Amicus Systems 401K 2008-2024 free printable template

Get, Create, Make and Sign

Editing adp 401k withdrawal online

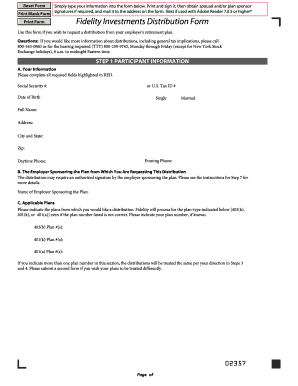

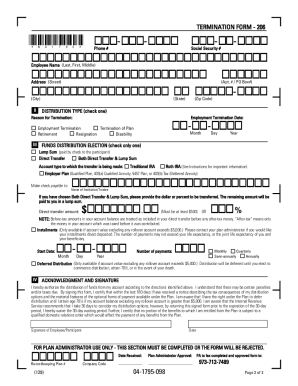

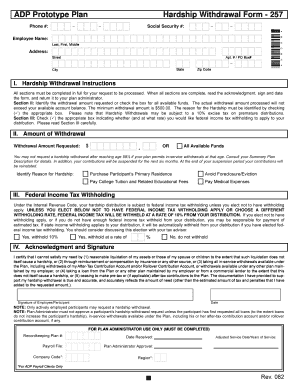

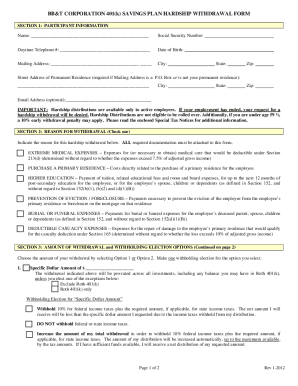

How to fill out adp 401k withdrawal form

How to fill out ADP 401k withdrawal form:

Who needs ADP 401k withdrawal form?

Video instructions and help with filling out and completing adp 401k withdrawal

Instructions and Help about how to withdraw from 401k adp form

Hi I'm Angela Today I'm going to show you how easy it is to create custom reports with the new Simplified Reporting enhancement to ADP Workforce Now You no longer need to be an expert report builder to quickly create the reports you need You can create basic columnar reports without using the seven-step report wizard I'll build a simple Annual Salary report to show you how it works I'll access Reports Custom Reports Set Up New Here's the new Set Up New Report page The title of my report is Annual Salary You can file the report in a folder if one has been created You can also add a description You can still access the seven-step wizard by selecting Advanced Columnar from the Advanced Options menu Or you can build a form report a data extract or mailing labels which also brings you to the seven-step wizard Those Custom Reports options still editor my report I'll use Simplified Reporting Ill start by clicking Select Fields Here's the new report building canvas that will make it very easy for you to build your reports My report will include the fields Last Name First Name Annual Salary and Home Department Description On the left you see simple categories that replace the reporting subjects files and sections you use today You will often include certain fields in your reports For your convenience these fields have been grouped into a predefined Commonly Used Fields category You can browse through the categories to select your fields, or you can use the search feature Ill search for the name fields Some fields are grouped into a bundled field as indicated by the field bundle icon For example when you add an employee name to the report typically you need to add more than one field You can add all the fields with one click And if you don't need some fields in this bundle you can easily remove them from your report I'll show you how to add fields individually First I'll add Last Name As you add fields to the report you will see a preview of your companies data in the report With this preview you can tell immediately if you added the correct fields I've added the rest of the fields to the report Notice the list of reports on the bottom of the page As you build your report Simplified Reporting lists the other reports that exist with similar fields You can then decide if you want to use one of these existing reports or continue to build your new report If the existing report has been previously run you can see a sample of the report when you point to Report When you point to Fields you can see the fields included in the existing report and add them to your report If you click the report name you can discard your new report and continue with the existing report You can also save your work and go to the other report At any time while you are building your report you can go to the seven-step wizard by clicking Advanced Reporting Everything you've selected is moved to the seven-step wizard You can create a simple filter right from this page For this report I...

Fill adp cash out 401k : Try Risk Free

People Also Ask about adp 401k withdrawal

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your adp 401k withdrawal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.