NV NAC-372.730 1990-2024 free printable template

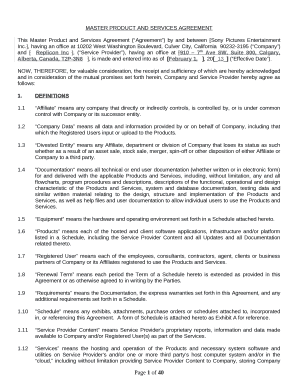

Get, Create, Make and Sign

How to edit resale certificate nevada online

How to fill out resale certificate nevada form

How to fill out Nevada form resale:

Who needs Nevada form resale:

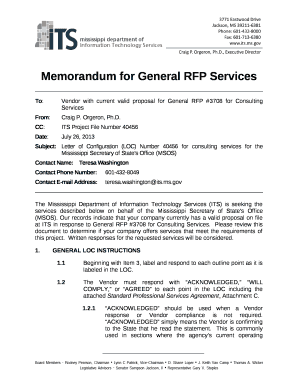

Video instructions and help with filling out and completing resale certificate nevada

Instructions and Help about nv form resale

Hey guys its Casey with small business millions today is December 28th 2015 we're almost done with the year, so I want to get a couple videos for you guys up before 2016, and I promise you guys in 2016 I'm going to get all the videos screenshots and samples and highlights up on all the social media Facebook Twitter and Instagram has a little of a slacker on that last year but you guys still followed us and still checked everything out, so I really appreciate that and everything will be down in the bottom of the box all the links to all the social media and the website and if you guys have any questions or comments or anything for us, it'll be down there in my email as well, and you can email me directly message comment whatever you need to do so let's jump into today's video today's video is about annual resale tax certificates I'm going to cover two things I'm going to cover one how you get a recent tax certificate and how you use it to buy all of your merchandise tax-free, and I'm in a second cover how to properly pay your sales in state sales taxes, so you don't get in trouble so what is a resale tax certificate that's a great question so basically a resale tax certificate allows you as a reseller to buy a piece of merchandise from another reseller tax-free, so you know how when you walk into Best Buy and you buy an iPad for $300 they charge you tax you're going to pay $320 for the item well what's great is with this tax certificate if you go into a place of business, and you present this a copy of your sales tax certificate you sign it you date it, and you give it to them, you get to buy that item for $300 you don't have to pay the tax sales tax is only meant for customers that are buying an item to use it so if you're going to buy that iPad to personally take home and use a play and watch Netflix on no-can-do don't sales tax certificate you will get in trouble only use it if you're going to resale the item which should be most of the stuff you're buying I use it every time I go into pawn shops they put me on file I give them a copy of it I buy my merchandise it's tax-free every time now what's great about that is you go down to the sales tax certificate you present it with your business and your tax ID, and they give you this it costs $5 here in Florida I'm sure it's different every state, so it's 5 bucks for the year, and you basically just make a bunch of copies of this when you get home take it out with you and if you can see here I've just used a sample of Google this is a 2013 annual resale for some company named friends of greyhounds it'll have your business name it'll have your address it will have your sales tax certificate number so when you bring this into a business, and you present it they can check all that out check your ID make sure it all matches up you will sign it date it and put the name of the place that you're at with your signature and date, and they'll give it to you tax-free that's pretty much how it works get to buy...

Fill nevada resale certificate example : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your resale certificate nevada form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.