Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

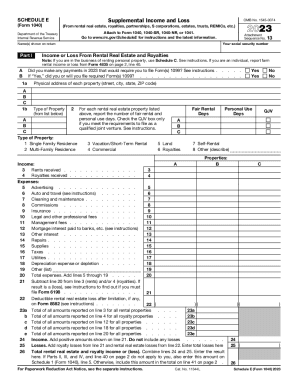

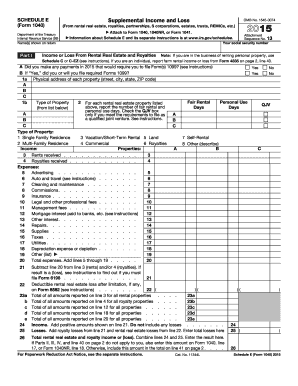

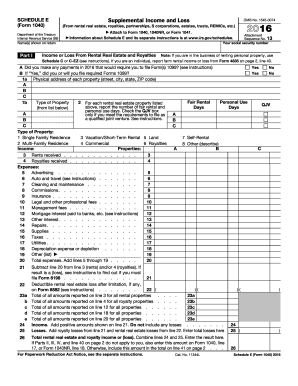

The 1040 form is the standard U.S. Individual Income Tax Return form. It is used by individuals to file their annual income tax return with the Internal Revenue Service (IRS). The form is used to report various types of income, deductions, credits, and calculate the amount of tax owed or refunded.

Who is required to file e 1040 form?

The e 1040 form, also known as Form 1040, is the standard federal income tax form used by individuals to file their annual tax returns with the Internal Revenue Service (IRS) in the United States. Generally, any individual who earns income in the United States and meets the filing requirements established by the IRS is required to file a Form 1040. However, the specific filing requirements may vary based on factors such as age, filing status, income level, and other specific circumstances. It is always recommended to consult with a tax professional or refer to the IRS guidelines to determine whether you are required to file a Form 1040.

What is the purpose of e 1040 form?

The purpose of Form 1040 is to report an individual's income, calculate and pay the appropriate amount of taxes due to the Internal Revenue Service (IRS) in the United States. It is the standard form used by taxpayers to file their annual federal income tax returns. The form covers various sources of income, deductions, credits, and allows individuals to claim any tax refunds or pay any taxes owed.

When is the deadline to file e 1040 form in 2023?

The deadline to file Form 1040 in 2023 will be April 17, 2023.

How to fill out e 1040 form?

To fill out a Form 1040 (U.S. Individual Income Tax Return), follow these steps:

1. Gather all necessary documents: Collect your W-2 forms, 1099 forms, receipts for expenses, and any other relevant financial documents.

2. Choose your filing status: Determine your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Provide personal information: Fill in your personal information, including your name, address, Social Security number, and other details as required.

4. Report your income: Enter your income information by listing your wages, salaries, tips, interest, dividends, and any other sources of income.

5. Deduct your expenses and credits: Deduct your eligible expenses, such as student loan interest, self-employment expenses, or contributions to retirement accounts. Claim any tax credits you are eligible for, such as the Child Tax Credit or the Earned Income Credit.

6. Calculate your tax: Use the tax tables or tax calculation worksheets provided in the Form 1040 instructions to determine your tax liability.

7. Claim your withheld tax: Enter the amount of federal income tax withheld from your paychecks throughout the year. This amount can be found on your W-2 forms.

8. Additional taxes or payments: If you owe any additional taxes or qualify for certain tax benefits, complete the appropriate sections of the form.

9. Determine if you are owed a refund or have a balance due: Calculate if you will receive a tax refund or owe additional taxes based on the information provided in steps 6-8.

10. Sign and date the form: Sign and date the form to certify that the information you provided is accurate.

11. Submit the form: Mail the Form 1040 to the appropriate address for your state or file electronically using online tax software or the IRS e-file service.

Remember to carefully review the instructions on the Form 1040 and consult a tax professional if needed.

What information must be reported on e 1040 form?

The information that must be reported on the Form 1040, also known as the U.S. Individual Income Tax Return, includes:

1. Personal information: such as your name, address, social security number (or taxpayer identification number), and filing status.

2. Income: You need to report all types of income earned during the tax year, including wages, salaries, tips, business income, rental income, investment income, and any other sources of income.

3. Deductions: You can claim various deductions to reduce your taxable income, including expenses for education, medical expenses, interest paid on mortgages, state and local taxes, and charitable contributions.

4. Tax credits: You can claim tax credits to reduce the amount of tax owed, such as the Child Tax Credit, Earned Income Credit, education credits, and energy-saving credits.

5. Payments and tax withholding: You need to report any tax payments already made throughout the year, including federal income tax withheld from your paycheck, estimated tax payments, and any other credits or payments you may have made.

6. Other additional information: The form may ask for additional information depending on your specific circumstances, such as if you have foreign accounts, certain types of investments, or if you qualify for certain tax benefits.

It's important to note that the Form 1040 may change from year to year, and it's essential to review the specific instructions and requirements for the tax year you are filing.

What is the penalty for the late filing of e 1040 form?

If you fail to file your Form 1040 (individual income tax return) by the deadline, you may incur penalties and interest charges. Here is the breakdown of the penalties:

1. Failure-to-File Penalty: If you don't file your return by the due date (usually April 15th), you may face a failure-to-file penalty. This penalty is calculated as 5% of the unpaid taxes for each month or part of a month your return is late, up to a maximum of 25% of the unpaid taxes.

2. Failure-to-Pay Penalty: In addition to the failure-to-file penalty, if you don't pay the taxes owed by the due date, you may also be subject to a failure-to-pay penalty. This penalty is calculated as 0.5% of the unpaid taxes for each month or part of a month your payment is late, up to a maximum of 25% of the unpaid taxes.

It's important to note that the failure-to-file penalty is generally higher than the failure-to-pay penalty. So, if you are unable to pay your taxes in full, it's still better to file your return on time and pay as much as you can to reduce the amount subject to the failure-to-pay penalty.

3. Interest Charges: In addition to the penalties, the IRS will also charge interest on any unpaid taxes from the original due date until the date the payment is made in full. The interest rate is determined quarterly and is generally compounded daily.

Keep in mind that penalties and interest charges can accumulate over time, so it's best to file your return as soon as possible, even if you can't pay the full amount due. Additionally, if you have a valid reason for filing your return late, you can request a penalty abatement from the IRS, but approval is not guaranteed.

How do I modify my 2014 e 1040 form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 2014 e 1040 form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for the 2014 e 1040 form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2014 e 1040 form in minutes.

How do I edit 2014 e 1040 form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 2014 e 1040 form from anywhere with an internet connection. Take use of the app's mobile capabilities.