IRS Instructions 1040 Schedule A 2017 free printable template

Show details

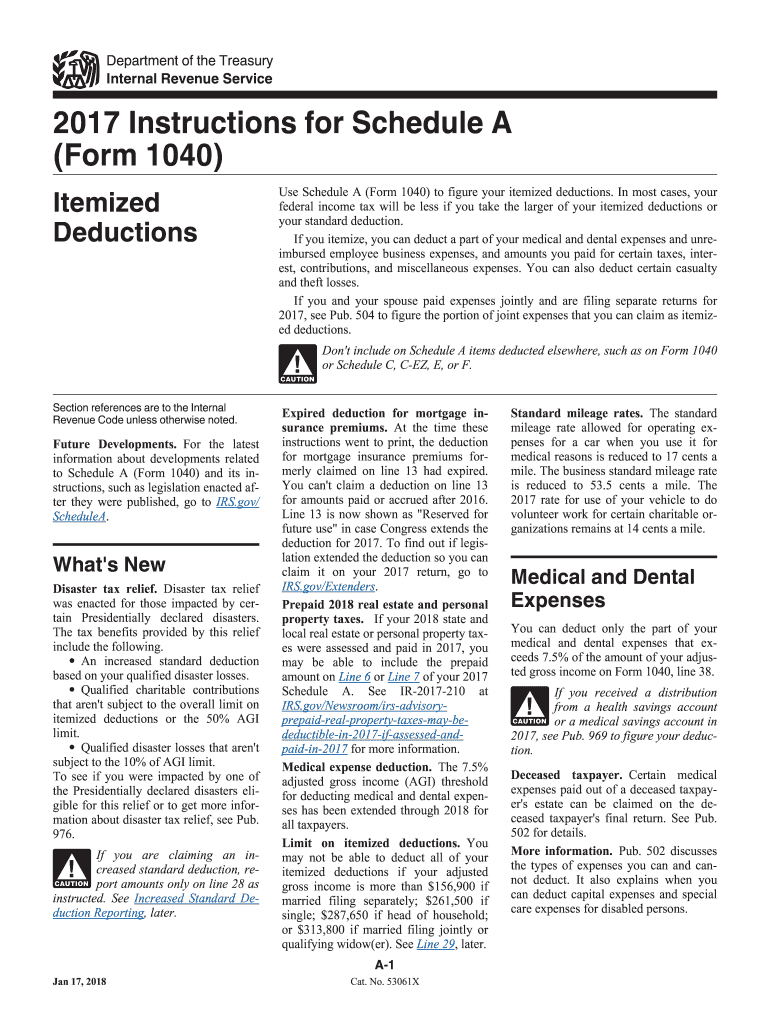

For the latest information about developments related to Schedule A Form 1040 and its instructions such as legislation enacted after they were published go to IRS.gov/ ScheduleA. Department of the Treasury Internal Revenue Service 2017 Instructions for Schedule A Form 1040 Itemized Deductions Use Schedule A Form 1040 to figure your itemized deductions. Refund of general sales taxes. If you received a refund of state or local general sales taxes in 2017 for amounts paid or local general sales...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

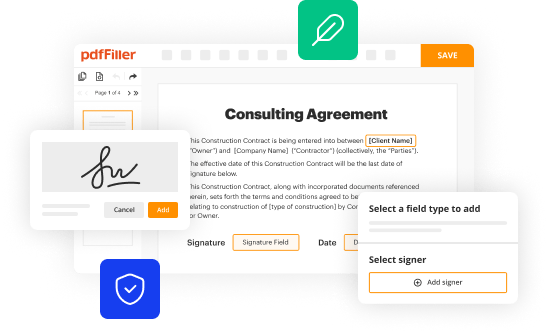

Edit your irs instructions 1040 schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs instructions 1040 schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs instructions 1040 schedule online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs instructions 1040 schedule. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

IRS Instructions 1040 Schedule A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs instructions 1040 schedule

How to fill out IRS instructions 1040 schedule:

01

Start by gathering all the necessary documents and information such as your W-2 forms, 1099 forms, and any other income or deduction records. Make sure you have all the relevant information for each category mentioned in the schedule.

