Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file credit information?

The three major credit reporting agencies (Equifax, Experian, and TransUnion) are required to file credit information. The information is typically obtained from lenders and creditors, who are required to report the information to the credit agencies.

How to fill out credit information?

1. Gather your required information. You will need to provide basic personal information, such as your full name, address, phone number, Social Security number, and date of birth.

2. Provide your credit card details. You will need to provide the name of the card issuer, the type of card, the card number, and the expiration date.

3. Enter your income information. You will need to provide an estimate of your annual income, as well as any other sources of income, such as investments or rental properties.

4. Enter your employment information. You will need to provide your current employer, job title, how long you’ve been employed, and your monthly salary.

5. Review and submit your information. Once you’ve filled out all the necessary information, review your credit information carefully for accuracy. Then, submit the form to complete the process.

What is the penalty for the late filing of credit information?

Late filing of credit information is subject to a penalty of up to $2,500 per late filing.

What is credit information?

Credit information refers to the details and data related to an individual's credit history, financial behavior, and borrowing activities. It typically includes information such as the person's credit score, credit report, outstanding debts, repayment history, credit limits, and any delinquencies or defaults on loans or credit cards. This information is collected and maintained by credit bureaus or credit reporting agencies, and it helps lenders and financial institutions assess an individual's creditworthiness when making decisions about lending money, extending credit, or offering financial services.

What is the purpose of credit information?

The purpose of credit information is to provide an assessment of an individual's or a company's creditworthiness, which helps lenders and financial institutions make informed decisions about extending credit. It includes information about an individual's past payment history, outstanding debts, credit limits, loan balances, and credit applications. This data is collected by credit reporting agencies and used to generate credit reports and credit scores, which are then used by lenders to determine the risk associated with providing credit to a borrower. Credit information helps lenders assess the borrower's ability to repay debts and make decisions regarding loan approvals, interest rates, and credit limits. It also serves as a tool for individuals to monitor and manage their own credit standing.

What information must be reported on credit information?

Credit information typically includes the following:

1. Personal Information: This includes your name, date of birth, social security number, contact information, and current and previous addresses.

2. Credit Accounts: This includes detailed information about your credit accounts, such as credit cards, loans, mortgages, and lines of credit. It may include the name of the creditor, account number, type of account, date opened, credit limit, loan amount, current balance, payment history, and status of the account (open, closed, or derogatory).

3. Payment History: This shows your payment pattern for each account, including the history of on-time payments, late payments, missed payments, defaults, and any collections or charge-offs.

4. Credit Inquiries: This lists the names of businesses or individuals who have requested to access your credit report for the purpose of evaluating your creditworthiness. It includes both hard inquiries (initiated by your credit application for a loan or credit card) and soft inquiries (such as by potential employers or yourself).

5. Public Records: Any public record information that may impact your creditworthiness, such as bankruptcies, tax liens, court judgments, and wage garnishments.

6. Collection Accounts: This includes information on any accounts that have been sent to collections agencies due to non-payment or default.

7. Credit Utilization: This is the ratio of your current credit card balances to your credit limits and is typically expressed as a percentage.

8. Credit Scores: While not technically reported on credit information itself, credit scores are often provided alongside credit reports. These scores are numerical representations of an individual's creditworthiness and are calculated using various algorithms and data points from credit reports.

It's important to note that the specific information reported may vary slightly depending on the credit reporting agency or country.

Where do I find credit application?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific credit application form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

