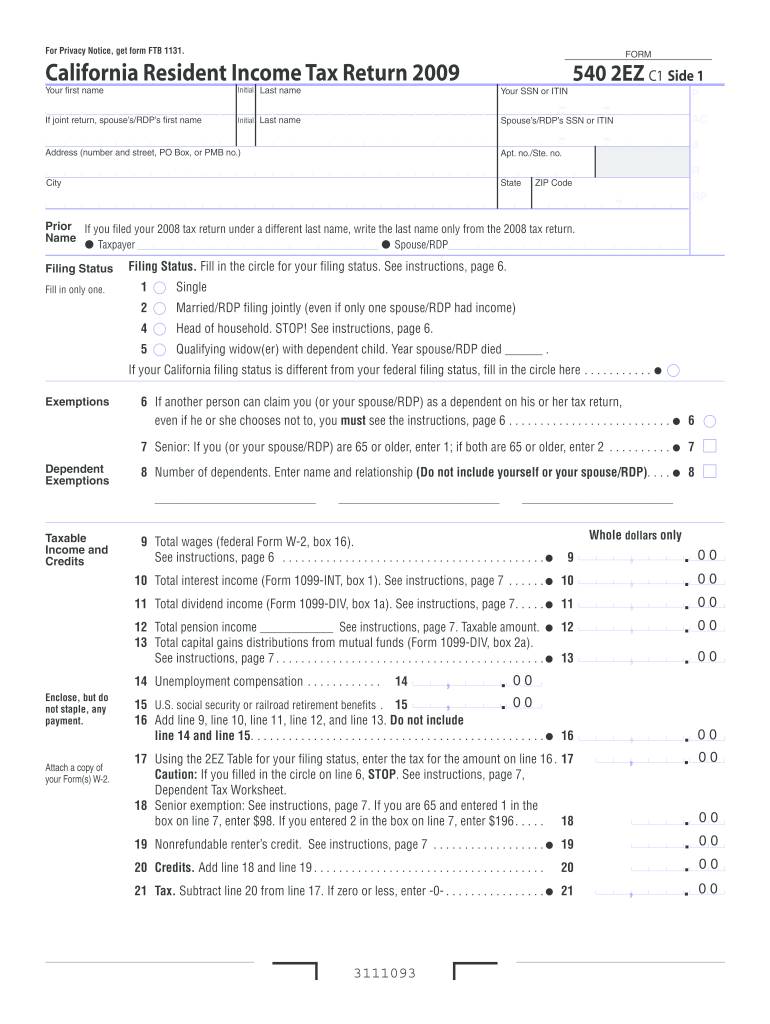

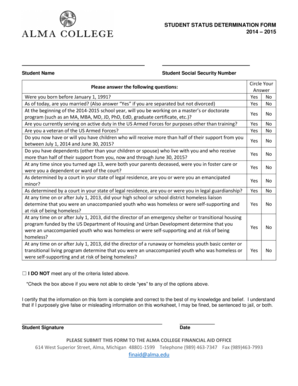

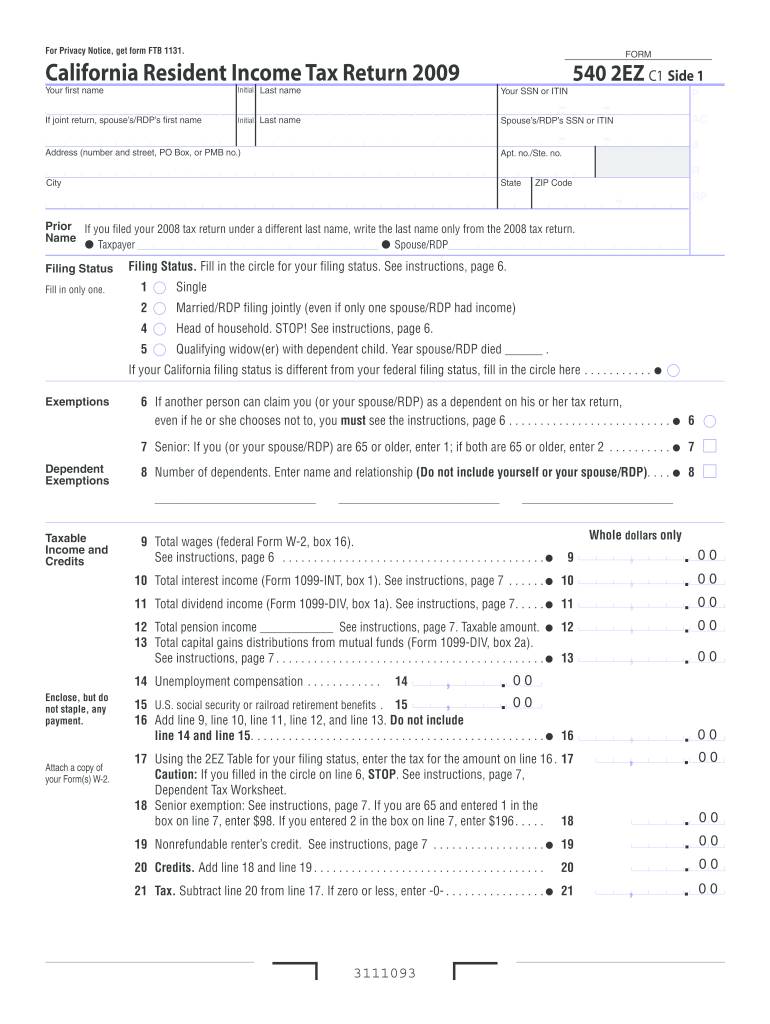

CA FTB 540 2EZ 2009 free printable template

Get, Create, Make and Sign

How to edit 2009 form 540 2ez online

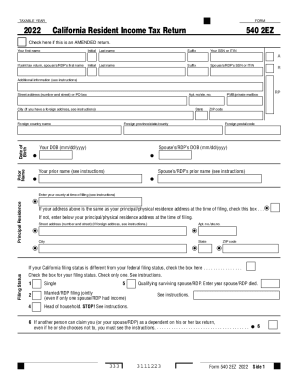

CA FTB 540 2EZ Form Versions

How to fill out 2009 form 540 2ez

How to fill out 2009 form 540 2ez:

Who needs 2009 form 540 2ez:

Instructions and Help about 2009 form 540 2ez

All righty welcome back, so we're going to go over the state tax return now that we've finished our federal return so on the state tax return this is amazing as it may sound it's twice as long as a federal return, so there's four pages on the state return there's two on uh the federal return but just with um you had with the federal return you're going to have line by line instructions, so it's going to talk to you about line one through five in terms of your filing status this booklet will come through we will need to do this dependent tax worksheet uh because somebody has to claimed us somebody has claimed us as a dependent on our federal return, so we'll need to do that as well remember that you'll need your w-2 when you get your w-2 you'll get numerous copies but down here at the bottom is the state information that we will need to fill out so on your state tax return you are going to fill in your name up here at the top first letter of your middle name your last name and your social security and for this...

Fill form : Try Risk Free

People Also Ask about 2009 form 540 2ez

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 2009 form 540 2ez online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.