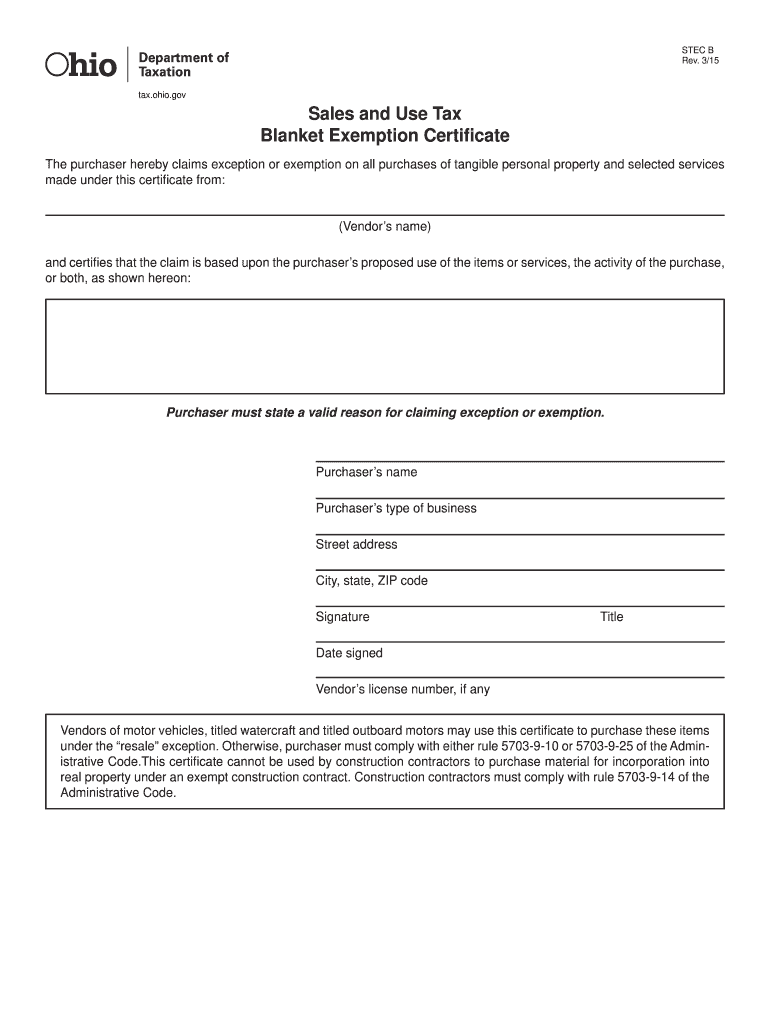

OH STEC B (Formerly STF OH41575F) 2015-2024 free printable template

Get, Create, Make and Sign

Editing ohio sales tax exemption form online

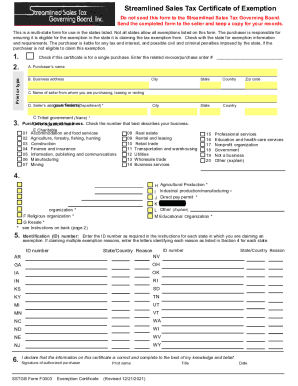

OH STEC B (Formerly STF OH41575F) Form Versions

How to fill out ohio sales tax exemption

How to fill out ohio sales tax exemption:

Who needs ohio sales tax exemption:

Video instructions and help with filling out and completing ohio sales tax exemption form

Instructions and Help about ohio tax exempt fillable form

As I've watched the Brad process occur and as I've watched how dependent our state is on a growing our workforce and the idea that we would have policies in place that would actually drive veterans out of this state to other states seemed to me not only something that we needed to change to honor our veterans but also something that we needed to do to improve the state's economy this state invested through our National Guard bases and through wright-patterson and others into a process of Brad where we would hopefully keep our military operations here in this state, and we have a lot of military contractors and so forth that either are here or have the opportunity as in Ohio to locate here we definitely want to do all we can to help grow jobs in the state one of the things as we've watched over time the Brad process occur in places like wright-patterson Air Force Base and others say we need some more we need military contractors we have the opportunity to leverage some research and the things like that are going on in our military bases that we need a workforce to support it and often times you hear military personnel say well Ohio doesn't really do what it needs to do we actually drive veterans out of this state because we tax their pensions and as we look at building an economic strategy in the state of Ohio which we have invested in as a state to get more leverage from the app from the economic opportunities that wright-patterson and other military installations and contractors provide us we need to do more to keep the workforce here we need to capitalize on the opportunity to make Ohio and inviting place 35 other states address this issue, yet Ohio doesn't and today is an announcement that I believe will be a winning strategy for our veterans for their families and for this the economy of the state of Ohio this certainly should be a great to those veterans who are retiring and choosing where they want to live out their retirement or go into a second profession to help choose Ohio by enacting this legislation Ohio will join 35 other states that either entirely do not exempt or partially exempt pensions from their state taxation, and we just want to say to our veterans that Ohio is the right place to continue living and being a productive member of our economy well as a retired Air Force colonel I am very proud to see the state of Ohio making strides towards honoring our military men and women who have chosen to serve our nation in defense of freedom for those who say the state cannot afford to give up this tax I would remind them that the military is a young person's organization many retire after 20 years and most are forced to retire when reaching 30 many in their mid-40s have not had the stability or the resources to invest in a home and so must seek another job to maintain or improve their lifestyle thus Ohio gains the additional compensation and tax revenue from the second career of the retiree the spouses job and investment interest if...

Fill stec b form : Try Risk Free

People Also Ask about ohio sales tax exemption form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ohio sales tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.