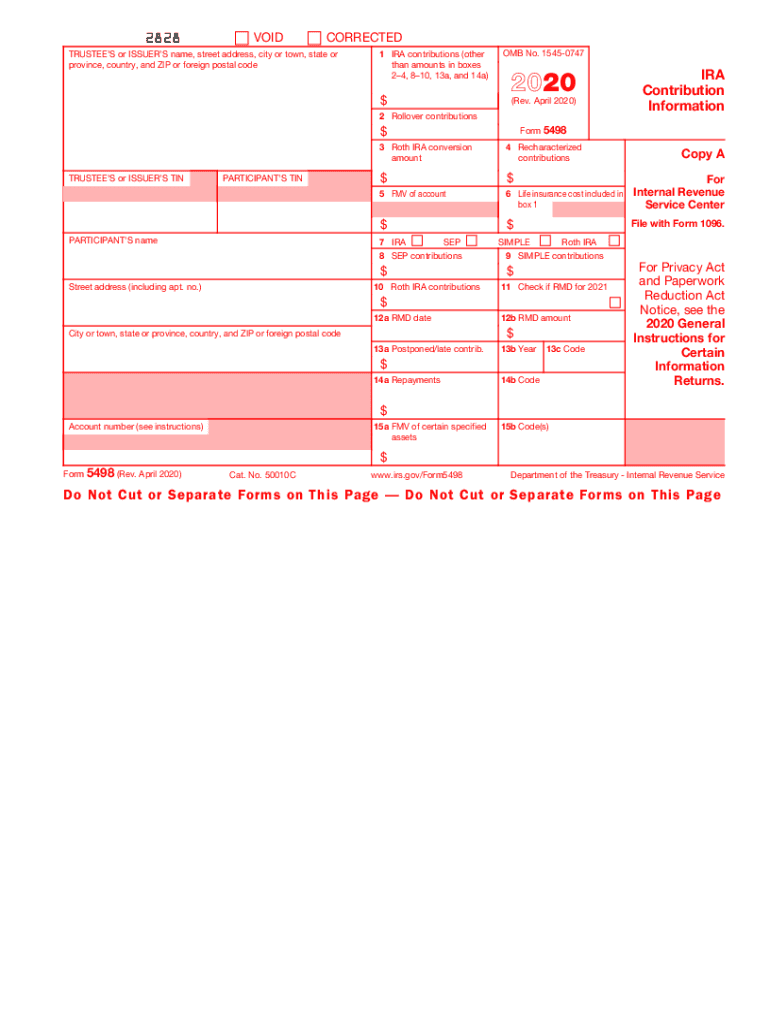

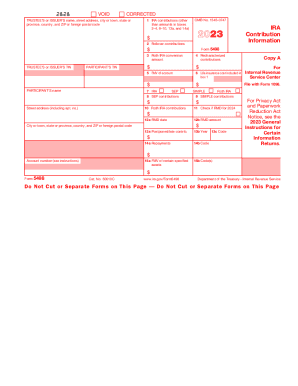

Who needs an IRS form 5498?

Form 5498 is a report about taxpayer’s contributions to the individual retirement account requested annually by the Internal Revenue Service. The IRA trustee or issuer has to complete it and send a copy to IRS and to the taxpayer.

What is IRS form 5498 for?

Reports about the IRA contributions are filed for the taxation purposes. This form is one of the basic personal financial documents for every taxpayer in the United States.

Is it accompanied by other forms?

The trustee or issuer doesn’t have to attach any forms to this form, but he has to complete at least three copies: one for the IRS, one for the participant and one for himself.

When is IRS form 5498 due?

Every year IRS establishes a new due date for these reports. Usually it’s in April or May, in the beginning of the new tax year. The taxpayers receive their copies in June or July.

How do I fill out form 5498?

There are three copies included in this form. Copy A is to be sent to Internal Revenue Service. It contains information about the trustee and the IRA participant, their names, addresses, the account number, trustee’s federal identification number and participant’s social security number. There is also a table on IRA contributions, including rollover contributions, fair market value of an account, life insurance cost etc. The trustee has to specify amounts of recharacterized and postponed contributions as well as repayments. Copies B and C look exactly the same, only copy B must be sent to the participant. The issuer retains copy C.

Where do I send form 5498?

The trustee can submit the report electronically at the official website of IRS or mail it to the IRS office.