Get the free pay stub generator form

Show details

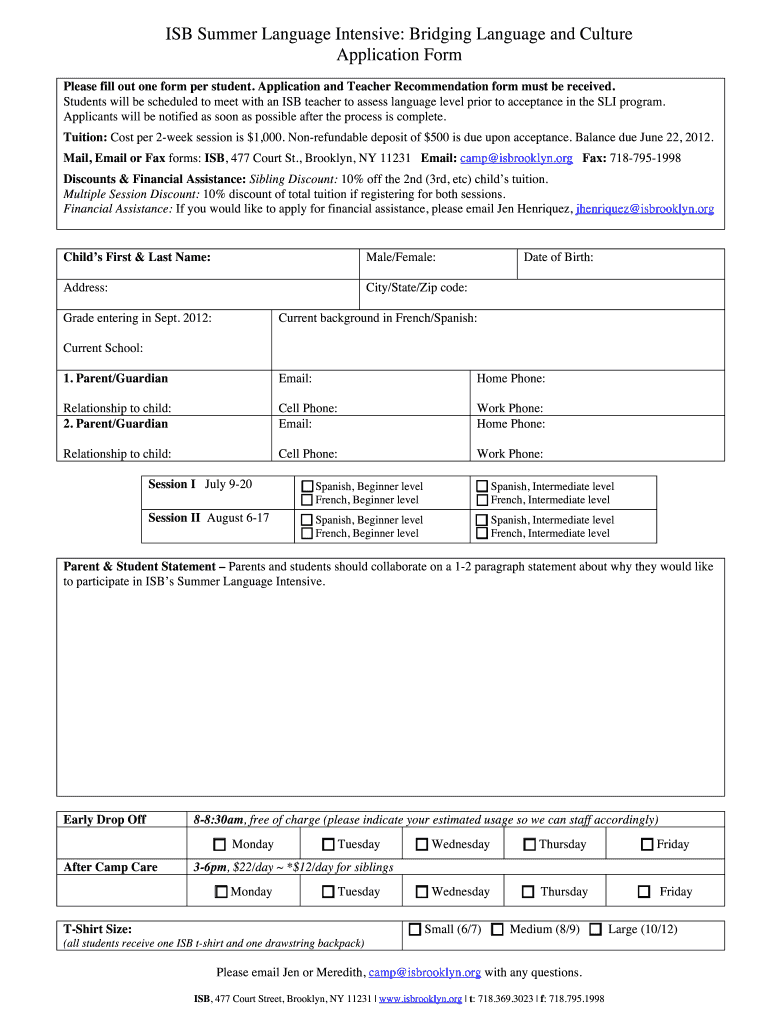

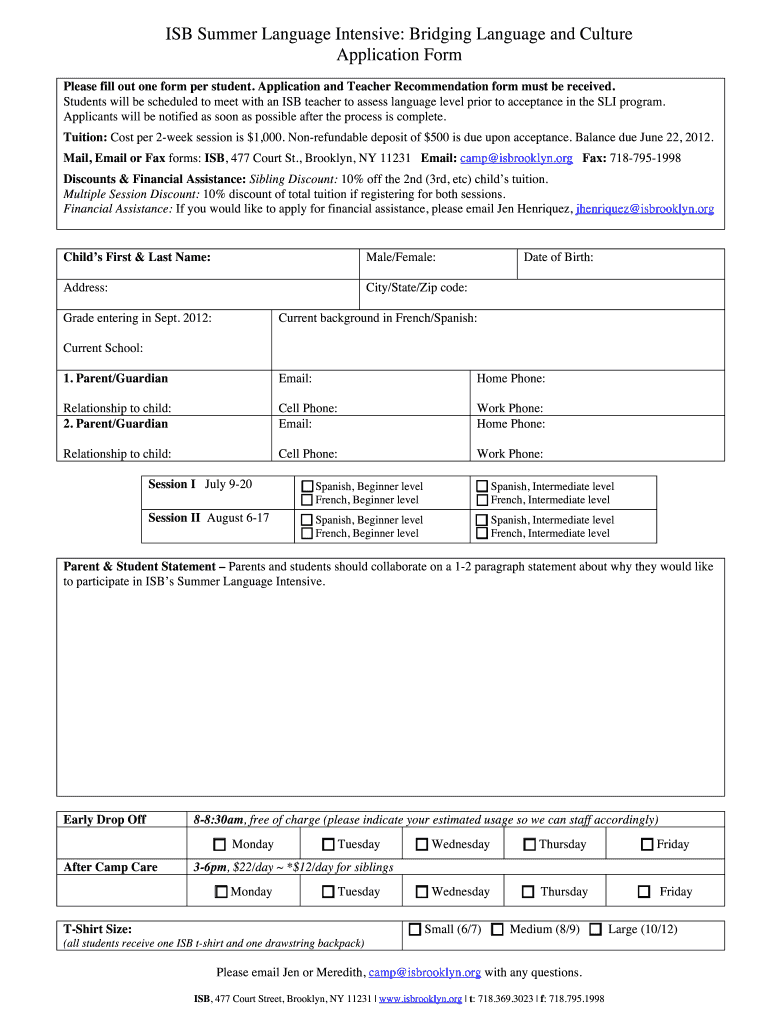

ISB Summer Language Intensive: Bridging Language and Culture Application Form

Please fill out one form per student. Application and Teacher Recommendation form must be received. Students will be scheduled

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your pay stub generator form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pay stub generator form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pay stub generator online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pay stubs maker form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

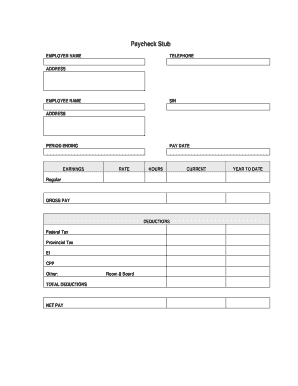

How to fill out pay stub generator form

Point by point how to fill out check stub maker:

01

Choose a reputable check stub maker website or software that suits your needs. There are various options available online, so make sure to select one that is user-friendly and provides all the necessary features.

02

Start by entering the basic information such as your company name, address, and contact details. This information will be displayed on the check stub.

03

Enter the employee details, including their name, address, and social security number. This is important for accurate record-keeping purposes.

04

Input the pay period dates and the employee's hours worked. This will allow the check stub maker to calculate the employee's gross wages accurately.

05

Enter any deductions or withholdings that need to be subtracted from the employee's gross wages. Common deductions include federal and state taxes, social security, Medicare, health insurance premiums, retirement contributions, and any other relevant deductions.

06

The check stub maker will automatically calculate the net pay (take-home pay) for the employee by subtracting the deductions from the gross wages.

07

Review the information entered to ensure its accuracy. Make any necessary adjustments or corrections before finalizing the check stub.

08

Generate the check stub and save it in a format that can be easily printed or shared with the employee. Some check stub makers also offer the option to email the check stub directly to the employee.

