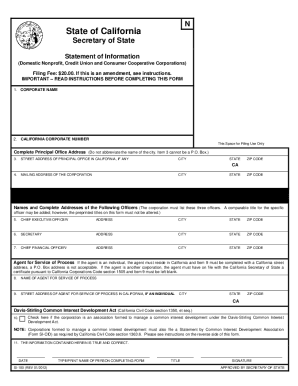

Who needs a form SI-100?

Credit unions, non-profit organizations, corporations and small companies need to file form SI-100 in the state of California every year or every two years in some cases. If they fail to submit this form in a timely manner the Secretary of State may revoke the organization’s tax-exempt status. There is a penalty of $250.

What is form SI-100 for?

In California, it is mandatory to verify and update information about your organization at the registration office (California Secretary of State). Form SI-100 stands for the Statement of Information about the organization.

Is form SI-100 accompanied by other forms?

The first Statement of Information must be filed within 90 days after the initial filing of the Article of Incorporation. Other than that, no additional documents are requested.

When is form SI-100 due?

Sending this form is an annual request for credit unions and consumer cooperative corporations. Other corporations and domestic non-profit organizations have to complete SI-100 biennially.

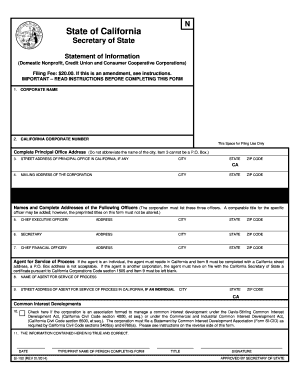

How do I fill out form SI-100?

Start with the name of the company and the California corporate number. Add the address of your main office, and give the full name, rather than an abbreviated name of the city. Fill in the box with the names and addresses of the secretary, chief financial officer and chief executive officer. After that give the name and the contacts of your agent for service of process. There is a separate box to check dedicated to the Davis-Stirling Common Interest Development Act. If your corporation formed a common interest development, you must also attach a Statement of Common Interest. Sign it at the bottom of the page. If you have any other questions, read the instructions attached to this form.

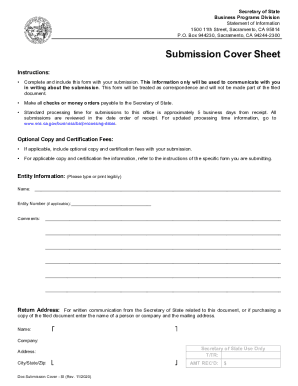

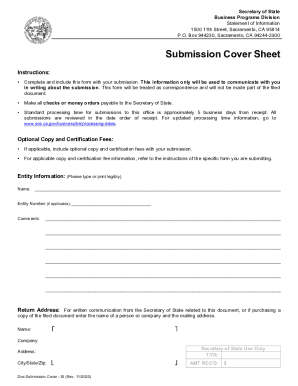

Where do I send form SI-100?

Send the form electronically via the California Secretary of State’s official website.