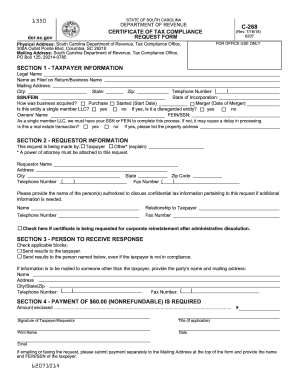

SC DoR C-268 2022-2024 free printable template

Show details

Compliance Officer. For any questions call 803-898-5381 or see SC Revenue Procedure 03-5 for more information. Instructions This certificate will not replace the Estate Tax Closing Letter. Sc.gov. You may also fax this form to the following number 803-896-0151 Specific Instructions Section 1 - Taxpayer Information. Enter the full name of the taxpayer as shown on the tax return current mailing address and applicable identification numbers. The taxpayer s federal employer identification number...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax compliance certificate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax compliance certificate form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax compliance certificate form online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit certificate tax compliance form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

SC DoR C-268 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax compliance certificate form

How to fill out tax compliance certificate form:

01

Obtain the tax compliance certificate form from the appropriate government agency or download it from their website.

02

Fill in your personal information accurately, including your full name, address, and taxpayer identification number (TIN).

03

Provide details about your tax obligations, such as the tax years you are certifying compliance for and the type of taxes you have paid.

04

If applicable, attach supporting documents that prove your tax compliance, such as copies of tax returns or payment receipts.

05

Review the completed form to ensure all information is accurate and legible.

06

Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

07

Submit the form to the appropriate government agency or follow their instructions for submission.

Who needs tax compliance certificate form:

01

Individuals or businesses that require proof of their tax compliance status.

02

Employers who need to verify the tax compliance of potential employees.

03

Suppliers or contractors who want to demonstrate their credibility to potential clients or customers.

04

Individuals or businesses involved in certain licensing or permit applications that require proof of tax compliance.

05

Financial institutions or lenders who need assurance of a borrower's tax compliance before extending credit.

06

In some jurisdictions, tax compliance certificates may also be necessary for immigration or visa purposes.

It is important to note that the specific requirements for obtaining a tax compliance certificate may vary depending on the jurisdiction. Therefore, it is advisable to consult the relevant government agency or seek professional guidance for accurate and up-to-date instructions.

Video instructions and help with filling out and completing tax compliance certificate form

Instructions and Help about state of south carolina form c 268

Fill form tax compliance : Try Risk Free

People Also Ask about tax compliance certificate form

How do I get a tax clearance certificate from the IRS?

What is US tax compliance certificate?

What is a tax compliance document?

What is an IRS tax compliance check?

What is an example of tax compliance?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax compliance certificate form?

A Tax Compliance Certificate Form is a document that certifies that a business has met all of its tax obligations with the federal, state, and local government. It is typically issued by the company's tax accountant or accountant and may be required by a lender, investor, or other third party. The form includes information about the company's tax filings, payments, and other pertinent financial information.

What is the purpose of tax compliance certificate form?

A tax compliance certificate form is used to provide proof that an individual or company is compliant with the relevant tax laws. It is a document provided by the relevant tax authority that confirms a taxpayer’s current compliance status. It is typically used when an individual or business is trying to obtain a loan, secure a contract, or provide evidence to a potential partner.

What is the penalty for the late filing of tax compliance certificate form?

The penalty for the late filing of a tax compliance certificate form is typically a fine equal to the amount of unpaid taxes plus interest. In some cases, criminal charges may also be brought against the taxpayer for failing to file.

Who is required to file tax compliance certificate form?

The tax compliance certificate form is typically required to be filed by individuals or businesses who need to prove that they have complied with and paid all their tax obligations. This may include individuals seeking employment, contractors bidding for government contracts, businesses applying for licenses or permits, and organizations applying for certain types of funding or grants. The specific requirements can vary depending on the jurisdiction and the purpose for which the tax compliance certificate is needed.

How to fill out tax compliance certificate form?

To fill out the tax compliance certificate form, follow these steps:

1. Download the tax compliance certificate form from the tax authority's website or obtain a physical copy from their office.

2. Read the instructions and requirements carefully to understand what information and documents you need to provide.

3. Provide personal details: Fill in your name, address, social security number, and other identification information as required.

4. Business details: If applicable, provide the details of your business, including the business name, address, tax identification number, and any other relevant information.

5. Tax information: Enter details of your tax payments and obligations, including the tax periods, amounts paid, and any outstanding tax liabilities.

6. Attach supporting documents: Ensure you have all the necessary supporting documents required for the certificate. This can include tax payment receipts, tax returns, financial statements, and any other documents as specified by the tax authority.

7. Sign and date the form: Once you have completed filling out the form and attached all the necessary documents, sign and date the form in the designated areas.

8. Review and submit: Double-check all the information provided to ensure accuracy and completeness. Make copies of the filled form and supporting documents for your records, then submit the originals to the tax authority through their designated channels (online submission, mail, or in-person submission).

Note: The specific requirements and processes for filling out a tax compliance certificate form may vary depending on your jurisdiction. It is advisable to consult the relevant tax authority's guidelines or seek professional advice to ensure compliance with local regulations.

What information must be reported on tax compliance certificate form?

The specific information required on a tax compliance certificate form can vary by jurisdiction, but generally, the following information may need to be reported:

1. Taxpayer's full name and contact information

2. Tax identification number (TIN) or social security number

3. Business name, if applicable

4. Nature of the taxpayer's business or occupation

5. Tax year(s) for which the certificate is being requested

6. Details of any taxes owed or outstanding, including the types of taxes (e.g., income tax, sales tax, payroll tax)

7. Amounts paid and dates of payment for any taxes due

8. Whether the taxpayer is currently under audit or investigation for tax-related matters

9. Any penalties or interest assessed on unpaid taxes

10. Declaration of accuracy and truthfulness of the information provided

It is important to note that the specific requirements can vary, so it is advisable to consult the relevant tax authority or seek professional advice to ensure compliance with applicable regulations.

Can I create an electronic signature for the tax compliance certificate form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your certificate tax compliance form in seconds.

Can I create an electronic signature for signing my form 1350 south carolina in Gmail?

Create your eSignature using pdfFiller and then eSign your south carolina form c 268 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete sc tax compliance certificate on an Android device?

Complete your how to certificate tax compliance form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your tax compliance certificate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1350 South Carolina is not the form you're looking for?Search for another form here.

Keywords relevant to sc c 268 form

Related to sc gov form c 268

If you believe that this page should be taken down, please follow our DMCA take down process

here

.