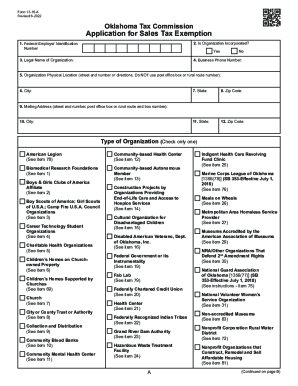

OK Sales Tax Exemption Packet E 2023-2024 free printable template

Show details

Oklahoma

Sales Tax

Exemption

Packet

Do You Need to Apply for Sales Tax Exemption in Oklahoma?

Entities that qualify for sales tax exemption in Oklahoma are specifically legislated. Therefore,

not

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your oklahoma sales tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma sales tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oklahoma sales tax exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ok sales tax exemption form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

OK Sales Tax Exemption Packet E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma sales tax exemption

How to fill out business incentivesoklahoma department of

01

To fill out packet e Oklahoma sales, follow these steps:

02

Download the packet e form from the official Oklahoma Tax Commission website.

03

Gather all the necessary information and documents required to complete the form.

04

Read the instructions provided with the form carefully to understand the requirements.

05

Enter your business information, including name, address, and contact details.

06

Provide details about the sales made during the reporting period, including sales amount and taxable sales.

07

Calculate and enter the tax due for the sales made.

08

Include any applicable exemptions or credits if eligible.

09

Review the completed form to ensure accuracy and completeness.

10

Sign the form and submit it to the Oklahoma Tax Commission along with any required attachments or payments.

11

Retain a copy of the filled form for your records.

Who needs business incentivesoklahoma department of?

01

Packet e Oklahoma sales is needed by businesses in Oklahoma that are required to report their sales and remit sales tax to the Oklahoma Tax Commission.

02

This includes retailers, wholesalers, and vendors who engage in taxable sales within the state.

03

Individuals or entities with a sales tax permit or businesses that meet the sales tax nexus criteria in Oklahoma are required to fill out packet e for reporting their sales.

Fill ok sales tax exemption form : Try Risk Free

People Also Ask about oklahoma sales tax exemption

Do I claim 0 or 1 on my w4?

Does Oklahoma have a tax exemption certificate?

Who is exempt from oil and gas sales tax in Oklahoma?

Do you get a W-2 if you are exempt?

What is exempt from Oklahoma state sales tax?

How do I get a tax-exempt certificate in Oklahoma?

What form is exempt on taxes?

How do I claim exempt on my taxes?

Should I claim 1 or 0?

What is exempt from state of Oklahoma tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is packet e oklahoma sales?

Packet E Oklahoma sales refers to the sales tax returns and accompanying forms that need to be filed by businesses in the state of Oklahoma.

Who is required to file packet e oklahoma sales?

All businesses in Oklahoma that engage in retail sales or provide taxable services are required to file packet E Oklahoma sales.

How to fill out packet e oklahoma sales?

Packet E Oklahoma sales can be filled out online using the Oklahoma Taxpayer Access Point (OkTAP) system or by mailing in a paper form. The form requires businesses to report their sales and calculate the amount of sales tax owed.

What is the purpose of packet e oklahoma sales?

The purpose of packet E Oklahoma sales is to collect sales tax revenue from businesses operating in the state in order to fund public services and infrastructure.

What information must be reported on packet e oklahoma sales?

On packet E Oklahoma sales, businesses must report their total sales revenue, taxable sales, exempt sales, and sales tax due. They may also need to report information such as their gross receipts and deductions.

When is the deadline to file packet e oklahoma sales in 2023?

The deadline to file packet E Oklahoma sales in 2023 is the 20th day of the month following the end of the reporting period. For example, for the reporting period of January 2023, the deadline would be February 20, 2023.

What is the penalty for the late filing of packet e oklahoma sales?

The penalty for late filing of packet E Oklahoma sales is 10% of the tax owed or $50, whichever is greater. There may also be an additional penalty of 1% per month on the unpaid tax amount.

How can I get oklahoma sales tax exemption?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the ok sales tax exemption form. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in ok sales tax exemption?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your oklahoma tax exempt form pdf and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the oklahoma sales tax exemption certificate pdf in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your oklahoma sales tax exempt form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your oklahoma sales tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ok Sales Tax Exemption is not the form you're looking for?Search for another form here.

Keywords relevant to sales tax exemption commission form

Related to oklahoma sales tax exemption pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.