Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

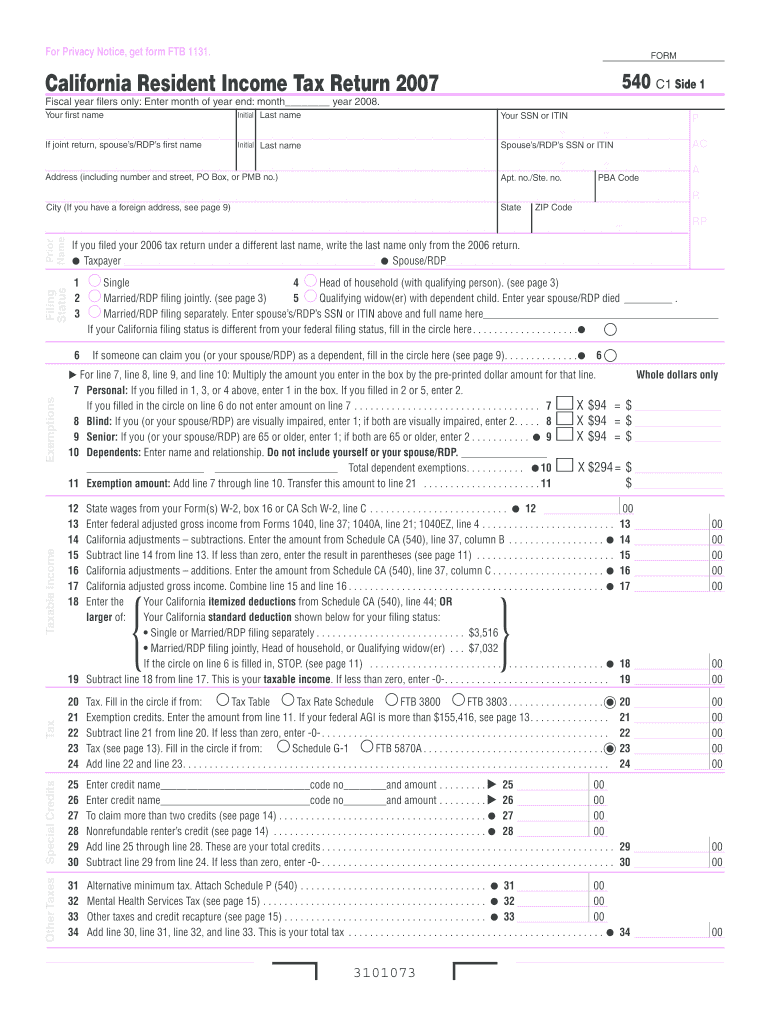

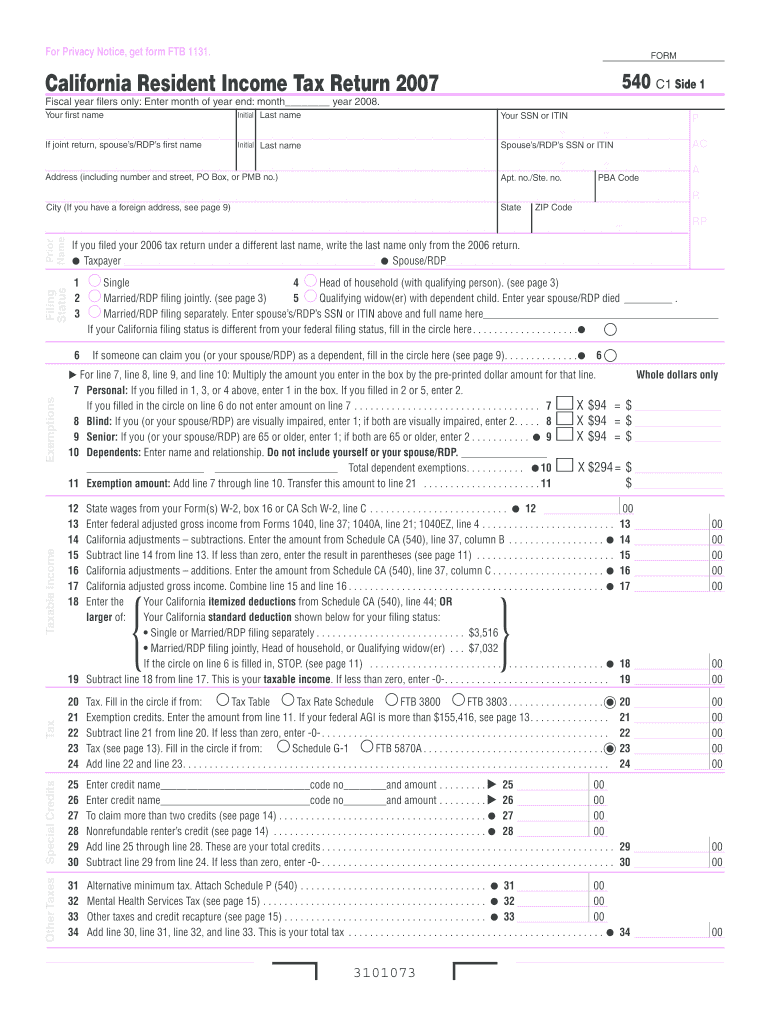

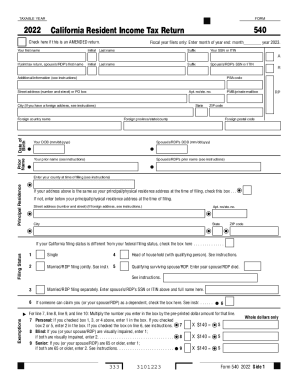

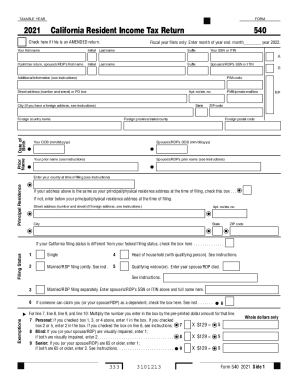

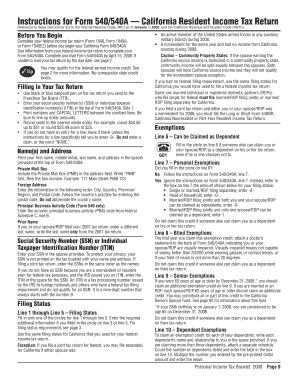

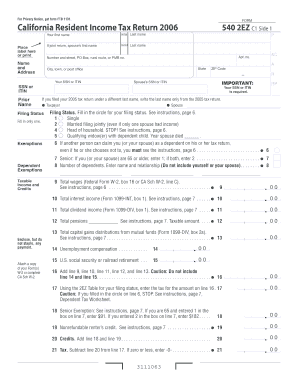

The 540 form is the California Resident Income Tax Return. This form is used by individuals who are residents of California to file their annual income tax return. The form is used to report income from all sources, calculate taxes due, and claim credits and deductions.

How to fill out 540 form?

The California Franchise Tax Board 540 form is used to file personal income tax returns in the state of California. To complete the form, you will need to provide information about your filing status, income, deductions, credits, and tax payments.

1. Enter basic information. On the first page, enter your name, address, Social Security number, and other contact information.

2. Select your filing status. Choose the filing status that applies to you, such as single, married filing jointly, or head of household.

3. Enter your income. This includes wages, salaries, tips, interest, dividends, and any other income you received during the tax year.

4. Calculate your deductions. Enter the total amount of deductions you can claim, such as medical expenses, charitable contributions, and state and local taxes.

5. Calculate your credits. Enter any credits you are eligible for, such as education credits and the Earned Income Credit.

6. Calculate your tax. Calculate your total tax liability based on your income, deductions, and credits.

7. Make your payment. You can make your payment by check, money order, or electronic funds transfer.

8. Sign and submit. Sign and date your form, then mail it to the Franchise Tax Board or submit it electronically.

What is the purpose of 540 form?

The 540 form is a form used by the California Franchise Tax Board to determine an individual's California income tax liability. It is a form that can be used to file either a resident or nonresident tax return. The form can also be used to claim credits, deductions, and other adjustments to income.

