Get the free gtbank savings account opening form

Show details

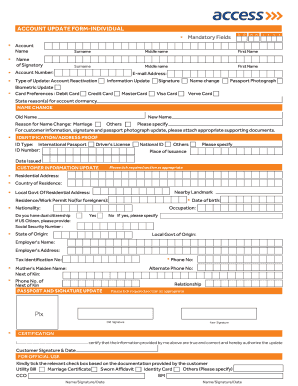

SAVINGS ACCOUNT OPENING FORM GTBank Guaranty Trust Bank Ghana Ltd Name Surname Other Names First Name Residential Address Mailing Address Tel Nos Mobile Date of Birth Office/Fax DD MM YY Occupation/ Profession Home Email Nationality Employer s Name and Address Name Occupation of Spouse I hereby request and authorize you to open a savings account in my name. I certify that the above particulars are true and correct. I agree 1. To guard against access to my withdrawal slip by unauthorized...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your gtbank savings account opening form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gtbank savings account opening form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gtbank savings account opening form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gtbank online account opening without bvn form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out gtbank savings account opening

How to fill out gtbank savings account opening:

01

Visit a GTBank branch or go online to the GTBank website.

02

Obtain the required application form for a savings account.

03

Fill out the form with accurate personal information such as your full name, date of birth, address, and contact details.

04

Provide valid identification documents, such as a national ID card, passport, or driver's license.

05

Submit any other required documents, such as proof of address or employment.

06

Determine the initial deposit amount required to open the savings account and provide the funds.

07

Review the terms and conditions of the account and ensure you understand them.

08

Sign the completed application form and any other necessary documents.

09

Submit the application form and supporting documents to a GTBank staff member if you are at a branch, or follow the online instructions if applying via the website.

Who needs gtbank savings account opening:

01

Individuals who want a safe and convenient place to save their money.

02

People looking for a reliable bank with a strong reputation.

03

Those who wish to have access to a wide range of financial services and benefits provided by GTBank.

04

Individuals who desire to earn interest on their savings account balance.

05

Those who want to enjoy the convenience of online banking, mobile banking, and ATM services.

06

People who need a savings account for various purposes, such as saving for emergencies, future expenses, or specific financial goals.

07

Students or young professionals who want to start building a financial foundation.

08

Anyone who prefers the security and peace of mind that comes with having a savings account at a reputable bank like GTBank.

Fill open gtbank account online without bvn : Try Risk Free

People Also Ask about gtbank savings account opening form

Can I open bank account without visiting bank?

How do I open a GTBank account on my phone?

Can you open savings account online?

How to fill GTB account upgrade form?

Can I open a bank account online without going to the bank in Nigeria?

Can I open a GTB savings account online?

How do I open a GTB savings account?

How do you open a GTB account without going to the bank?

How do I open a GTWorld account?

How to fill out a GTBank form?

Can I open a GTBank account online without going to the bank?

Can I open a bank account online without going into a branch?

How to fill out a GTB form?

How can I open my GTB account on my phone without BVN?

How do I open a GTB account online?

How to fill GTBank deposit slip?

Can I open a GTB account on the app?

How do I fill out an application to open a bank account?

Can I open GTB account without BVN?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file gtbank savings account opening?

Any individual, corporate body, or organization who wishes to open a savings account with GTBank is required to file an application for opening the account.

What is the penalty for the late filing of gtbank savings account opening?

The penalty for late filing of GTBank savings account opening is a fee of N500.

What is gtbank savings account opening?

GTBank Savings Account Opening is the process of creating a savings account with Guarantee Trust Bank (GTBank), a Nigerian multinational financial institution. This allows individuals to deposit their money into a secure account and earn interest on their savings. GTBank offers various types of savings accounts, including standard savings accounts, kids' savings accounts, target savings accounts, and more. To open a GTBank savings account, individuals typically need to provide necessary identification documents, complete an account opening form, and meet any other requirements specified by the bank.

How to fill out gtbank savings account opening?

To fill out a GTBank savings account opening form, follow these steps:

1. Visit the nearest GTBank branch or their official website to obtain the savings account opening form.

2. Fill in your personal information such as your full name, date of birth, address, and contact details.

3. Provide your valid means of identification (e.g., driver's license, International Passport, National ID card, or Voter's card) and provide the necessary details.

4. Choose the type of savings account you want to open, such as a regular savings account or a targeted savings account.

5. Set your initial deposit amount and indicate the source of the funds (e.g., cash, check, transfer).

6. If you already have an existing account with GTBank, provide your account number.

7. Select the type of ATM card you want to be issued (MasterCard, Visa, or Verve).

8. Read the terms and conditions of operating the account and give your consent by signing the form.

9. Submit the filled form along with the required supporting documents to the bank representative or through the official online portal if applicable.

10. After successful submission, you will receive an account number and any other necessary information to access your savings account.

Note: Make sure to provide accurate and up-to-date information on the form to avoid any delays or issues during the account opening process.

What is the purpose of gtbank savings account opening?

The purpose of GTBank savings account opening is to provide individuals with a secure and convenient way to save and manage their money. The account allows customers to deposit and earn interest on their savings, perform transactions such as withdrawals and transfers, and enjoy banking services provided by Guaranty Trust Bank (GTBank). This account helps customers to organize their finances, build savings, and have access to their funds whenever they need them.

What information must be reported on gtbank savings account opening?

When opening a savings account with Guaranty Trust Bank (GTBank), the following information typically needs to be reported:

1. Personal Information: This includes details such as the customer's full name, date of birth, gender, marital status, and occupation.

2. Contact Details: Customers need to provide their residential address, email address, and telephone number.

3. Identification: Valid forms of identification, such as a national identity card, passport, driver's license, or voter's card, must be provided. For non-residents, an international passport may be required.

4. Proof of Address: Customers may be required to provide proof of address, such as utility bills, bank statements, or a tenancy agreement.

5. Next of Kin Details: The name, phone number, and address of a next of kin or alternate contact person may be required for emergency purposes.

6. Employment Information: Customers may need to provide details about their current employment, including the name and address of their employer and their job position.

7. Transaction Purpose: Customers may be asked to provide reasons for opening the savings account, such as savings goals or intended use of the account.

8. Source of Funds: Information may be required regarding the source of the funds that will be deposited into the account, particularly for large deposits.

9. References: Some banks may ask for references from existing customers as part of the account opening process.

10. Specifying Account Type: Customers should indicate the specific type of savings account they wish to open, such as a regular savings account or a targeted savings account.

It is important to note that the exact requirements may vary depending on the specific policies and regulations of the bank and the country where the account is being opened. It is advisable to contact GTBank directly or visit their website for the most accurate and up-to-date information on opening a savings account.

How do I modify my gtbank savings account opening form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your gtbank online account opening without bvn form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify open gtbank savings account online without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including open gtbank account without bvn. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out gtbank account opening using my mobile device?

Use the pdfFiller mobile app to fill out and sign open gtb student account online without bvn form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your gtbank savings account opening online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Open Gtbank Savings Account Online is not the form you're looking for?Search for another form here.

Keywords relevant to how to open gtb account on my phone form

Related to gtbank account opening form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.