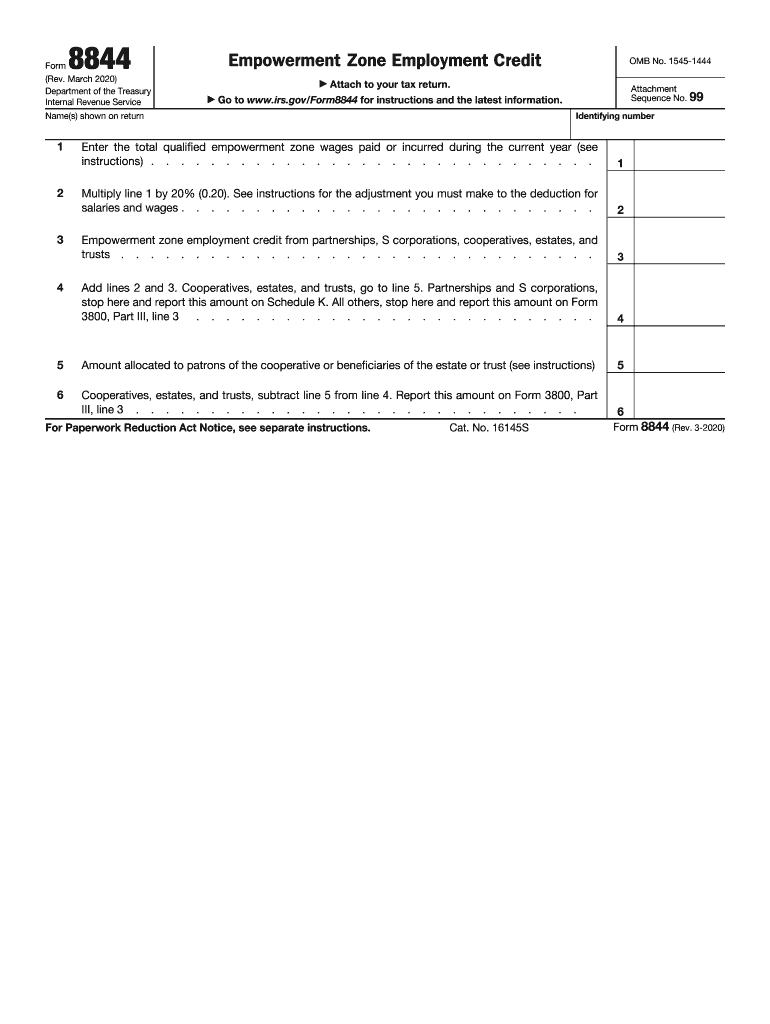

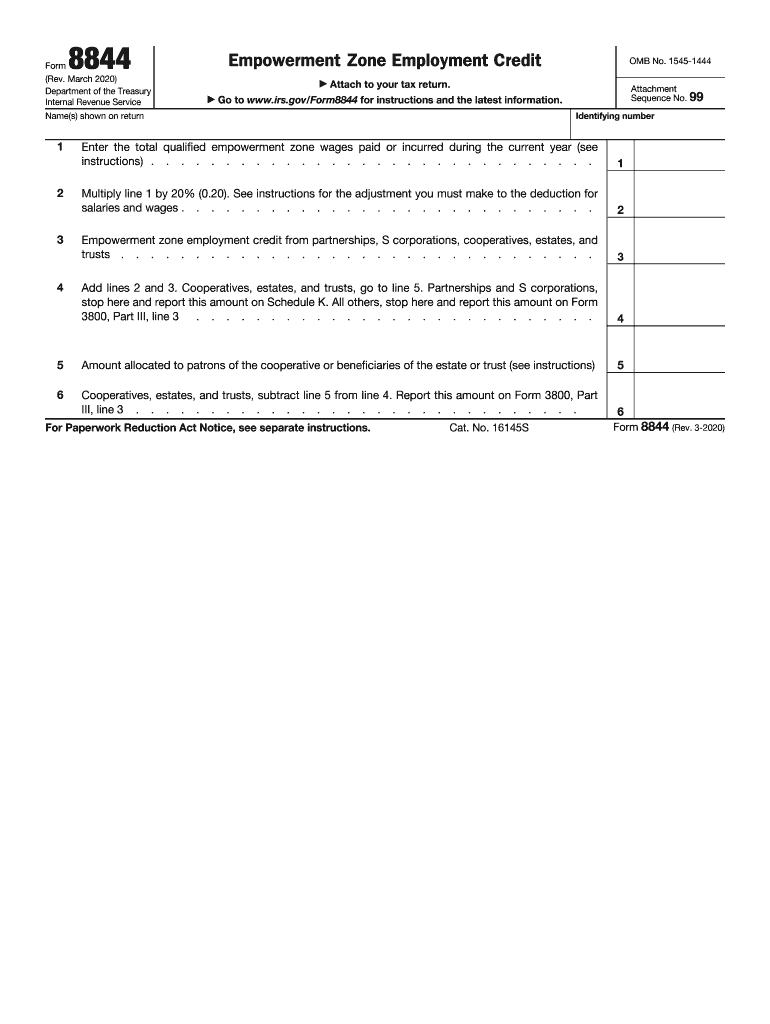

Form Rev. March 2020 Department of the Treasury Internal Revenue Service Empowerment Zone Employment Credit Attach to your tax return. Go to www.irs.gov/Form8844 for instructions and the latest information. Attachment Sequence No. 99 Identifying number Name s shown on return OMB No. 1545-1444 Enter the total qualified empowerment zone wages paid or incurred during the current year see instructions. Multiply line 1 by 20 0. 20. See instructions for the adjustment you must make to the...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your 8844 2020-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8844 2020-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 8844 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 8844 credit form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

IRS 8844 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 8844 2020-2024 form

How to fill out 8844:

01

Gather all necessary information such as your employer's address, your social security number, and the dates of your employment.

02

Provide your personal information accurately including your name, address, and contact details.

03

Fill out the details of your employer, such as their name, address, and employer identification number (EIN).

04

Specify the periods of your employment, including the starting and ending dates.

05

Indicate the total number of qualified employees and the total number of hours worked during each period of employment.

06

Sign and date the form.

07

Keep a copy of the completed form for your records.

Who needs 8844:

01

Employers who qualify for the Work Opportunity Tax Credit (WOTC) program.

02

