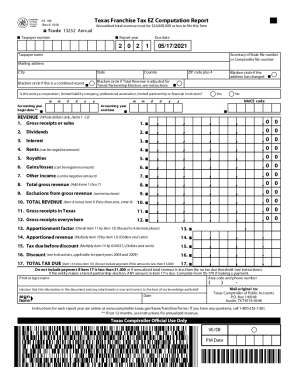

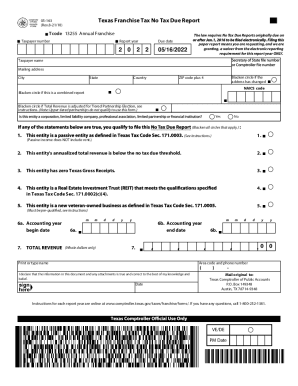

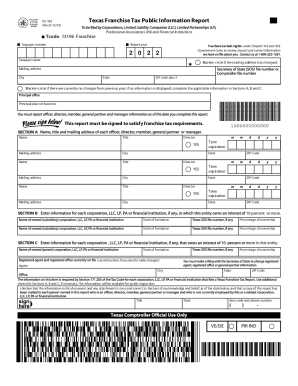

TX 05-169 2022-2024 free printable template

Get, Create, Make and Sign

How to edit texas franchise computation online

TX 05-169 Form Versions

How to fill out texas franchise computation 2022-2024

How to fill out Texas franchise tax computation:

Who needs Texas franchise tax computation:

Video instructions and help with filling out and completing texas franchise computation

Instructions and Help about texas franchise tax ez computation form

>>> NEXT ON C-SPAN, THE DAILY White House PRESS BRIEFING WITH PRESS SECRETARY SEAN SPICER. [CHEERS AND APPLAUSE] >> SETTLE DOWN! SETTLE DOWN! SETTLE DOWN! BEFORE WE BEGIN, I KNOW THAT MYSELF AND THE PRESS HAVE GOTTEN OFF TO A ROCKY START. [CHEERS AND APPLAUSE] ALL RIGHT, ALL RIGHT, ALL RIGHT, ALL RIGHT. IN A SENSE, WHEN I SAY ROCKY START, I MEAN IT IN THE SENSE OF “ROCKY” THE MOVIE. BECAUSE I CAME OUT HERE TO PUNCH YOU! IN THE FACE! AND ALSO I DON'T TALK SO GOOD. SO I'D LIKE TO BEGIN TODAY BY APOLOGIZING ON BEHALF OF YOU, TO ME. [LAUGHTER] FOR HOW YOU TREATED ME IN THE LAST TWO WEEKS. AND THAT APOLOGY IS NOT ACCEPTED. [LAUGHTER] BECAUSE I'M NOT HERE TO BE YOUR BUDDY, I'M HERE TO SWALLOW GUM, I'M HERE TO TAKE NAMES. [LAUGHTER] [LAUGHTER] OKAY, NOW LET ME WAVE SOMETHING SHINY IN FRONT OF YOU MONKEYS! I'LL GET BACK TO YOU. [LAUGHTER] AS YOU KNOW, PRESIDENT TRUMP ANNOUNCED HIS SUPREME COURT PICK ON THE NATIONAL TV TODAY. WHEN HE ENTERED THE ROOM, THE CROWD GREETED HIM WITH A STANDING OVATION. WHICH LASTED A FULL 15 MINUTES. YOU CAN CHECK THE TAPE. EVERYONE WAS SMILING. EVERYONE WAS HAPPY. [LAUGHTER] THE MEN ALL HAD ERECTIONS. AND EVERY SINGLE ONE OF THE WOMEN WAS OVULATING LEFT AND RIGHT. [LAUGHTER] AND NO ONE, NO ONE WAS SAD. THOSE ARE THE FACTS FOREVER AND THERE'S SOMETHING ELSE. WE GOT SOMETHING X, THREE, FOUR, CAPITAL P, CAPITAL T, EIGHT, FOUR -- NO, THAT'S MY E-MAIL PASS WORD, FORGET THAT. STOP WRITING THAT DOWN! NOW. PRESIDENT'S SCHEDULE FOR TODAY, 3:45, PRESIDENT WILL HOST AN ENCORE SCREENING OF “FINDING DORY.” [LAUGHTER] OKAY? THE STORY OF A FORGETFUL FISH, OKAY? EVERYBODY LIKES THAT. THEN AT 6:00 P.M. HE'S GOING TO ABOLISH THE NATIONAL PARK SYSTEM. BUT “DORY”! GOOD STUFF. SO IF NOBODY HAS ANY QUESTIONS -→> OKAY, A COUPLE QUESTIONS. GO. GLEN FLUSH, “NEW YORK TIMES, *?? BOO! GO AHEAD. >> YEAH, I WANTED TO ASK ABOUT THE TRAVEL BAN ON MUSLIMS. >> IT'S NOT A BAN. >> I'M SORRY? >> NOT A BAN. THE TRAVEL BAN IS NOT A BAN WHICH MAKES IT NOT A BAN. >> YOU JUST CALLED IT A BAN. >> BECAUSE I'M USING YOUR WORDS. YOU SAID BAN. YOU SAID BAN, NOW I'M SAYING -→> THE PRESIDENT TWEETED, AND I QUOTE, “IF THE BAN WERE ANNOUNCED WITH A ONE-WEEK NOTICE -→> YEAH, EXACTLY, YOU JUST SAID THAT. HE'S QUOTING YOU. IT'S YOUR WORDS. HE'S USING YOUR WORDS WHEN YOU USED THE WORDS AND HE USES THEM BACK, IT'S CIRCULAR USING OF THE WORD AND THAT'S FROM YOU. [LAUGHTER] >> WHAT? [CHEERS AND APPLAUSE] >> SERIOUSLY GLEN, ARE YOU GOING TO START WITH ME RIGHT OUT OF THE GATE? WHAT DO YOU WANT ME TO TAKE MY NUTS OUT SO YOU CAN GET A BETTER KICK AT THEM? >> YOU HAD TO HAVE KNOWN THAT I WOULD ASK THAT QUESTION -→> SIT DOWN, GLEN. WHO HERE -- JUST BY SHOW OF HANDS, WHO HATES GLEN? QUICK SHOW OF HANDS. EVERYBODY, EVERYBODY. ONE, TWO, THREE, INFINITY. NOW, LET THE RECORD SHOW THAT EVERYONE RAISED THEIR HANDS AND EVERYBODY HATES GLEN. PRINT THAT THAT'S YOUR STORY. NEXT QUESTION. GO. >> YES, I'D LIKE TO ASK ABOUT STEVE BANNON'S ROLE ON THE NATIONAL SECURITY COUNCIL. >> OKAY, THAT'S A DUMB...

Fill texas 05 169 instructions : Try Risk Free

People Also Ask about texas franchise computation

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your texas franchise computation 2022-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.