Get the free form 01 922

Show details

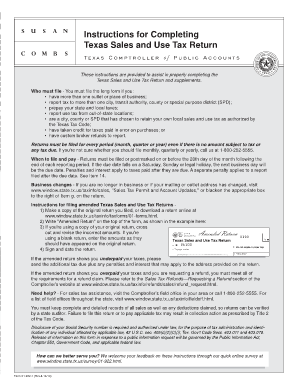

TEXAS SALES AND USE TAX RETURN a. 26100 c. Taxpayer number 01-114 (Rev.2-08/36) PRINT FORM CLEAR FIELDS DDD Do not staple or paper clip. d. Filing period b. Instructions in English SEE INSTRUCTIONS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

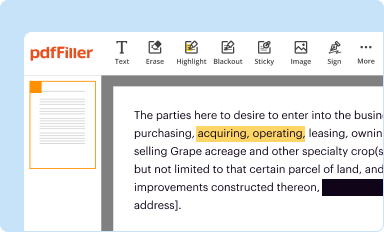

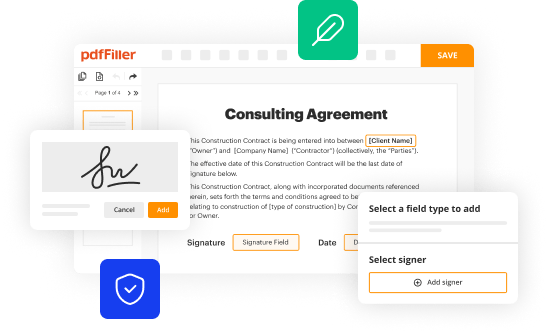

Edit your form 01 922 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 01 922 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 01 922 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas sales tax form pdf. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out form 01 922

To fill out form 01 922, follow these steps:

01

Begin by obtaining the form, either online or from the relevant government agency.

02

Read the instructions and make sure you understand the purpose and requirements of the form.

03

Gather all the necessary information and documents needed to complete the form accurately.

04

Start by providing your personal details such as your name, address, and contact information.

05

Follow the form's prompts to fill in additional sections such as employment history or financial information.

06

Be careful to provide accurate and truthful information, as any inaccuracies could lead to complications or penalties.

07

Double-check all the filled-in information to ensure it is complete and error-free.

08

Sign and date the completed form where required.

09

If there are any additional documents or supporting materials needed, attach them securely to the form.

10

Once you have completed the form, review it one final time to ensure everything is in order.

11

Submit the form according to the specified instructions, whether it be online, in person, or by mail.

Form 01 922 is usually required by individuals or organizations who need to provide specific information to a government agency, employer, or other authority. The exact requirements and reasons for needing this form may vary, so it is essential to consult the instructions or relevant guidelines to determine if you need to fill it out. Some common examples of who may need form 01 922 include job applicants, individuals applying for government assistance or benefits, or individuals involved in legal proceedings.

Fill sale tax form : Try Risk Free

People Also Ask about form 01 922

Is resale certificate same as sales and use tax permit in Texas?

What is a Texas sales tax exemption certificate?

How to fill Texas resale certificate?

What is the difference between sales and taxable sales?

Who needs to fill out a Texas sales and use tax resale certificate?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 01 922?

Form 922 is required to be filed by employers who are subject to the federal unemployment tax (FUTA) who have paid wages of $1,500 or more in any calendar quarter.

How to fill out form 01 922?

Form 01 922 is an application form for applying to become an agent of a foreign corporation in the United States.

1. Fill out the top section with your company’s information.

2. Complete the “Foreign Corporation” section with the name and address of the foreign corporation you are representing.

3. Under “Agent”, provide your name, address, and telephone number.

4. Complete the “Authority” section with details about the specific authority granted to you by the foreign corporation.

5. If there are other people who will act as agents, provide their information in the “Additional Agents” section.

6. Sign and date the application in the “Signature” section.

7. Submit the application, along with the applicable filing fee, to the address indicated on the form.

What is the purpose of form 01 922?

Form 922 is used by the IRS to report excise taxes on certain types of firearms and ammunition. It is used to report the amount of taxes paid on certain types of firearms and ammunition purchased or manufactured. It is also used to report any credits or refunds due to the purchaser or manufacturer of such items.

What information must be reported on form 01 922?

Form 922 is a Form 941 reconciliation form used by employers to reconcile the amount of taxes withheld from employee wages with the amount of taxes reported and paid on Form 941. The form requires employers to report the total amount of wages paid to employees, the total taxes withheld from those wages, and the total taxes paid on Form 941. Additionally, employers must list the total amount of any tax credits or overpayments and the total amount of any taxes due.

What is form 01 922?

Form 01-922 is the Taxpayer Assistance Request for Innocent Spouse Relief. This form is used by individuals who are seeking relief from joint and several liability on a joint return, as they believe they should not be held responsible for any erroneous or unpaid taxes, penalties, or interest. The form is submitted to the Internal Revenue Service (IRS) to initiate the innocent spouse relief process.

How do I execute form 01 922 online?

Filling out and eSigning texas sales tax form pdf is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out texas sales and use tax form using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign texas sales and use tax return short form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out texas sales and use tax return form 01 922 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your texas sales and use tax return form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your form 01 922 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Sales And Use Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to form 922

Related to sales tax form texas

If you believe that this page should be taken down, please follow our DMCA take down process

here

.