Get the free irs printable tax forms

Get, Create, Make and Sign

Editing irs printable tax forms online

How to fill out irs printable tax forms

How to fill out tax filing online:

Who needs tax filing online:

Video instructions and help with filling out and completing irs printable tax forms

Instructions and Help about form irs

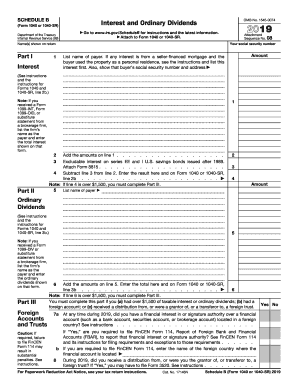

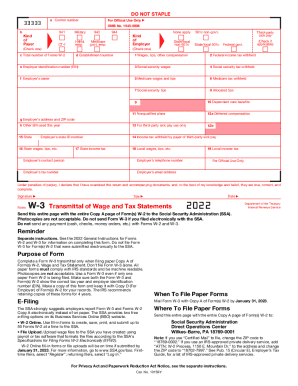

How I filled my federal taxes online with free fillable forms you can check it out at WWE from horn stock so if you've ever filed your federal taxes might have come across the successive link to Baguio textures using free file here's the website through IRS and this is what they say about that website that they suggest free file fillable forms is hosted operated and maintained by an IRS authorized iris file provider virus in partnership with free alliance org free Fire Island alliance org offers this free service, and then it says you have to exit somewhere that was a privacy statement and so you have other prowling options there's other software tools you can use such as turbo tax I know people I know who buy from Costco you can use HR block and there's another large one is tax exact personally I've only used turbo tax from all those tax software as I mentioned, and I thought Turbo Tax was really easy to use they explained things very well, and so I even used it to compare with my own tax calculations, and it came out to be the same, so it works pretty well for me back to free file fillable forms, so you can go to their website and basically if you re file your taxes on paper this isn't too different it's basically the same exact forms, but they're available online, and we filled them online once you finish drilling them online you just go through their submitting process and when you're done you just submit the forms online, and they also have all the schedule forms that you need to fill out on their website and so once you submit it that's it the requirements to do this is you need to he should work on any operating system that works on i.e. Firefox or Chrome the main requirement is you need, they'll be flashed the latest version of the adobe flash in a reliable internet connection I'm assuming based on these requirements you could run it on a Mac computer I haven't tried because I don't own a mac and tried looking on the website, but I couldn't really find different I'm sure if you can figure it so some comments about using this online tools filling these forms online take some time to get used to like figure out how to open certain schedule forms and where they're located or difficult for me at first but once I knew where I can access them wasn't a problem another thing is you'll need to fill out your w-2 information again on the website because normally you would just attach the w2's and mail it, but they need you to enter the information into a separate form so as I said once you've filled in finish filling out forms you'll have to submit the form online, and then they do verification through their own servers to see that you submitted the right information, and usually they reply within 12 hours to see if your application was accepted or rejected and in my case I've done this for the past three years in two of those years I had problems where I made a mistake, and it sent it back to me and first time it was easy to find where the mistake...

Fill where can i file my state taxes for : Try Risk Free

People Also Ask about irs printable tax forms

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs printable tax forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.