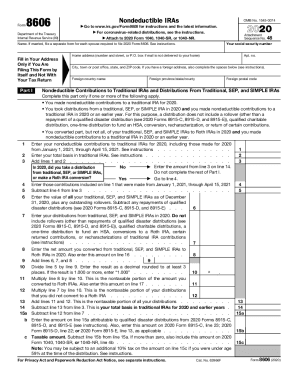

Get the free af form 860a

Show details

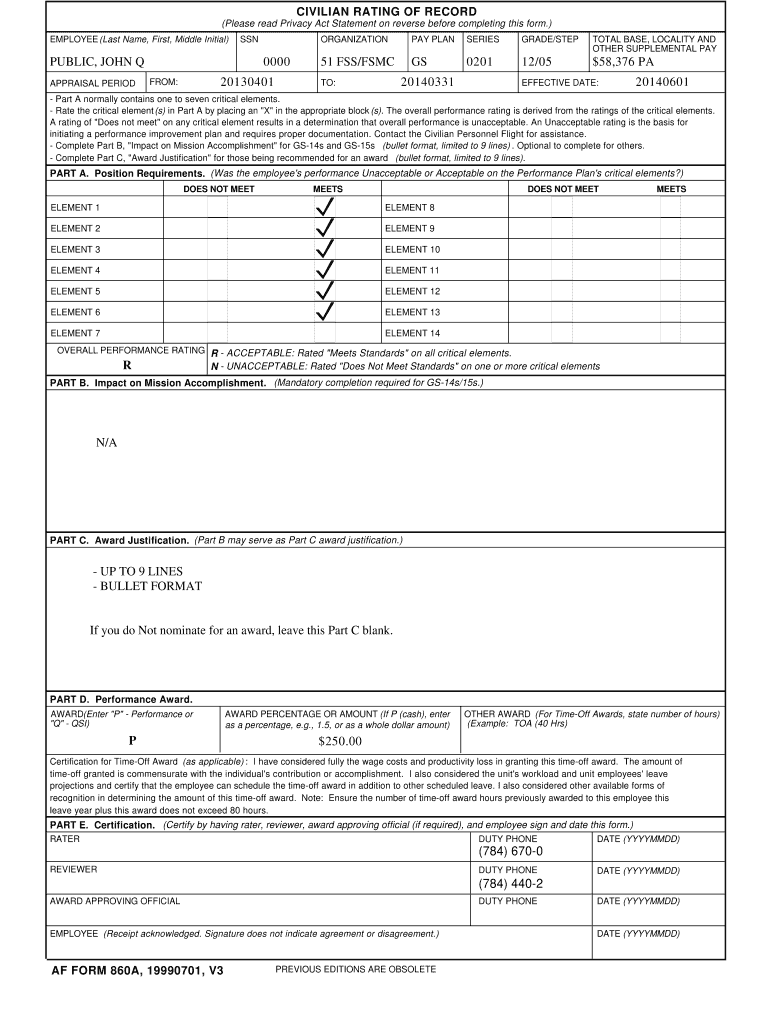

CIVILIAN RATING OF RECORD (Please read Privacy Act Statement on reverse before completing this form.) EMPLOYEE (Last Name, First, Middle Initial) SSN PUBLIC, JOHN Q APPRAISAL PERIOD ORGANIZATION 0000

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your af form 860a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your af form 860a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit af form 860a online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax earned credit form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out af form 860a

How to fill out tax earned credit:

01

Gather necessary documents: Collect all the relevant information and documents such as W-2 forms, 1099 forms, and records of any other income sources.

02

Determine eligibility: Check the income limits and other eligibility criteria to ensure that you meet the requirements for claiming the tax earned credit. These criteria can vary each year, so it is important to stay updated.

03

Complete Form 1040: Fill out your federal income tax return using Form 1040. Make sure to include all the necessary information, including your personal details, income, deductions, and credits.

04

Calculate the tax earned credit: Use the appropriate tax tables or the EITC Assistant tool provided by the IRS to determine the exact amount of tax earned credit you are eligible for. This credit is based on your income and the number of qualifying children you have.

05

Claim the credit: Enter the calculated amount of tax earned credit on the appropriate line of your tax return. Double-check everything before submitting to avoid any errors or omissions.

Who needs tax earned credit:

01

Low-income individuals: Tax earned credit is primarily intended for individuals or families with low to moderate income levels. It is designed to provide financial assistance and reduce the tax burden on those who earn low wages.

02

Individuals with qualifying children: The tax earned credit provides higher benefits for taxpayers with qualifying children. The number of qualifying children you have will impact the credit amount you are eligible for.

03

Those who meet the income and eligibility criteria: To claim the tax earned credit, you must meet specific income limitations and other eligibility criteria set by the IRS. These requirements differ each year, so it is essential to review the guidelines for the current tax year.