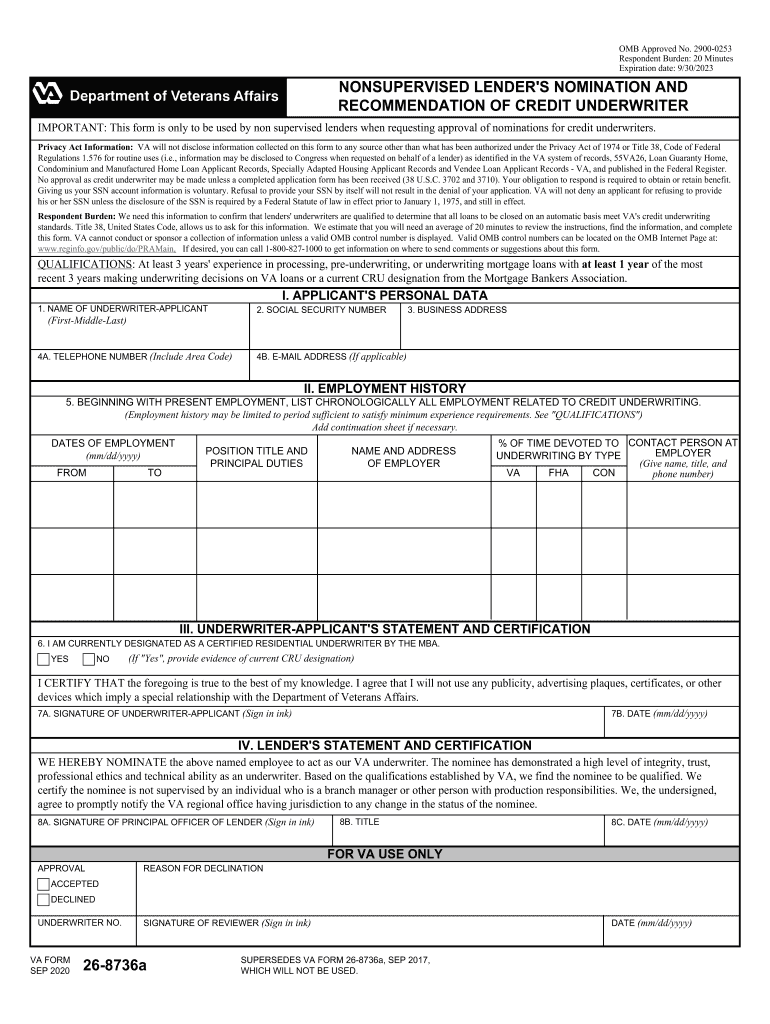

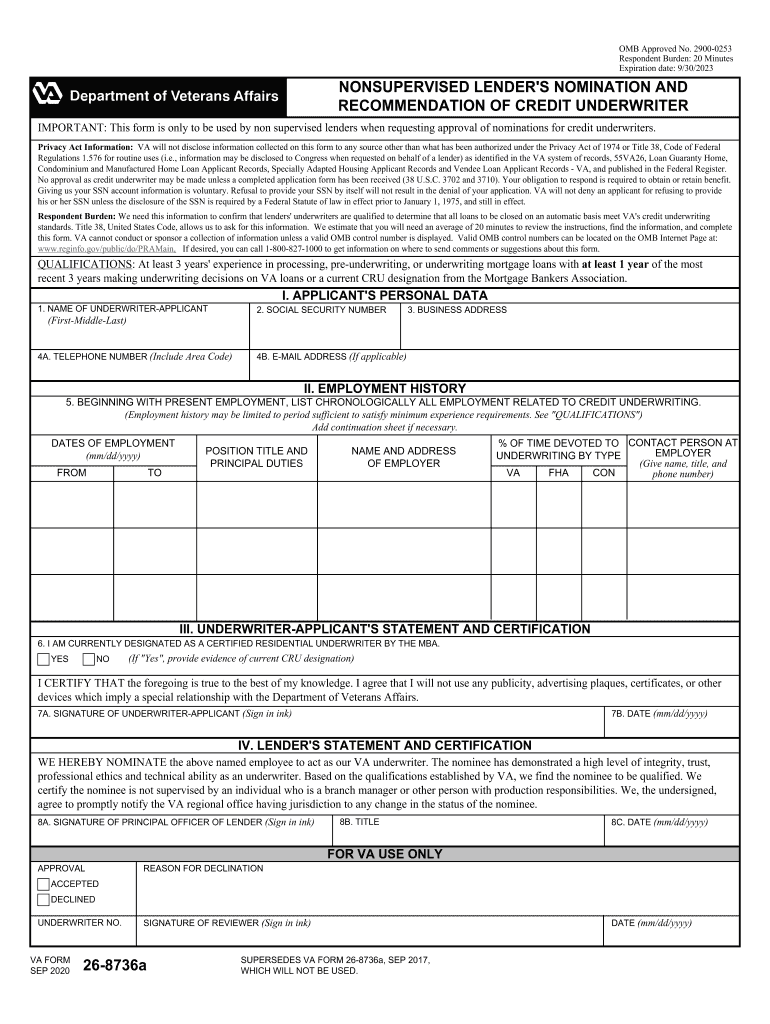

How do I complete va applicant lender search online?

pdfFiller has made filling out and eSigning application form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

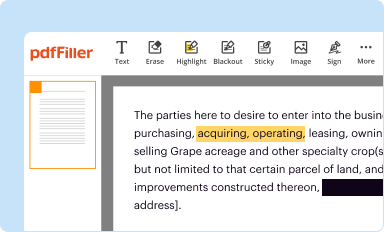

How do I make changes in va applicant lender?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your va form 26 8736a to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.