TX Comptroller of Public Accounts Form 53-105 2009-2024 free printable template

Show details

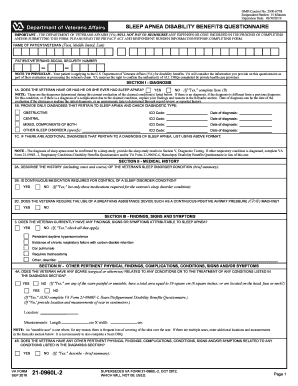

53-105 (Rev.7-09/3) COMPTROLLER OF PUBLIC ACCOUNTS UNCLAIMED PROPERTY HOLDER REPORTING SECTION TEXAS REPORT OF UNCLAIMED PROPERTY PAGE OF Holder name Item no. Federal Employer Identification Number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your unclaimed money texas form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unclaimed money texas form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unclaimed money texas online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas unclaimed property payment form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out unclaimed money texas form

How to fill out texas comptroller public accounts:

01

Gather all relevant financial records and documents, such as income statements, balance sheets, and receipts.

02

Review the instructions provided by the Texas Comptroller's office regarding the specific requirements for filling out the public accounts form.

03

Enter the requested information accurately and in the designated fields on the form, including details about income, expenditures, assets, and liabilities.

04

Double-check all entered information for any errors or omissions before submitting the completed form.

05

Submit the filled-out Texas Comptroller public accounts form by the specified deadline, either online or through mail, ensuring it reaches the appropriate department.

Who needs texas comptroller public accounts:

01

Businesses and individuals operating in Texas who are required by law to report their financial information to the state.

02

Non-profit organizations and government entities that receive funding or engage in financial transactions subject to Texas Comptroller's oversight.

03

Any entity or individual that has been specifically instructed or requested by the Texas Comptroller's office to fill out public accounts forms.

Fill person property : Try Risk Free

People Also Ask about unclaimed money texas

Who is the comptroller of public accounts in Texas?

What is the most important power of the Texas Comptroller of Public Accounts?

What is the primary role of the comptroller of public accounts?

What is the revenue of the comptroller of public accounts in Texas?

What does comptroller of public accounts mean?

What is the purpose of the Texas Comptroller of Public Accounts?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas comptroller public accounts?

The Texas Comptroller of Public Accounts is a state government agency in Texas, United States. It is responsible for managing the state's finances, including collecting and distributing taxes, conducting audits, and providing taxpayers with various services and resources. The Comptroller's office also plays a role in economic forecasting, revenue estimation, and providing financial transparency to the public.

Who is required to file texas comptroller public accounts?

All taxable entities operating in Texas are required to file with the Texas Comptroller of Public Accounts. This includes corporations, individuals, partnerships, limited liability companies, trusts, and other entities engaged in business activities subject to Texas franchise tax or sales tax.

How to fill out texas comptroller public accounts?

To fill out the Texas Comptroller Public Accounts form, follow these steps:

1. Visit the official website of the Texas Comptroller of Public Accounts.

2. Download the appropriate form for the type of account you need to fill out. There are different forms for individuals, businesses, organizations, and institutions.

3. Carefully read the instructions provided with the form to ensure you understand the requirements and any specific directions for filling it out.

4. Gather all the necessary documents and information required to complete the form. This may include personal identification, tax documents, financial statements, and other relevant records.

5. Start filling out the form by entering the requested information in the appropriate fields. Common details required include personal and/or business name, address, social security numbers or tax identification numbers, income information, expenses, assets, and liabilities.

6. Fill in each section of the form accurately and completely. Make sure to double-check your entries for errors or omissions. Incorrect or incomplete information could cause delays or issues with your account.

7. Attach any additional documentation required, such as supporting schedules, attachments, or supplementary forms. Refer to the instructions to determine if any additional documents are needed.

8. Review the completed form thoroughly to ensure all the necessary fields have been filled out and all attachments are included.

9. Sign and date the form where required. Depending on the type of account, signatures may be needed from authorized individuals, business owners, or representatives.

10. Make copies of the completed form and all supporting documentation for your records.

11. Submit the form and any required documentation to the Texas Comptroller of Public Accounts. The submission methods may vary, so refer to the instructions provided with the form for the appropriate submission options (such as online filing, mail, or in-person).

It is advisable to consult with a tax professional or refer to the official website of the Texas Comptroller of Public Accounts for specific and up-to-date instructions related to your particular situation.

What is the purpose of texas comptroller public accounts?

The purpose of the Texas Comptroller of Public Accounts is to serve as the chief financial officer and accounting officer for the state of Texas. Their primary responsibilities include managing and overseeing the state's financial resources, administering tax laws and collecting revenues, conducting audits and ensuring fiscal transparency, providing economic analysis and forecasting, and offering various taxpayer services and educational programs. Ultimately, the comptroller's office aims to promote fiscal responsibility and accountability, support efficient and effective government operations, and provide useful information and services to taxpayers and other stakeholders in the state.

What information must be reported on texas comptroller public accounts?

The Texas Comptroller Public Accounts website provides several types of information that must be reported, including:

1. Financial Reports: This includes comprehensive annual financial reports, condensed financial statements, and management reports, which present the financial position and results of operations of state agencies and universities.

2. Revenue Reports: These reports provide details on state revenue collections, including taxes, fees, and other sources of income.

3. Expenditure Reports: These reports provide information on how state funds are being spent, including expenditures by agencies, grants, and contract payments.

4. Economic and Demographic Reports: The website also offers reports on various economic indicators, such as employment statistics, population estimates, and economic forecasts.

5. Transparency Reports: These reports provide detailed information on state contracts, vendors, and payments, promoting transparency and accountability in government spending.

6. Tax Reports: Information on various taxes, such as sales tax, franchise tax, and motor fuel tax, including trends, collections, and distribution of the tax revenue.

7. Local Government Reports: Reports on local government finances, including municipal budget summaries, property tax collections, and other financial data.

8. Debt Reports: Information on state debt, including outstanding bonds, debt service payments, and debt capacity analysis.

9. Statistical Reports: Various statistical data on topics like education, transportation, crime rates, and healthcare, aimed at providing a comprehensive overview of the state's performance.

The specific information reported may vary depending on the type of report and the scope of reporting required by law.

What is the penalty for the late filing of texas comptroller public accounts?

The penalty for late filing of the Texas Comptroller Public Accounts varies depending on the specific circumstances. The penalty is calculated as a percentage of the tax due, and the rate increases based on the number of days late the filing is. The current penalties are as follows:

- 5% of the tax due for filings up to 30 days late

- An additional 5% of the tax due for filings between 31-60 days late

- An additional 10% of the tax due for filings between 61-180 days late

- An additional 15% of the tax due for filings between 181-365 days late

- An additional 20% of the tax due for filings over 365 days late

In addition to these penalties, there may also be interest charged on the unpaid tax amount. It's important to note that these penalties and interest rates are subject to change, so it's always best to consult the Texas Comptroller's official website or contact their office for the most up-to-date information.

How do I edit unclaimed money texas in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your texas unclaimed property payment form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit tx comptroller public accounts on an Android device?

You can make any changes to PDF files, like texas unclaimed property owner claim form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete claimittexas org unclaimed on an Android device?

Complete your texas comptroller public accounts form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your unclaimed money texas form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tx Comptroller Public Accounts is not the form you're looking for?Search for another form here.

Keywords relevant to texas unclaimed property form

Related to unclaimed property public

If you believe that this page should be taken down, please follow our DMCA take down process

here

.