09

Finally, distribute the check stub to the employee along with their paycheck.

Who needs check stub maker?

01

Small business owners: Check stub makers can be helpful for small business owners who don't have access to payroll software or prefer a more cost-effective solution. It allows them to generate professional-looking check stubs for their employees.

02

Freelancers and self-employed individuals: Check stub makers can also be beneficial for freelancers and self-employed individuals who need to provide proof of income or keep track of their earnings for personal accounting purposes.

03

Employees: While employees don't necessarily need a check stub maker, they can benefit from receiving detailed check stubs that provide a breakdown of their earnings, deductions, and net pay. It helps them understand their compensation and provides transparency in the payment process.

Fill pay stub template with calculator : Try Risk Free

People Also Ask about pay stub generator

Can I create my own paystub?

How do I create a paystub?

Can you create a pay stub for free?

Does Microsoft Word have a pay stub template?

What is the best free check stub maker?

How do I make a paystub for myself?

Can I make my own check stub?

Is it legal to make your own pay stub?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is check stub maker?

A check stub maker is a software program or online tool that allows users to create and generate professional-looking pay stubs. It typically takes inputs such as employee information, pay rate, hours worked, deductions, and taxes, and generates a check stub that can be used as proof of income or for record-keeping purposes. The check stub maker can calculate gross pay, net pay, deductions, and taxes, and may also include options for customization such as adding company logos or specific information.

Who is required to file check stub maker?

Anyone who receives a paycheck or pays employees is required to have check stubs. This includes employers, self-employed individuals, and freelancers. Filing check stubs is necessary for record-keeping and compliance with tax and payroll regulations.

