Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

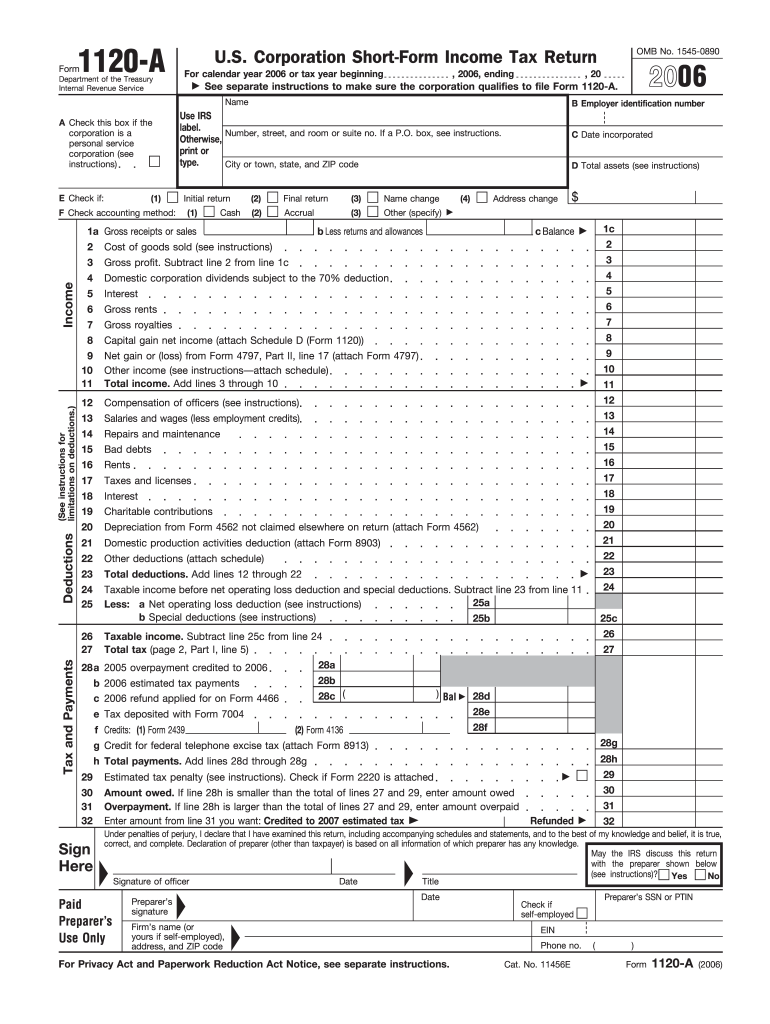

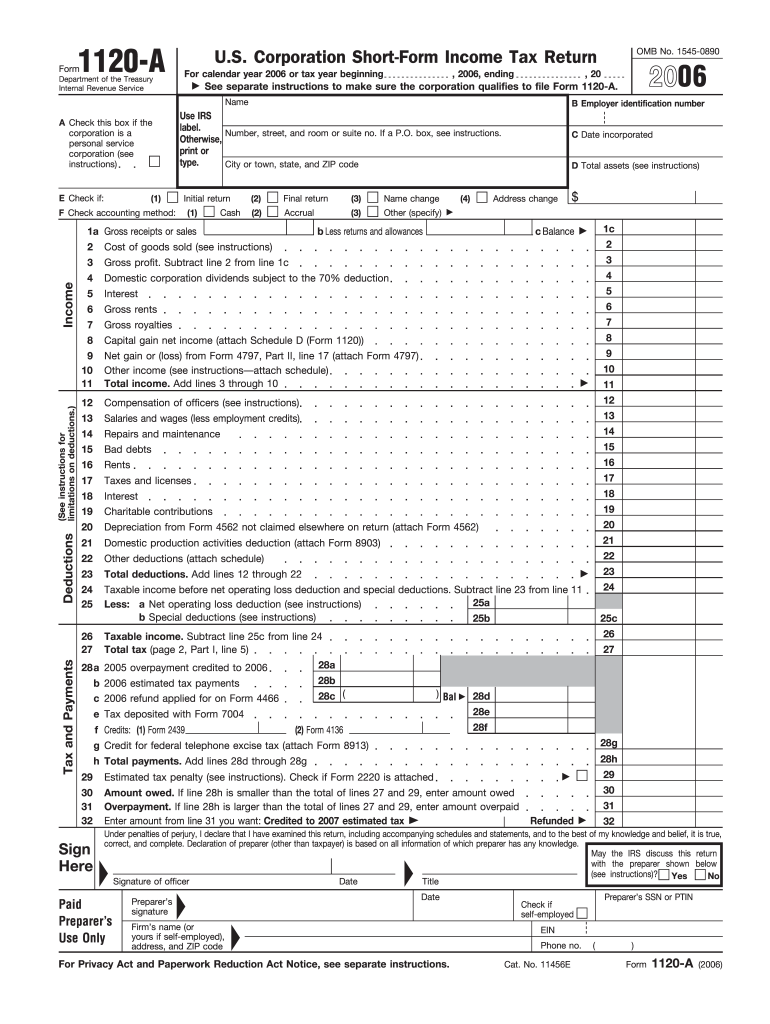

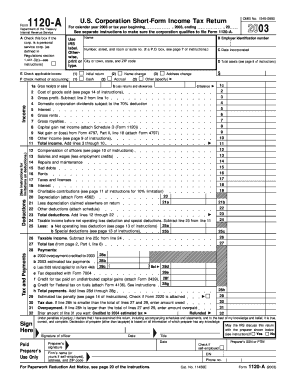

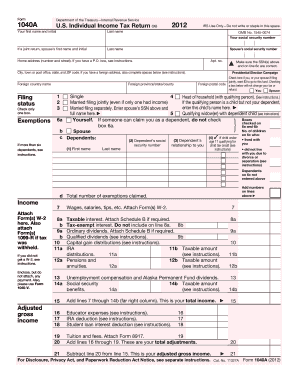

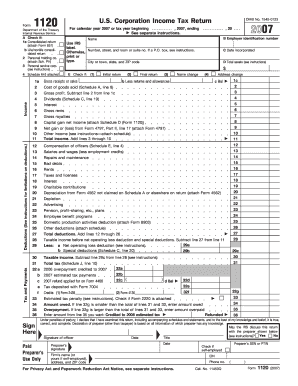

How to fill out irs publication?

1. Start with the basics. Gather your tax documents, such as your W-2s, 1099s, and other income statements.

2. Fill in your personal information. On the front page of the publication, provide your name, address, Social Security number, and other relevant data.

3. Determine which filing status applies to you. The IRS provides five filing statuses, and you must choose the one that applies to you.

4. Use the instructions provided in the publication to complete your tax return. Read each section carefully, and make sure to answer all of the questions.

5. Calculate your deductions and credits. Use the instructions provided in the publication to determine which deductions and credits you qualify for.

6. Double-check your work. Carefully review your tax return, and make sure all of the information is correct.

7. Submit your tax return. Once you’ve completed your tax return, you can submit it electronically or mail it to the IRS.

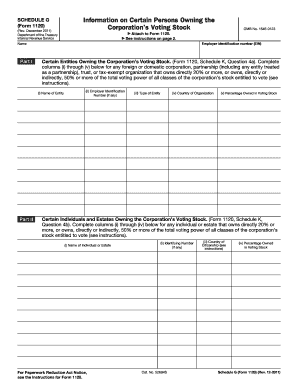

What information must be reported on irs publication?

IRS Publication 525, Taxable and Nontaxable Income, contains information about what types of income are taxable or nontaxable for federal income tax purposes. It also explains if certain types of income are subject to self-employment tax or can be excluded from income. Additionally, it explains the tax implications of certain fringe benefits, such as health insurance, education expenses, and moving expenses. Finally, it explains the tax rules that apply when you sell property or receive a settlement.

IRS publication refers to any document or informational material that is released by the Internal Revenue Service (IRS) in the United States. These publications provide detailed instructions, guidelines, forms, and explanations on various tax-related topics, such as income tax, deductions, credits, and reporting requirements. They aim to assist taxpayers in understanding and complying with the tax laws and regulations. IRS publications are available both online and in printed form and can be accessed for free on the official IRS website.

