IRS IRA Required Minimum Distribution Worksheet 2015-2024 free printable template

Show details

IRA Required Minimum Distribution Worksheets this worksheet to figure this year's required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

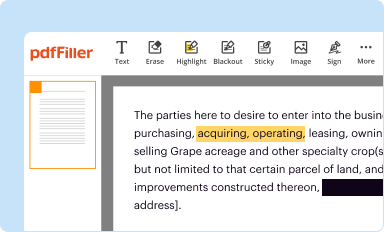

Edit your ira required minimum distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

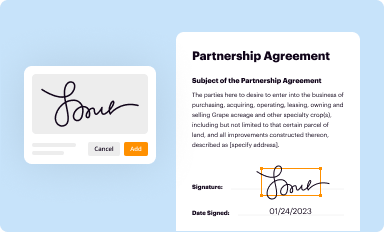

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

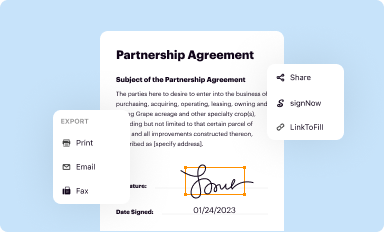

Share your form instantly

Email, fax, or share your ira required minimum distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

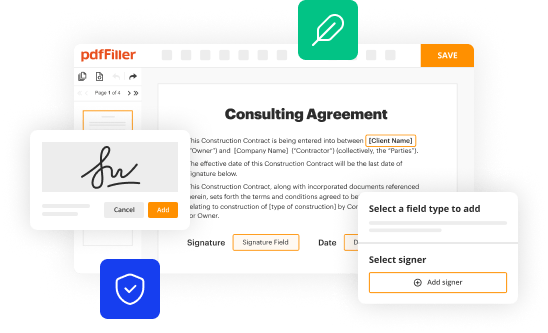

Editing ira required minimum distribution worksheet online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ira required minimum distribution form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out ira required minimum distribution

01

To fill out an IRA Required Minimum Distribution (RMD), first determine if you are subject to this requirement. Individuals who have traditional IRAs, SEP IRAs, or SIMPLE IRAs and reach the age of 72 (or 70 ½ if born before July 1, 1949) need to take RMDs. Roth IRAs do not have RMDs while the original account holder is alive.

02

Calculate your RMD amount using the appropriate IRS Life Expectancy Table. These tables determine your life expectancy based on your age and account balance. The RMD amount represents the minimum withdrawal that must be taken from your IRA for the year to avoid penalties.

03

Contact your IRA custodian and inform them that you want to take your RMD. They will guide you on the necessary steps to initiate the distribution. It is important to do this before the deadline, which is December 31st of each year starting from the year you turn 72 (or 70 ½ if born before July 1, 1949).

04

Decide how you want to receive your RMD. You can choose to have the funds transferred directly to your bank account, receive a check, or reinvest them into a non-retirement account. Each option has its own tax implications, so consult with a financial advisor or tax professional to make the best decision for your situation.

05

Once you receive your RMD, report it on your income tax return. The distribution amount will be added to your taxable income for the year and subject to regular income tax rates. If you have multiple IRAs, you can aggregate the RMD amounts and withdraw from just one account or distribute proportionately across all accounts.

Who needs IRA Required Minimum Distribution?

01

Individuals who have traditional IRAs, SEP IRAs, or SIMPLE IRAs are generally subject to the IRA Required Minimum Distribution (RMD) rule.

02

The age for initiating RMDs is 72, or 70 ½ if born before July 1, 1949.

03

Roth IRAs do not have RMDs, allowing account holders to potentially preserve their savings longer if they choose not to withdraw funds.

Fill ira minimum : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira required minimum distribution?

IRA Required Minimum Distributions (RMDs) are the minimum amount of money that must be taken out of an individual retirement account (IRA) annually. An RMD is calculated based on the total account balance and the account holder's age. This money is taxed as ordinary income, and must be taken out before the account holder's tax filing deadline. Failure to take out the required minimum distribution can result in a penalty equal to 50 percent of the amount that should have been withdrawn.

How to fill out ira required minimum distribution?

1. Determine Your Required Minimum Distribution:

To figure out your Required Minimum Distribution (RMD), you will need to know the total value of all of your IRAs, SEPs, and SIMPLE IRAs as of the end of the previous year. This amount will be divided by your life expectancy, based on the IRS life expectancy tables.

2. Withdraw the Funds:

Once you have determined your RMD, you will need to withdraw the funds from your account. You can do this either by writing a check, making a withdrawal from an ATM, or transferring the funds electronically.

3. Report the Distribution:

You will need to report your RMD on your tax return. The amount of the distribution will be reported on Form 1040, line 15a or 15b, depending on the type of account from which you took the distribution. You may also need to report the distribution on Form 8606, Nondeductible IRAs.

4. Consider Tax Implications:

Keep in mind that the RMD will be subject to income tax. The amount of the RMD is included in your taxable income for the year, so you should plan accordingly. Additionally, any distributions that are not rolled over are subject to an additional 10% early withdrawal penalty, so be sure to factor this into your tax planning.

What information must be reported on ira required minimum distribution?

The required minimum distribution (RMD) must include the following information:

1. The name, address, and Social Security number of the IRA holder.

2. The financial institution that holds the IRA.

3. The amount of the RMD.

4. The date that the RMD was taken.

5. The type of account from which the RMD was taken.

What is the penalty for the late filing of ira required minimum distribution?

The penalty for the late filing of an IRA required minimum distribution is a 50% excise tax on the amount not distributed as required.

Who is required to file ira required minimum distribution?

Individuals who are age 72 or older are generally required to start taking minimum distributions from their traditional IRAs. However, individuals who turned 70½ before January 1, 2020, fall under the previous rules and must start taking distributions at age 70½. Additionally, individuals who inherit an IRA may also be required to take minimum distributions.

What is the purpose of ira required minimum distribution?

The purpose of an Individual Retirement Account (IRA) Required Minimum Distribution (RMD) is to ensure that individuals do not defer their tax obligations on retirement savings indefinitely.

When an individual reaches the age of 72 (or 70 ½ for individuals born before July 1, 1949), the IRS requires them to start taking annual distributions from their traditional IRA accounts. This is because contributions to traditional IRAs are made with pre-tax dollars, and the government wants to start collecting taxes on these savings once the individual is retired and no longer contributing to the account.

The RMD amount is calculated based on the individual's life expectancy and the account balance at the end of the previous year. The IRS provides tables to determine the exact distribution amount required each year. If an individual fails to take the required distribution, they may be subject to a significant tax penalty of up to 50% of the distribution amount that should have been withdrawn.

In summary, the purpose of IRA required minimum distributions is to ensure that individuals pay taxes on their retirement savings and prevent the indefinite deferral of tax obligations on these accounts.

How can I modify ira required minimum distribution worksheet without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your ira required minimum distribution form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete irs required minimum distribution worksheet online?

pdfFiller makes it easy to finish and sign irs required minimum distribution online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I fill out irs distribution on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your irs ira distribution form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your ira required minimum distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Required Minimum Distribution Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to irs minimum distribution worksheet form

Related to required minimum distribution worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.