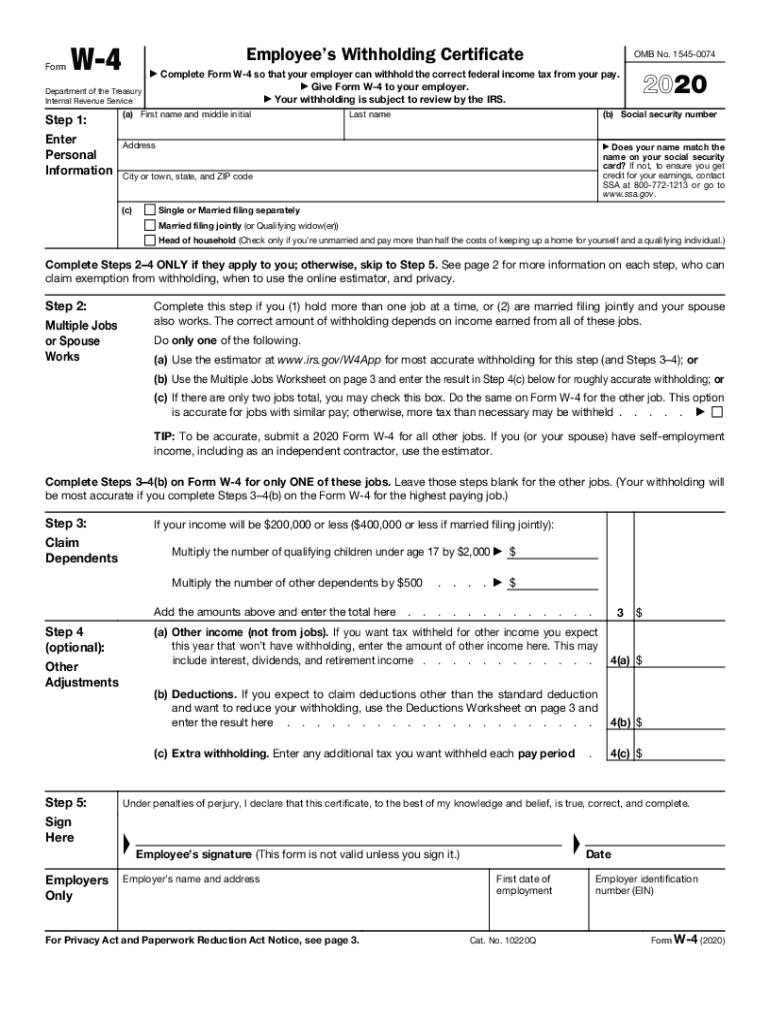

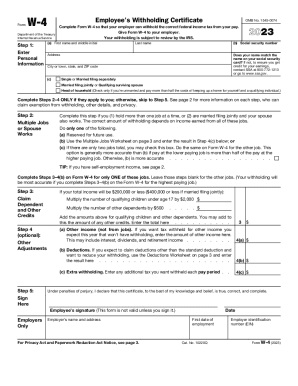

IRS W-4 2020 free printable template

Get, Create, Make and Sign

How to edit form w4 online

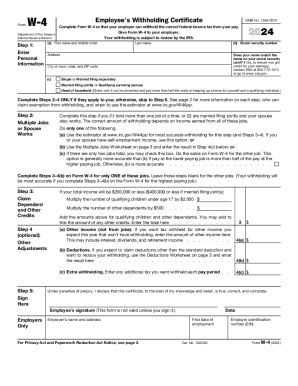

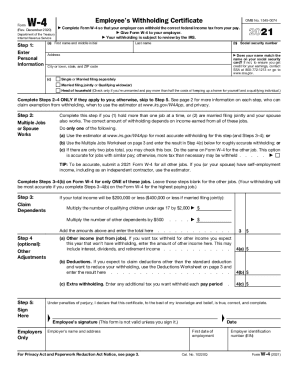

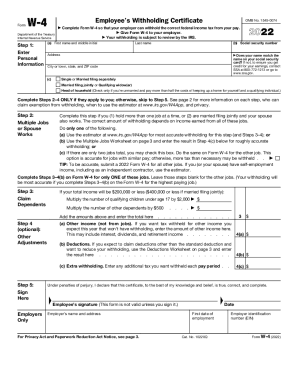

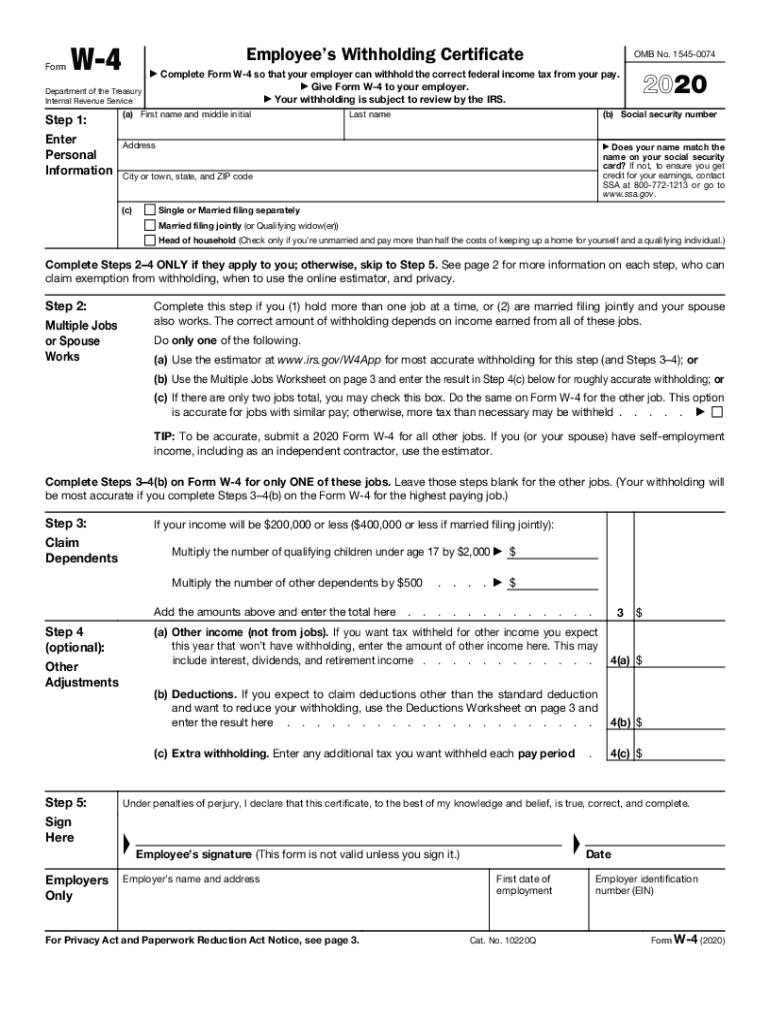

IRS W-4 Form Versions

How to fill out form w4 2020

How to fill out form w4:

Who needs form w4:

Video instructions and help with filling out and completing form w4

Instructions and Help about form pdf

The employees withholding allowance certificate or w-4 is an IRS form filled out by employees to provide employers with information about their tax situation you can either download form w-4 from the IRS website or go to pdfiller.com and get the current revision of the form that you can edit sign and submit electronically in 2020 the IRS rolled out a new w-4 form that eliminates claims for personal allowances it has five sections to fill out versus the seven sections from the pre-2020 version start by completing step 1 fill out your full name address filing status and social security number single filers with a simple tax situation only need to sign and date the form, and they are done complete steps two through four only if they apply to you otherwise skip to step five proceed to step two if you have more than one job or your filing status is married filing jointly and your spouse works to get a more accurate withholding result choose the complete option a b or c depending on your number of jobs and income if you have dependents fill out step 3 to determine your eligibility for the child tax credit and credit for other dependents proceed to step 4 to refine your withholding if you want extra tax withheld or expect to claim deductions other than the standard deduction when you do your taxes you can note that once all the fields are completed and checked off sign and date your w4 directly in the PDF filler editor save the document to your device or securely share it with your recipient via email fax USPS or SMS.

Fill w 4 : Try Risk Free

What is w 4 forms?

People Also Ask about form w4

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form w4 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.