02

Review the instructions carefully and make sure you understand each step. Take note of any specific requirements or supporting documentation that may be needed.

03

Identify the sections on the schedule that are applicable to your tax situation. Fill in all the required information accurately, ensuring that you provide the correct figures.

04

Double-check all the calculations and make sure you haven't missed any important details. Accuracy is crucial to avoid any issues or delays with your tax return.

05

If you have any questions or uncertainties, consider seeking professional assistance or guidance from a tax preparer or accountant. They can provide clarification and help ensure the accuracy of your tax return.

06

Once you have completed filling out the schedule, review it again to make sure you haven't overlooked anything. It's important to be thorough and comprehensive in your submission.

07

Attach the schedule to your main Form 1040 tax return, following any specific instructions on how to include it.

Who needs IRS instructions 1040 schedule:

01

Individuals who have specific types of income or deductions that are required to be reported on the schedule. This includes individuals who have business income, rental income, farm income, or income from self-employment.

02

Taxpayers who have certain credits or deductions that can only be claimed by completing the schedule. Examples include the child and dependent care credit, education credits, or the deduction for student loan interest.

03

Anyone who has complex tax situations or unique circumstances that necessitate the use of the schedule. This may include individuals with multiple sources of income, self-employed individuals, or those with extensive deductions or credits.

04

Taxpayers who may be subject to additional reporting requirements or who need to provide supplementary information to the IRS. The schedule allows them to provide the necessary details in a standardized format.

Instructions and Help about irs instructions 1040 schedule

Fill form : Try Risk Free

People Also Ask about irs instructions 1040 schedule

How do I know if I itemized my last year's deductions?

How much deductions can I claim without receipts?

What is Schedule B form for?

Which expenses can be deducted?

When should you itemize instead of claiming the standard deduction?

What deductions can I claim without receipts?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs instructions 1040 schedule?

IRS Instructions 1040 Schedule refers to the instructions provided by the Internal Revenue Service (IRS) for filling out Schedule A, B, C, D, E, and other relevant schedules attached to Form 1040, which is the U.S. Individual Income Tax Return. These instructions provide taxpayers with guidance on how to report their income, deductions, credits, and tax liability for the year. The instructions outline the requirements and procedures for completing each section of the schedule accurately and in accordance with tax laws and regulations. Taxpayers should refer to these instructions while completing their tax forms to ensure compliance and to maximize their eligible deductions and credits.

Who is required to file irs instructions 1040 schedule?

Individuals who need to report specific kinds of income or claim certain credits or deductions are required to file Schedule 1040 when filing their federal income tax return. Some common reasons for filing Schedule 1040 include:

- Reporting income from self-employment (Schedule C)

- Reporting rental income (Schedule E)

- Claiming certain tax credits such as the Child and Dependent Care Credit, Education Credits, or the Residential Energy Credit

- Claiming deductions for student loan interest, educator expenses, or certain business expenses (Schedule 1)

- Reporting capital gains or losses (Schedule D)

- Reporting certain taxes such as the Alternative Minimum Tax (AMT) or the Additional Medicare Tax

It's important to note that not all individuals will need to file Schedule 1040. The general 1040 form is used by all individuals to report their income and claim standard deductions, and not all taxpayers will have additional income or deductions that require the use of Schedule 1040. The specific instructions for filing Schedule 1040 and determining if it is necessary can be found on the official IRS website. It is recommended to consult the instructions or a tax professional to determine if Schedule 1040 is required for your specific situation.

How to fill out irs instructions 1040 schedule?

To fill out IRS instructions for the 1040 Schedule, you will need to follow the steps below:

1. Obtain a copy of the IRS instructions for Schedule 1040 and gather all the necessary information, documents, and forms needed to complete the schedule.

