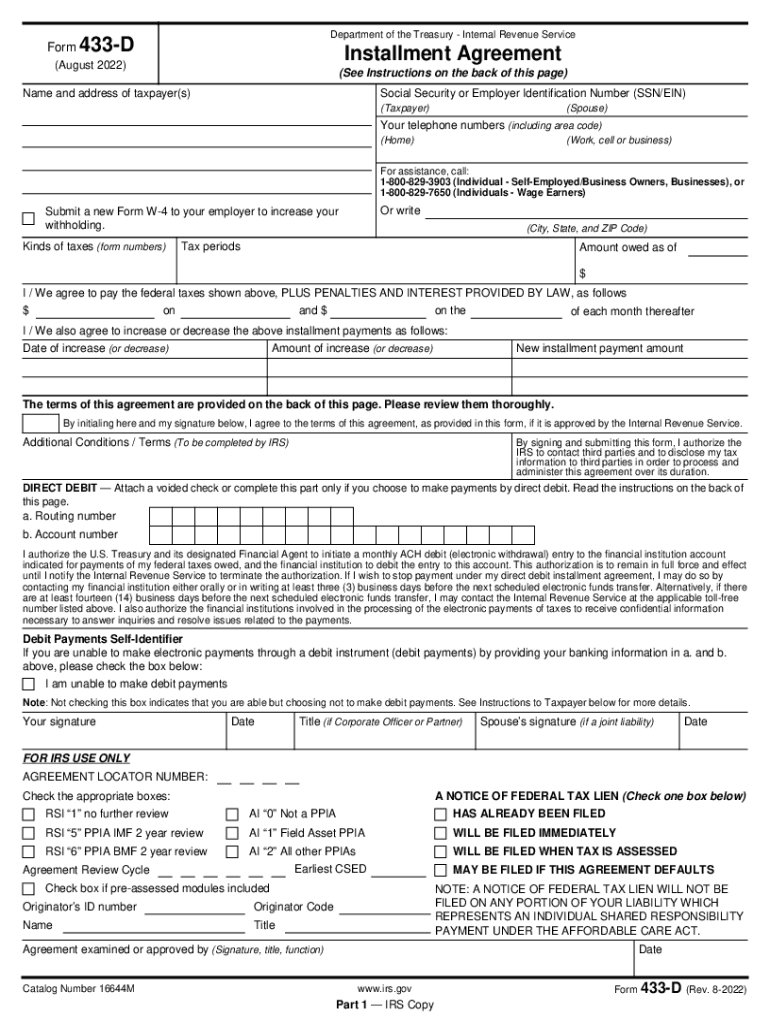

Who should File IRS Form 433-D?

IRS Form 433-D is known as the Installment Agreement. It must be filed by the taxpayers who do not have enough money to pay the whole amount of their imposed taxes. You may fill in this form right on our site using all the powerful editing and e-signing features that filler offers. The form is not complicated and will not take much time for completion.

What is IRS Form 433-D for?

The main purpose of this form is to help those taxpayers who do not have possibility to pay the entire amount of their taxes. When applying this IRS form, a taxpayer may receive an approval from the Internal Revenue Service and a certain amount due will be paid off after that.

When is IRS Form 433-D Due?

You must personally indicate the tax periods for which the decrease in payment must be approved. The form does not have a fixed deadline.

In IRS Form 433-D Accompanied by Other Documents?

If you need, you may submit Form W-4 along with this document. If not, avoid it. However, there are some forms that must be attached to the Installment Agreement. They are Form 1040A, Form 1040EZ or Form 1040.

What Information do I Include in IRS Form 433-D?

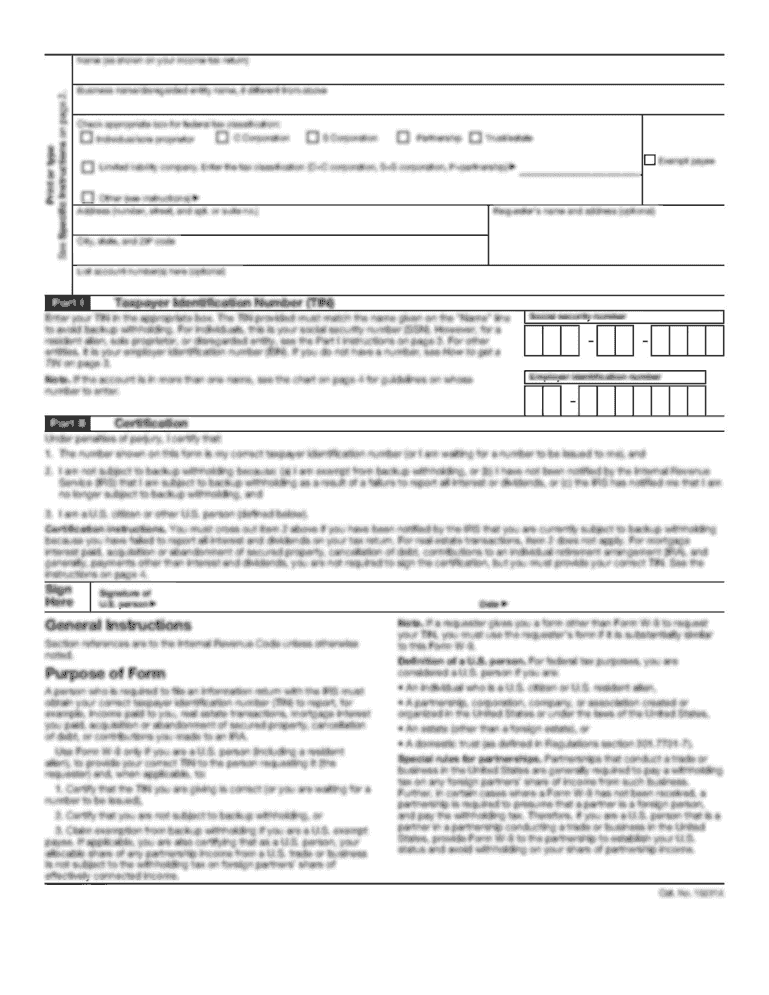

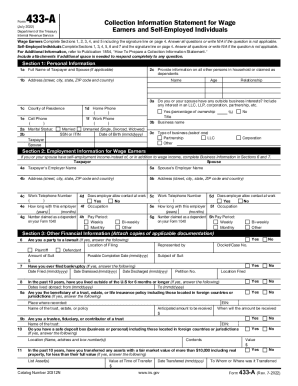

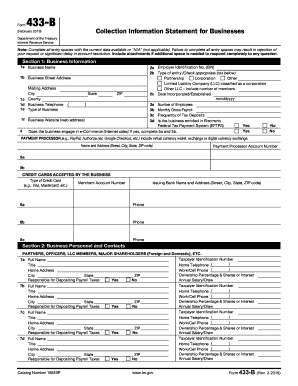

First provide the address and the name of the taxpayer who files this form. Then you must indicate the social security number or taxpayer identification number. Contact information must also be provided. Then indicate the employer, financial institution, types of taxes, tax periods and the owned amounts. You must have a copy of this document after filing it.

Where do I Send IRS Form 433-D?

You must send this form to the Internal Revenue Service — Department of Treasury.