Employers who wish to claim the tax credit for hiring individuals from targeted groups such as veterans, ex-felons, and long-term unemployed.

03

Employers who want to provide necessary information to the Internal Revenue Service (IRS) for the tax credit.

04

Individuals who are hired by qualifying employers and want to ensure their employer receives the tax credit for hiring them.

Fill 8844 form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8844?

8844 is a four-digit number that does not hold any specific significance or meaning on its own. It is simply a numeric value.

Who is required to file 8844?

Form 8844 is required to be filed by certain Indian gaming operations that are exempt from federal income tax under section 7871 of the Internal Revenue Code. It is specifically filed by organizations that are operating under Tribal-State compacts for the purpose of operating a gaming facility.

What is the purpose of 8844?

8844 is the altitude in meters of Mount Everest, which is the highest peak in the world. The purpose of referring to this number is usually to emphasize the extreme height and difficulty involved in climbing or summiting Mount Everest.

How to fill out 8844?

Form 8844 is used by businesses to claim the Indian Employment Credit. Here are the steps to fill out Form 8844:

1. Download the form: Visit the official website of the Internal Revenue Service (IRS) and search for "Form 8844." Download the latest version of the form.

2. Provide identifying information: At the top of the form, indicate the name, address, and employer identification number (EIN) of your business. If you don't have an EIN, you can apply for it using Form SS-4.

3. Check the appropriate box: Determine the appropriate box to check on Line 1, based on whether you employ enrolled members of an Indian tribe.