Note: It is advisable to consult with a tax professional or use tax software to ensure accurate and complete filing of tax earned credit.

Fill credits tax time : Try Risk Free

People Also Ask about af form 860a

Why did I get a letter from IRS about earned income credit?

What does form 15111 mean?

What is form 15112 IRS?

What is earned income credit Form 1040?

Where is EITC on tax form?

Why did I get a 15111 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax earned credit?

Tax earned credit is a tax credit that is awarded to individuals or families for each dollar that they earn. It is designed to reduce the financial burden on individuals and families, particularly those with low incomes, by providing additional funds to help them pay for daily living expenses. The amount of the credit varies depending on the individual's taxable income, but can be as much as $1,000.

What is the purpose of tax earned credit?

The Earned Income Tax Credit (EITC) is a tax credit designed to help low to moderate income working families reduce the amount of taxes they owe. The credit can be up to $6,557 for a family with three or more qualifying children. It can provide a much-needed boost to a family’s budget and help them make ends meet.

What information must be reported on tax earned credit?

Earned Income Tax Credit (EITC) must be reported on your tax return. The information that must be reported includes the total amount of the credit, your filing status, the number of qualifying children (if applicable), any payments you received under the American Recovery and Reinvestment Act of 2009, and the total amount of wages, net earnings from self-employment, and other income.

When is the deadline to file tax earned credit in 2023?

The deadline to file the Earned Income Tax Credit (EITC) for the year 2023 is April 15, 2024.

Who is required to file tax earned credit?

Individuals who meet certain eligibility criteria, such as having a certain level of earned income and meeting specific income limits, are required to file for the Earned Income Tax Credit (EITC) when filing their federal income tax return. This credit is primarily targeted towards low to moderate-income individuals and families. Eligibility requirements and income limits may vary each year, so it is important for individuals to review the current guidelines set by the Internal Revenue Service (IRS) to determine if they are required to file for the Earned Income Tax Credit.

How to fill out tax earned credit?

To fill out the Earned Income Tax Credit (EITC) on your tax return, you will need to follow these steps:

1. Determine your eligibility: The EITC is available to low to moderate-income individuals and families who meet certain criteria, such as earned income, filing status, and investment income limits. You can use the IRS EITC Assistant tool on their website to check your eligibility.

2. Gather necessary documents: Collect all the required documents and information, including your Social Security Number (SSN), income statements like W-2 forms, 1099 forms, or self-employment records, as well as records of any eligible expenses.

3. Choose the correct tax form: The EITC is claimed on your federal tax return, so choose the appropriate form (e.g. Form 1040, 1040A, or 1040EZ) depending on your circumstances.

4. Complete tax return: Start filling out your tax return by providing your personal information and any other relevant details. If you are using tax software or online platforms, they will guide you through each step.

5. Claim the EITC: In the appropriate section of your tax return, indicate that you are claiming the EITC. The software or tax form should have instructions on where to do this. Make sure to accurately follow the instructions and provide all the necessary information.

6. Calculate the credit: Depending on your income and filing status, the EITC amount may vary. Use the EITC table in the tax form's instructions or refer to the IRS publications to calculate the credit. Some tax software will automatically calculate it for you.

7. Enter and double-check information: On your tax return, enter the calculated EITC amount in the designated box. Review all the information you've entered to ensure it is accurate and complete.

8. Submit your tax return: After completing the necessary steps and checking for errors, submit your tax return to the IRS along with any other required forms or schedules. If you are using e-file options, follow the online instructions to electronically submit your return.

Remember, it's always a good idea to consult with a tax professional or utilize tax preparation software to ensure you are accurately claiming the Earned Income Tax Credit.

What is the penalty for the late filing of tax earned credit?

The penalty for the late filing of the Earned Income Tax Credit (EITC) depends on whether the taxpayer is entitled to the credit or not.

If a taxpayer is entitled to the EITC but files their tax return late, there is generally no penalty for late filing. However, in order to claim the credit, the taxpayer must file a tax return. If they fail to file a return within three years from the due date, they will forfeit their right to claim the credit for that tax year.

On the other hand, if a taxpayer fraudulently claims the EITC or provides inaccurate information knowingly, there could be penalties, including fines and potential criminal charges. The penalty amount would depend on the specific circumstances and can vary.

How do I modify my af form 860a in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your tax earned credit form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send credits income earned for eSignature?

Once your af form 860 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find employee tax credit?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the af form 860a pdf in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Fill out your af form 860a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credits Income Earned is not the form you're looking for?Search for another form here.

Keywords relevant to credits time form

Related to form 860a make

If you believe that this page should be taken down, please follow our DMCA take down process

here

.