Who is required to file irs publication?

IRS publication is applicable to individuals or entities that are required to file federal income tax returns or report certain financial transactions to the IRS.

What is the purpose of irs publication?

The purpose of IRS publication is to provide detailed and specific information on various tax topics to help taxpayers understand and comply with the tax laws and regulations set by the Internal Revenue Service (IRS). Publications offer guidance on a wide range of tax-related matters, including income taxes, deductions, credits, exemptions, retirement plans, record-keeping, and IRS procedures. They are intended to assist individuals, businesses, and organizations in filing accurate and complete tax returns, understanding their rights and responsibilities, and staying compliant with tax laws. Publications also address common tax questions and scenarios, providing examples and explanations to help taxpayers navigate the complex tax system.

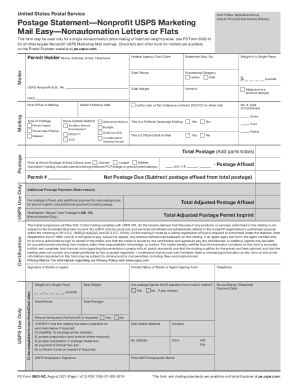

What is the penalty for the late filing of irs publication?

The penalty for late filing of IRS publications depends on the specific publication and the type of tax return being filed.

If you are referring to late filing of an IRS tax return, the penalty can be calculated based on the amount of tax owed and the number of days late. The penalty is typically a percentage of the unpaid tax, ranging from 5% to 25%. Additionally, there is a minimum penalty for late filing, which is the lesser of $435 or 100% of the unpaid tax.

However, if you are referring to the late filing of an IRS publication (such as a Form or Schedule), there is generally no specific penalty for late filing of publications themselves. These publications are typically informational materials or instructions to help individuals understand how to complete their tax returns.

How can I manage my form 1120 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign corporation 1120 form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

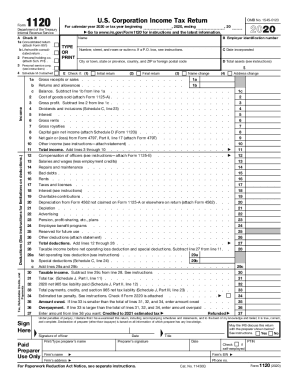

How do I fill out the 1120 a form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign 1120 due date. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out form 1120a on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 1120a form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.