Get the free form 10f sample

Show details

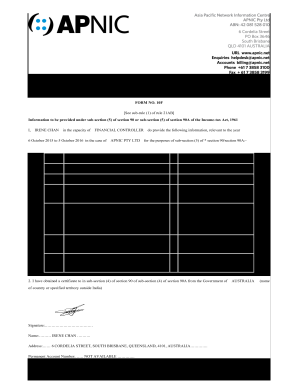

FORM NO. 10F See sub-rule (1) of rule 21AB Information to be provided under sub-section (5) of section 90 or sub-section (5) of section 90A of the Income-tax Act, 1961 I. . . . . . . . . . . . . .

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 10f sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10f sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 10f sample online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 10f example. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out form 10f sample

How to fill out return tax?

01

Gather all necessary documents such as W-2 forms, 1099 forms, and receipts for deductions.

02

Use a tax software or hire a professional tax preparer to streamline the process.

03

Provide accurate information about your income, expenses, and deductions.

04

Check for any potential credits or deductions that you may qualify for.

05

Make sure to double-check all the information before submitting the return.

06

File the return electronically or mail it to the appropriate tax agency by the deadline.

Who needs return tax?

01

Individuals who earned income during the tax year, including employees, self-employed individuals, and independent contractors.

02

Business owners, including sole proprietors, partnerships, and corporations.

03

Investors who earned income from stocks, bonds, or mutual funds.

04

Homeowners who paid mortgage interest or property taxes.

05

Parents who qualify for child tax credits or dependents' exemptions.

06

Those who received income from rental properties or royalties.

07

Non-resident aliens who earned income in the country.

08

Individuals who had significant life events such as marriage, divorce, birth, or death in the family that may impact their tax liability.

In summary, individuals and businesses who earned income or experienced relevant life events during the tax year need to fill out return tax. Following the step-by-step process and ensuring accurate information is crucial when completing the return. Using tax software or consulting a professional can help simplify the process and maximize potential credits and deductions.

Fill form 10f pdf download : Try Risk Free

People Also Ask about form 10f sample

What does a tax return form?

What is the 1040 tax form?

Are there 3 types of tax return forms?

What is 1040 vs 1099?

What is a 1040 vs W-2?

How do you calculate your tax return?

When can I expect my refund 2022?

What is a tax return and when is it due?

Do I need to mail my w2 with my tax return?

What forms do I need to mail in to the IRS with 1040?

What supporting documents do I need to mail in my tax return?

What documents do I need to mail with my tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is return tax?

Return tax is a type of tax that is paid when an item is returned to a store or other place of purchase. This tax is charged in some states and countries to discourage people from taking advantage of store return policies. The rate of tax varies from place to place, and can be as low as a few percent or as high as 20 percent or more.

Who is required to file return tax?

Generally, all individuals with an annual gross income of more than $12,400 must file a federal income tax return in the US. This includes self-employed individuals, independent contractors, and those earning income from investments. Additionally, certain lower-income individuals may be required to file a return depending on their filing status, age, and other factors.

How to fill out return tax?

The process for filing taxes varies by country, but most countries require a form to be filled out. Generally, a tax return form will require basic information such as your name, address, date of birth and other identifying information. It will also require details about your income, deductions, credits and other tax-related items. Depending on the country, additional information may be required, such as information about your bank accounts, investments, business activities, etc. After you’ve completed the form, you can submit it to the relevant tax authority.

What is the purpose of return tax?

The purpose of a return tax, commonly known as income tax, is to generate revenue for the government. It is a tax levied on the income or profits earned by individuals and businesses within a jurisdiction. Return tax plays a crucial role in funding government activities and public services, such as healthcare, education, infrastructure development, defense, social welfare programs, and more. It is used to ensure the redistribution of wealth and maintain economic stability within a country by collecting funds from those who earn higher incomes and allocating them for the benefit of society as a whole. Return tax also helps regulate the economy by influencing consumer spending and investment decisions.

What information must be reported on return tax?

The specific information that must be reported on a tax return can vary depending on the country, tax laws, and individual circumstances. However, some common information that generally needs to be reported includes:

1. Personal Information: This includes your full name, Social Security number or taxpayer identification number, address, and filing status (e.g., single, married filing jointly, etc.).

2. Income: All forms of income earned during the tax year must be reported, including wages, self-employment income, rental income, investment income, and any other earned income such as tips or bonuses.

3. Deductions: Certain expenses, referred to as deductions, may be claimed to lower your taxable income. Common deductions include mortgage interest, medical expenses, state and local taxes, charitable contributions, and education expenses.

4. Credits: Tax credits are a dollar-for-dollar reduction in the amount of tax owed. Various credits may be available, such as the Earned Income Tax Credit, Child Tax Credit, or Education Credits. These credits are usually based on specific criteria, such as income level, dependents, or education expenses.

5. Tax Withholdings: If you are an employee, you will need to report the amount of income tax that was withheld from your paycheck by your employer. This will determine whether you owe more tax or are due a refund.

6. Additional Forms and Schedules: Depending on your circumstances, you may need to include additional forms or schedules. For instance, if you have self-employment income, you may need to attach a Schedule C or C-EZ. If you have investment income, you may need to attach a Schedule D or Form 8949. Other examples of additional forms include rental income (Schedule E), foreign assets (Form 8938), or education expenses (Form 1098-T).

It is important to note that tax laws are complex and subject to change, so it is advisable to consult with a tax professional or refer to the specific tax authorities in your country for accurate and up-to-date information.

When is the deadline to file return tax in 2023?

The deadline to file a tax return for the year 2023 would be April 17, 2024. However, please note that tax deadlines can vary depending on the country and individual circumstances. It is always recommended to consult with a tax professional or the tax authority in your jurisdiction for the most accurate information.

What is the penalty for the late filing of return tax?

The penalties for filing a tax return late vary depending on the jurisdiction. In the United States, for example, if a taxpayer fails to file their tax return by the due date, they may be subject to a failure-to-file penalty. The penalty is generally 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid taxes.

There may also be additional penalties and interest charges for late payment of taxes owed. It's important to note that penalty amounts and rules may differ based on individual circumstances and tax laws in each jurisdiction, so it is advisable to consult with a tax professional or the tax authority in your specific jurisdiction for accurate and up-to-date information.

How can I edit form 10f sample from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form 10f example. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for signing my form 10f in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your form no 10f sub form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete form 10f filled sample on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form 10f india example. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your form 10f sample online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10f is not the form you're looking for?Search for another form here.

Keywords relevant to form no 10f example

Related to sample filled form 10f india

If you believe that this page should be taken down, please follow our DMCA take down process

here

.