Who needs the Additional Insured — Designated Person or Organization Form?

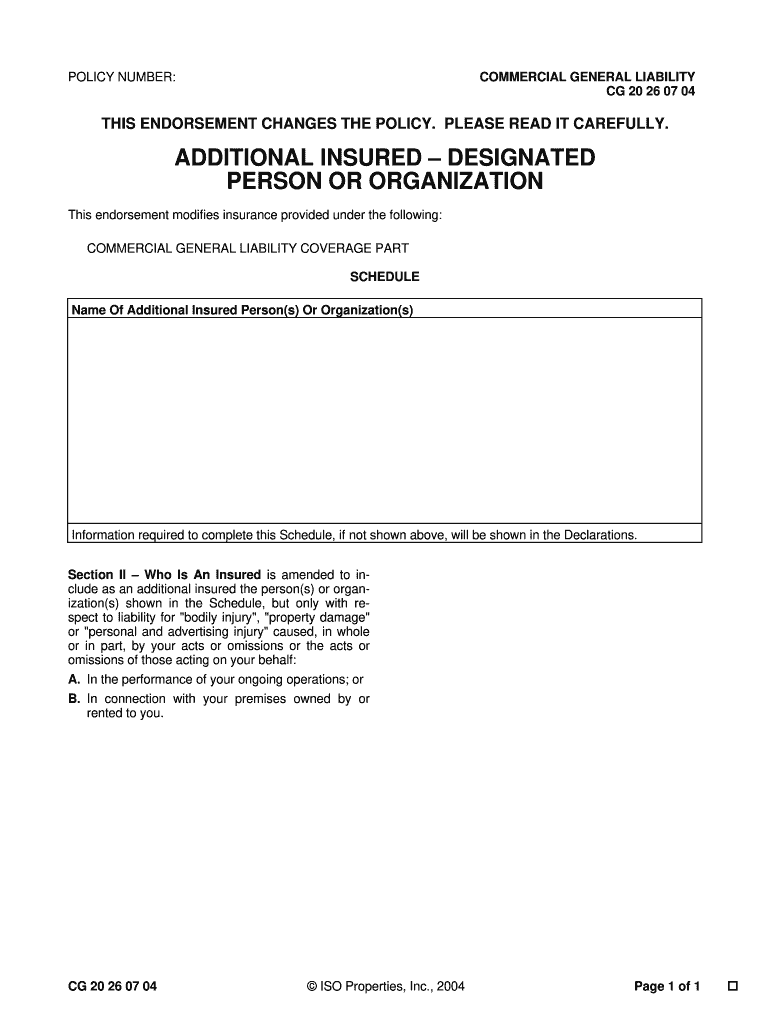

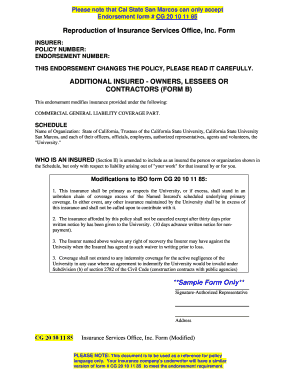

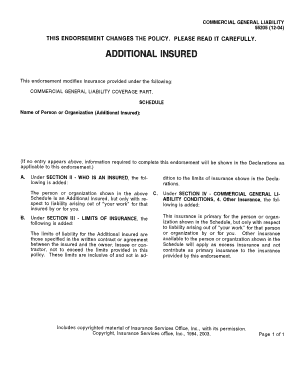

The Additional Insured — Designated Person or Organization Form also labeled as CG-20-26 Form is an attachment document to a liability insurance policy under which an organization or individual gets immediately insured in addition to the original purchaser of the policy as required by the contract or other provisions. Therefore, an ‘additional insured’ is an individual (or organization) making use of the benefits of the insurance policy purchased by another party.

Is the CG-20-26 Form accompanied by any other documents?

As the indicated form serves as the endorsement, it must be filed along with the given insurance policy.

When is the Additional Insured — Designated Person or Organization Form due?

The CG-20-26 Form does not have a particular due or expiration date. The only requirement for its filling out is that it should be completed together with the insurance policy.

How do I fill out the Additional Insured Endorsement Form?

For the proper completion of the CG-2026 Form, only the full legal name of additional insured person(s) or organization(s) data must be indicated on the one-page form.

Where do I submit the completed the Additional Insured — Designated Person or Organization Form?

The original copies of the insurance policy and the endorsement form CG-2026 should be retained by the insurance provider, the insured (insurance purchaser) and the additional insured person(s) or organization(s) named in the given attachment.