Get the free empower retirement 401k rollover form

Show details

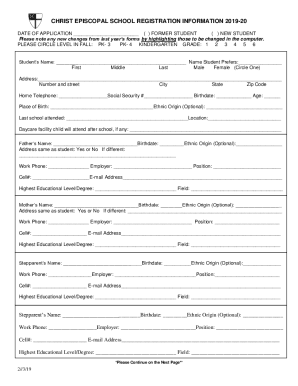

Incoming Direct Rollover 401(a) Plan Do not complete the Investment Option Information portion of this form if you elected to have your account professionally managed by Advised Assets Group, LLC

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your empower retirement 401k rollover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your empower retirement 401k rollover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit empower retirement 401k rollover form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit empower 401k rollover form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out empower retirement 401k rollover

How to fill out empower retirement 401k rollover:

01

Gather all necessary documents: You will need your current 401k statement, personal identification information, and any additional forms provided by empower retirement.

02

Contact empower retirement: Reach out to the empower retirement team by phone or email to notify them of your intention to perform a rollover. They will guide you through the process and provide any necessary guidance.

03

Complete the necessary forms: Fill out the empower retirement rollover form accurately and thoroughly. Provide all required information, including your personal details, current 401k information, and the desired rollover amount.

04

Review and verify: Carefully review the completed forms before submitting them. Ensure that all information is accurate, as any mistakes could delay the rollover process.

05

Submit the forms: Send the completed empower retirement rollover form to the specified address or submit it electronically, according to the instructions provided by empower retirement.

06

Follow up: After submitting the forms, stay in contact with empower retirement to track the progress of your rollover. They will provide updates and address any additional requirements if necessary.

Who needs empower retirement 401k rollover:

01

Individuals changing jobs: Employees who are leaving their current job and transitioning to a new employer or self-employment may benefit from a 401k rollover to empower retirement to consolidate retirement savings and gain control over investment options.

02

Retirees: People who have recently retired and want to transfer their 401k savings to an account that aligns better with their retirement goals may consider empower retirement for rollover services.

03

Individuals with multiple retirement accounts: Those who have multiple retirement accounts with different providers may opt for an empower retirement 401k rollover to simplify their financial management and potentially reduce administrative fees.

04

Employees approaching retirement age: Individuals who are approaching retirement and wish to explore different investment options for their 401k savings might find empower retirement suitable for a rollover.

05

Individuals dissatisfied with their current plan: Individuals who are dissatisfied with the investment performance, fees, or customer service of their current retirement plan may consider a rollover to empower retirement as an alternative solution.

Fill rollover 401k from empower : Try Risk Free

People Also Ask about empower retirement 401k rollover form

What form is used for a 401K rollover?

What forms do I need for 401K rollover?

How do I rollover my 401K to a new employer?

Do you get a 1099-R when you do a rollover?

How do I rollover my 401K from empower retirement?

Can I rollover my 401K myself?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out empower retirement 401k rollover?

1. Contact your current plan administrator to request a 401(k) rollover package. These forms will provide instructions on how to proceed with your 401(k) rollover.

2. Complete and sign the 401(k) rollover forms. Follow the instructions to designate Empower Retirement as the new custodian of your 401(k) funds.

3. Provide the following information to your current plan administrator:

Empower Retirement

Account Name: [Your Name]

Account Number: [Your Account Number]

Address: Empower Retirement, P.O. Box 145450, Denver, CO 80214-5450

Phone: 800-719-9914

4. Ask your current plan administrator to send a check made payable to Empower Retirement for the full amount of your 401(k) funds.

5. Forward the check, along with your completed and signed rollover forms, to Empower Retirement.

6. Upon receipt of the funds and forms, Empower Retirement will complete the rollover and notify you of the transaction.

What is the purpose of empower retirement 401k rollover?

The purpose of a 401(k) rollover is to allow an individual to move their retirement funds from one retirement account to another without being taxed or penalized. This is typically done when an individual changes jobs, retires, or wants to consolidate their retirement accounts. A 401(k) rollover allows an individual to transfer their retirement funds into an IRA, another employer’s 401(k) plan, or another qualified retirement plan.

What information must be reported on empower retirement 401k rollover?

The information typically required to complete a 401(k) rollover from Empower Retirement to another qualified retirement plan includes:

1. Account holder’s full name, address, and Social Security Number.

2. Description of the 401(k) plan, including the employer’s name.

3. Plan Number.

4. Current account balance in the Empower Retirement account.

5. Desired rollover amount and destination account information, including the name and address of the plan, plan number, and account holder’s name and Social Security Number.

6. Signature of the account holder or authorized representative.

When is the deadline to file empower retirement 401k rollover in 2023?

The deadline for filing an Empower Retirement 401(k) rollover in 2023 will depend on your individual tax situation and filing status. Generally, you will need to file your taxes by April 15th of that year.

What is the penalty for the late filing of empower retirement 401k rollover?

The penalty for the late filing of an empower retirement 401k rollover is generally a 10% early withdrawal penalty from the IRS. This penalty applies to any withdrawal made before the age of 59 1/2. In addition, the late filer may also be subject to back taxes and interest on the amount withdrawn.

What is empower retirement 401k rollover?

Empower Retirement 401k rollover refers to the process of transferring retirement funds from an existing 401k account into an Empower Retirement 401k account. A 401k rollover is typically done when an individual changes jobs or retires, and wants to consolidate their retirement savings into a single account. By rolling over the funds into an Empower Retirement 401k, individuals can continue to benefit from tax-deferred growth and have more control over their retirement savings. It is important to note that there may be certain eligibility requirements and fees associated with initiating a rollover.

Who is required to file empower retirement 401k rollover?

Individuals who have recently changed jobs or retired and possess a 401(k) plan from their previous employer typically need to file an Empower Retirement 401(k) rollover. This process involves moving the funds from their previous employer's 401(k) plan to an Individual Retirement Account (IRA) or another retirement account. The specific requirements can vary, so it is recommended to consult with a financial advisor or the Empower Retirement website for accurate and tailored information based on individual circumstances.

How do I make changes in empower retirement 401k rollover form?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your empower 401k rollover form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit empower rollover process in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing empower rollover request form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit empower retirement rollover form on an Android device?

You can make any changes to PDF files, such as empower incoming rollover form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your empower retirement 401k rollover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Empower Rollover Process is not the form you're looking for?Search for another form here.

Keywords relevant to empower retirement rollover 401k form

Related to empower rollover

If you believe that this page should be taken down, please follow our DMCA take down process

here

.