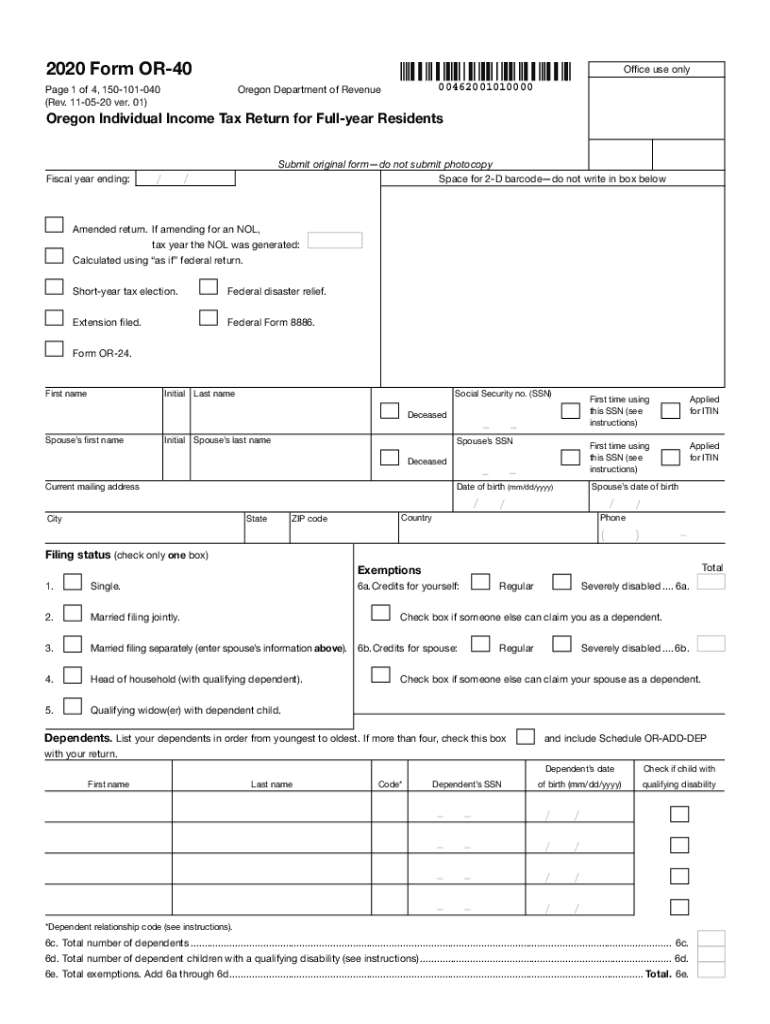

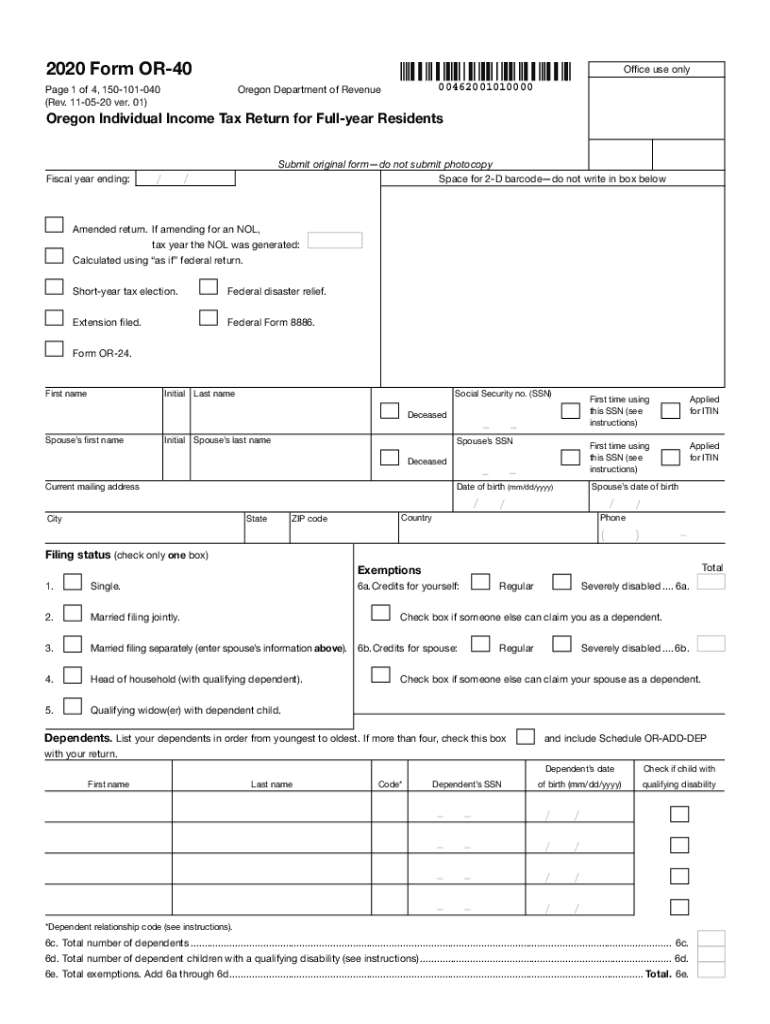

OR DoR OR-40 2020 free printable template

Get, Create, Make and Sign

Editing oregon form 40 online

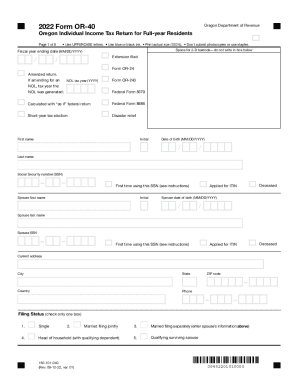

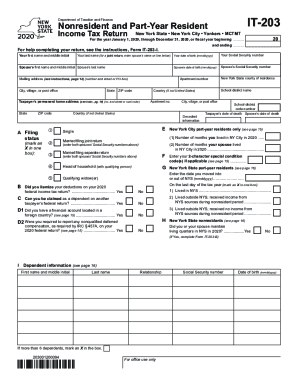

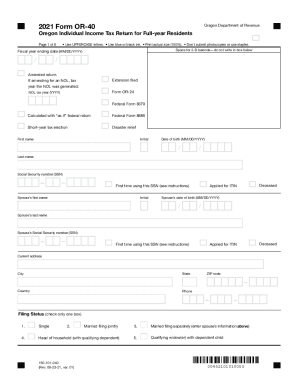

OR DoR OR-40 Form Versions

How to fill out oregon form 40 2020

How to fill out Oregon Form 40:

Who needs Oregon Form 40?

Video instructions and help with filling out and completing oregon form 40

Instructions and Help about oregon form

Music thank you so I am indeed Russells and I want to talk to you about functional programming this morning just briefly about me I am kind of a programming language geek I have been learning programming languages and occasionally writing books about them for most of my career and lately Ive been doing functional programming so a couple of things about this talk before I really get started its you might be thanking functional programming in 40 minutes how is he going to cover functional programming in 40 minutes and Im thinking what am I gonna do with the last 10 minutes because I I think the whole theme of this talk is that functional programming has been mystified and people get very excited about new technologies or technologies that are new themselves and they start talking about them in big expansive terms about how its gonna change everything and in fact functional programming really is a fundamentally simple idea and thats what Im going to try and get across this morning I do want to warn you that Im a closure programmer so my flavour of functional programming is with closure so necessarily my point of view and what Im gonna tell you is going to have sort of a closure spin to it Im going to try to point out in places where this is the way closure does it and other programming languages do it differently but keep in mind that Im kind of a closure programmer so I really want to cover three things this morning and really one main thing and the main thing is what is functional programming where did it come from like whats the ideas behind functional programming how did we come to them and thats most of what Im going to talk about this morning and then from there Im going to move on to whats it like to be a functional programmer whats it like to actually do it and in particular whats it like to do it as a beginner I may be from the object-oriented tradition and I start programming in a functional style whats that light that transition like and then finally Im going to try and answer the question which is maybe a little subjective which is does it work can you can you make it work and again Im sort of a practical software engineer I write applications for my day job and so this is going to be a sort of functional programming for you no ordinary programmers who want to write applications and libraries so lets start with what it is and there is so when I was first getting involved in functional programming you know you google functional programming how do I learn functional programming and there was one thing that I saw over and over and over and it is functional programming forget everything you know about programming or even worse functional programming forget everything you think you know about programming yeah I think software developers programmers here it turns out we know quite a lot about programming what do we know about programming we know about things like programs are full of names and you assign values to those names programs are...

Fill state of oregon tax forms : Try Risk Free

People Also Ask about oregon form 40

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your oregon form 40 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.