How to fill out check stub maker?

To fill out a check stub maker, follow these steps:

1. Provide your personal information: Start by entering your full name, address, and contact details in the designated fields.

2. Enter pay period information: Input the dates for the pay period you are generating the check stub for. This includes the start date and end date.

3. Input pay details: Enter your gross income or salary amount for the specified pay period. Include any additional earnings, such as bonuses or overtime, if applicable.

4. Deductions and withholdings: Input any deductions from your gross income, such as taxes, insurance premiums, retirement contributions, or other recurring deductions.

5. Calculate net income: The check stub maker will automatically calculate your net income by subtracting the total deductions from your gross income. Ensure the calculated amount matches your actual take-home pay.

6. Provide YTD (year-to-date) information: If applicable, input the year-to-date earnings and deductions to reflect the totals for the entire year.

7. Employee benefits and contributions: Include any other benefits you receive as an employee, such as health insurance, retirement contributions, or flexible spending accounts.

8. Preview and review: Once all the necessary information is entered, review the check stub to verify its accuracy. Ensure all amounts, dates, and personal details are correct.

9. Generate/print the check stub: After confirming the accuracy, generate the check stub and save it as a PDF or print it to have a physical copy.

Remember to keep a copy of the generated check stub for your records, as it may be useful for tax purposes, loan applications, or other financial needs.

What is the purpose of check stub maker?

The purpose of a check stub maker is to generate professional and accurate pay stubs for employees. It is typically used by businesses or individuals who need to create pay stubs for employees or contractors. This tool helps in organizing and documenting essential details related to an employee's pay, such as earnings, taxes, deductions, and year-to-date information. It ensures compliance with regulations, facilitates transparency, and simplifies record-keeping for payroll purposes.

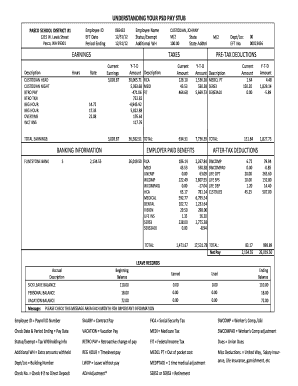

What information must be reported on check stub maker?

The specific information that must be reported on a check stub maker may vary depending on the country, state, or company policies. However, some common information that is typically included on check stubs are:

1. Employee information: This includes the employee's full name, address, social security number, employee ID, or any unique identification number.

2. Employer information: The name, address, and contact details of the employer or company.

3. Pay period: The specific dates or period for which the employee is being paid.

4. Earnings: The gross amount earned by the employee during the pay period. This includes regular wages, overtime pay, or any bonuses or commission.

5. Deductions: Various deductions made from the employee's earnings, such as taxes (federal, state, or local), social security, Medicare, health insurance premiums, retirement contributions, or any other voluntary deductions like pension plans or charitable donations.

6. Net pay: The total amount of earnings after deducting all applicable taxes and deductions from the gross pay.

7. Hours worked: The number of regular hours worked, any overtime hours, and the rate of pay for each.

8. Year-to-date (YTD) information: A summary of the employee's earnings and deductions for the current year.

9. Accrued benefits: Any vacation time, sick leave, or other accrued benefits that the employee has earned but not used.

10. Employer contributions: If applicable, any contributions made by the employer on behalf of the employee, such as retirement plan contributions or health insurance premiums.

11. Additional information: Other potential information on a check stub can include pay rate, pay frequency (weekly, bi-weekly, monthly), check number, and any notes or messages from the employer.

It is important to consult with your local labor or employment laws, as regulations can vary from jurisdiction to jurisdiction. Additionally, employers may have specific requirements or additional information they want to include on their check stubs.

What is the penalty for the late filing of check stub maker?

It is not clear what you are referring to by "check stub maker." If you are referring to the late filing of pay stubs, please provide additional information about the specific jurisdiction as penalties may vary.

How can I send pay stub generator for eSignature?

Once your pay stubs maker form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the pay check stub maker in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your pay stub pdf filler and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit printable paystubs on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as paycheck stub maker form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your pay stub generator form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pay Check Stub Maker is not the form you're looking for?Search for another form here.

Keywords relevant to pdf filler pay stub form

Related to printable paycheck stubs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.