2. Start by reading the instructions carefully to understand the requirements and ensure you are eligible to use Schedule 1040.

3. Begin filling out the schedule using the information from your Form 1040. This may include income, deductions, credits, and adjustments.

4. Carefully review each line of the instructions and provide the requested information accurately. Make sure to input the correct amounts and calculations.

5. Use the supporting forms and schedules provided in the IRS instructions, if applicable, to report additional information or provide necessary details.

6. Double-check all calculations, verify that you have provided accurate information, and review the instructions one last time to ensure you haven't missed anything.

7. Sign and date the completed Schedule 1040 as required, and attach it to your Form 1040 when filing your taxes.

8. Retain a copy of the completed Schedule 1040 and any supporting documents for your records.

It is important to note that the instructions and requirements may change each year, so make sure to refer to the most updated version of the IRS instructions for Schedule 1040 and consult with a tax professional if you have any questions or concerns.

What is the purpose of irs instructions 1040 schedule?

The purpose of IRS instructions for Schedule 1040 is to provide guidance and clarify how to complete the Schedule 1040 form. The Schedule 1040 form is used by individuals to report additional income, deductions, credits, and taxes that may not be included on the main Form 1040. The instructions provide line-by-line explanations, definitions, and examples to help taxpayers accurately fill out the Schedule 1040 form and calculate their tax liability or refund.

What information must be reported on irs instructions 1040 schedule?

The information that must be reported on IRS Instructions 1040 Schedule varies depending on the specific form and individual circumstances. However, some common information that may need to be reported includes:

1. Personal information: Full name, Social Security Number (SSN), address, and taxpayer status.

2. Filing status: Choose the appropriate filing status, such as single, married filing jointly, head of household, etc.

3. Income: Report all sources of income, including wages, self-employment income, dividends, interest, rental income, retirement income, etc.

4. Adjustments to income: Report any deductions or adjustments to your income, such as student loan interest, self-employed health insurance, IRA contributions, etc.

5. Itemized deductions or standard deduction: Choose either to itemize deductions or take the standard deduction based on your eligible expenses.

6. Tax credits: Report any tax credits you may qualify for, such as the Child Tax Credit, Earned Income Credit, education credits, etc.

7. Other taxes: Report any additional taxes owed, such as self-employment tax, household employment taxes, Alternative Minimum Tax (AMT), etc.

8. Payments and refunds: Report any federal income tax withheld from your paychecks, estimated tax payments, prior year overpayment applied, etc.

9. Health care coverage: Report if you had health insurance coverage or if you are exempt from coverage, as required by the Affordable Care Act.

10. Other information: Depending on your circumstances, there may be additional requirements, such as reporting foreign financial accounts, alimony received, etc.

It's important to carefully review the specific instructions for IRS Form 1040 Schedule that apply to your situation, which can be found on the IRS website.

When is the deadline to file irs instructions 1040 schedule in 2023?

The deadline to file IRS Form 1040 (Schedule) for the year 2023 would be April 15, 2024. However, please note that the IRS may occasionally change these deadlines, so it is always recommended to check with the IRS or a tax professional for the most up-to-date information.

What is the penalty for the late filing of irs instructions 1040 schedule?

The penalty for the late filing of IRS Form 1040 Schedule C (Profit or Loss from Business) depends on various factors. As of 2021, the penalty for filing Form 1040 Schedule C late is typically 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax.

However, please note that penalties and regulations may vary, and it is always recommended to consult the official IRS guidelines or a tax professional for accurate and up-to-date information regarding your specific situation.

How can I manage my irs instructions 1040 schedule directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your irs instructions 1040 schedule and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit irs instructions 1040 schedule from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including irs instructions 1040 schedule, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out the irs instructions 1040 schedule form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign irs instructions 1040 schedule and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your irs instructions 1040 schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.