What information must be reported on 540 form?

The California 540 form requires taxpayers to report their filing status, income, credits, taxes paid, and other information to calculate their tax liability. Specifically, taxpayers must report their wages, salaries, tips, taxable interest, unemployment compensation, alimony received, capital gains, business and rental income, pension and annuity income, IRA distributions, Social Security benefits, and other income. Taxpayers must also report any credits they are eligible for, such as the dependent exemption credit, the elderly or disabled credit, the child and dependent care credit, the nonrefundable renter’s credit, and any other credits they are eligible to claim. Finally, taxpayers must report any taxes they have paid, including estimated taxes, withholding taxes, taxes paid to other states, and any other taxes paid.

When is the deadline to file 540 form in 2023?

The deadline to file a California Form 540 for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of 540 form?

The California Franchise Tax Board (FTB) imposes a late filing penalty of 5% of the amount of the unpaid tax due for each month or part of a month that a return is late up to a maximum of 25% of the total tax due. If the return is more than 60 days late, the minimum penalty is the lesser of $135 or 100% of the tax due.

Who is required to file 540 form?

Form 540 is the California Resident Income Tax Return form. California residents are required to file this form if they meet certain criteria-

1. You are a California resident for tax purposes.

2. You are required to file a federal income tax return.

3. You have income from California sources.

4. Your income exceeds the filing threshold set by the California Franchise Tax Board.

How can I edit 540 form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 540 fillable form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute ca 540 form online?

Filling out and eSigning form california resident 540 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit form 540 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign form 540 c1 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.