4. Fill out Part I - Indian Employment Credit:

a. Line 2: Enter the total wages and salaries paid to enrolled members of the Indian tribe during the tax year.

b. Line 3: Indicate the total amount of qualified wages paid during the tax year.

c. Line 4: Multiply the amount on Line 3 by 20% and enter the result.

d. Line 5: Determine the amount of wages paid to qualified Indian employees in empowerment zones. Enter the amount.

e. Line 6: Multiply the amount on Line 5 by 20% and enter the result.

f. Line 7: Add Line 4 and Line 6 and enter the total.

g. Line 8: Multiply the amount on Line 7 by 25% and enter the result.

h. Line 9: Enter the total employment tax liability of the business.

i. Line 10: Multiply the amount on Line 8 by the percentage from Line 2 (if applicable) and enter the result.

j. Line 11: Enter the smaller of Line 9 or Line 10.

k. Line 12: Multiply the amount on Line 11 by the Indian employment credit rate (specified on the form) and enter the result.

5. Fill out Part II - Carryover of Indian Employment Credit:

If you have any credit from a prior year to carry over, provide the necessary information as requested in Part II.

6. Sign and date: After completing the form, sign and date it in the appropriate section to certify that the information provided is true and accurate.

7. Attach supporting documents: If required, attach any supporting documents as mentioned in the form instructions.

8. Retain a copy: Make a copy of the completed form and all supporting documents for your records.

Remember to review all the instructions and seek professional advice if needed before submitting the form to the IRS.

What information must be reported on 8844?

Form 8844, Employer's Annual Federal Tax Return for Agricultural Employees, is used by employers in the agricultural industry to report wages and taxes withheld for each employee during a tax year. The following information must be reported on Form 8844:

1. Employer Identification Number (EIN): The employer's unique identification number is required.

2. Employer's Name and Address: The legal name and address of the agricultural employer should be provided.

3. Agricultural Labor: Details regarding the agricultural labor provided by employees during the tax year, including the average number of agricultural workers employed on a typical workday, and the total workdays.

4. Wages Paid: The total wages paid to employees engaged in qualified agricultural labor should be reported.

5. Taxes Withheld: The amount of federal income tax, social security tax, and Medicare tax withheld from employees' wages should be reported.

6. Agricultural Workers' Payments: Any cash or noncash payment provided to agricultural workers should be reported, including amounts paid for meals or lodging.

7. Credit for Social Security and Medicare Taxes: Information for any credits claimed for social security and Medicare taxes paid on employee tips should be reported.

8. Payments to Crew Leaders: If there were payments made to crew leaders who furnished workers during the tax year, those payments should be reported.

9. Signature and Date: The return should be signed and dated by an authorized individual.

It is important to note that these are general guidelines, and employers should refer to the instructions associated with Form 8844 for specific details and requirements. Additionally, employers are advised to consult with a tax professional for accurate and personalized guidance related to their specific circumstances.

When is the deadline to file 8844 in 2023?

The IRS has not yet released the specific deadline for filing Form 8844 for the 2023 tax year. Typically, the deadline is April 15th for most tax forms, but it can vary. It is important to check the IRS website or consult a tax professional for the exact deadline as it gets closer to the tax year.

What is the penalty for the late filing of 8844?

The late filing penalty for Form 8844, also known as the Empowerment Zone Employment Credit, is generally equal to 5% of the unpaid tax required to be shown on the return for each month or part of the month the return is late, up to a maximum of 25% of the unpaid tax. However, if the return is filed more than 60 days after the due date (including extensions), the minimum penalty is the smaller of $205 or 100% of the unpaid tax. It is important to note that these penalties can vary depending on the specific circumstances, so it is always recommended to consult the official IRS guidelines or seek professional advice for accurate and up-to-date information.

How can I send 8844 to be eSigned by others?

Once your 8844 credit form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit irs employment credit on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share empowerment employment from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit empowerment zone employment credit on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute empowerment credit form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your 8844 2020-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Employment Credit is not the form you're looking for?Search for another form here.

Keywords relevant to empowerment zone credit form

Related to 8844 download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.