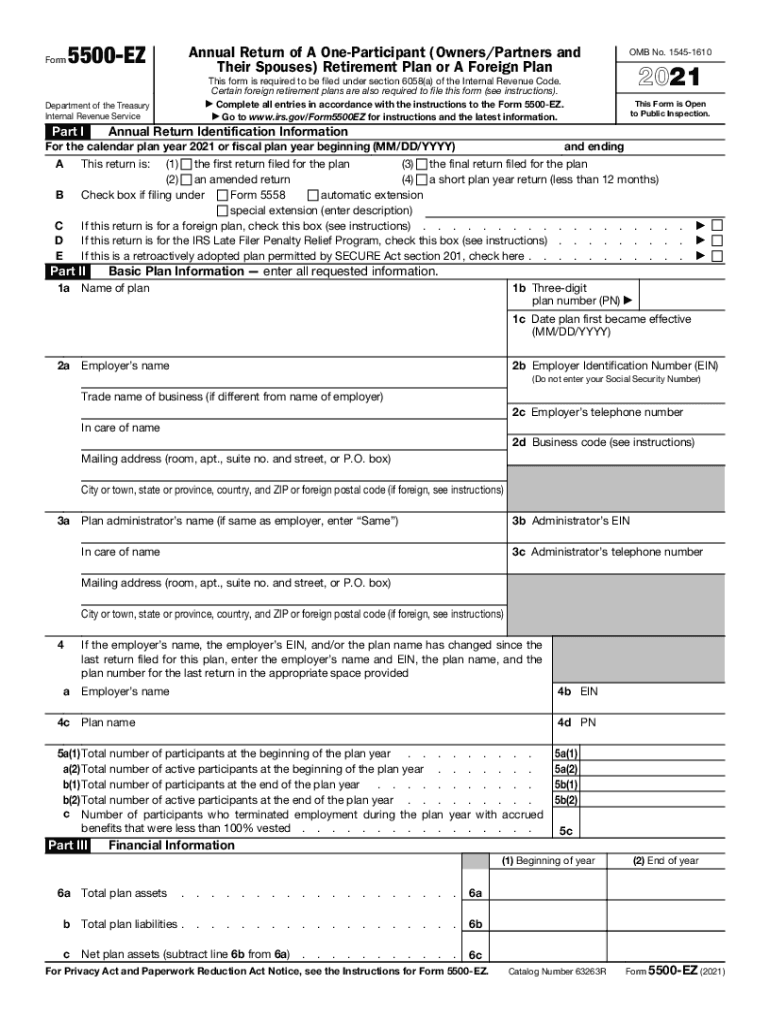

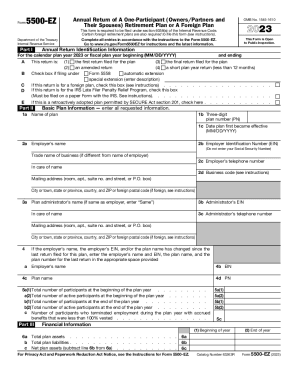

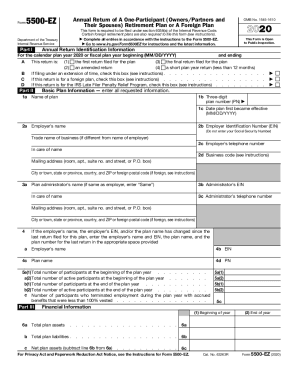

Who needs a 5500-EZ form?

This form is required if you have a one-participant retirement plan or a foreign retirement plan. A one-participant retirement plan means that it covers only one person (the business owner) without any employees. This plan also may cover the owner’s spouse and members of the partnership. The foreign retirement plan means that it has been conducted in Na country other than US. This plan should be filed by mail.

What is the 5500-EZ form for?

The information in this plan is filed with the IRS every year. This data is required for your retirement plan, as it contains the financial assets of your business.

What forms must be accompanied by the 5500-EZ form?

As a rule, the filer doesn’t have to enclose any other schedules and additional attachments of the form 5500t, but it’s better to keep these as a personal record.

When is the 5500-EZ form due?

This plan should be filed with the IRS not later than the last day of the 7th calendar month after the end of the plan year. If the business owners fail to submit the form in time, he is to pay the designated penalty.

What information should be provided in the 5500-EZ form?

While completing the form, the filer will add the following information:

- Annual return information: beginning and ending of the calendar plan year; type of the return plan;

- Basic plan information: name of the plan, plan number, date of the first effectiveness; employer’s name, ID, phone number; trade name of business, business code, mailing address; plan administrator’s name, EIN, phone number, mailing address; name of trust, EIN, phone number, name of trustee or custodian;

- Financial information: total plan assets, total plan liabilities, net plan assets, received contributions;

- Plan characteristics;

- Questions about the compliance and funding;

The filler (employer or plan administrator) has to sign and date the form.

What do I do with the form after its completion?

The completed form must be printed and forwarded to Department of the Treasury, IRS.