IRS Publication 503 2023-2024 free printable template

Show details

Department of the Treasury

Internal Revenue ServicePublication 503Contents

Whats New . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Reminders . . . . . . . . . . . . . . . . . . .

pdfFiller is not affiliated with IRS

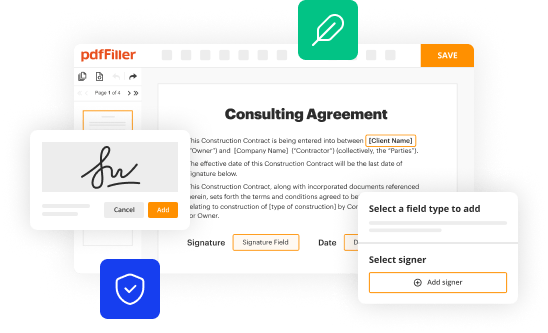

Get, Create, Make and Sign

Edit your armed forces tax guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your armed forces tax guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing armed forces tax guide online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit armed forces tax guide. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

IRS Publication 503 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out armed forces tax guide

How to fill out armed forces tax guide

01

To fill out the 2023 publication 503, follow these steps:

02

Start by downloading the 2023 publication 503 form from the official IRS website.

03

Gather all the necessary information and documents needed to complete the form. This may include details about your dependent care expenses, your employer's identification number, and other relevant financial information.

04

Read the instructions provided with the form carefully. It will contain important information about how to properly fill out each section.

05

Begin filling out the form with your personal information, such as your name, address, and social security number.

06

Provide information about your employer, including their name, address, and employer identification number (EIN).

07

Enter the total expenses paid for dependent care in the appropriate section. Make sure to follow any guidelines or limits mentioned in the instructions.

08

Calculate the credit amount you are eligible for based on the provided formula or tables.

09

Complete any additional sections or worksheets required, if applicable.

10

Double-check all the information you have entered for accuracy and completeness.

11

Sign and date the form before submitting it.

12

Keep a copy of the filled-out form for your records.

13

If you have any doubts or questions while filling out the form, it is recommended to consult with a tax professional or contact the IRS for assistance.

Who needs armed forces tax guide?

01

The 2023 publication 503 is needed by individuals who have incurred expenses for the care of dependents such as children or qualifying relatives. This publication provides guidelines and information on how to claim the dependent care tax credit on their federal tax return. If you paid someone to care for your dependent(s) while you were working or looking for work, you may be eligible for this tax credit. It is important to review the publication or consult with a tax professional to determine your eligibility and understand the specific requirements for claiming this credit.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2023 publication 503?

2023 publication 503 is a tax form issued by the Internal Revenue Service (IRS) that provides information on the medical and dental expenses that are deductible for taxpayers.

Who is required to file 2023 publication 503?

Taxpayers who have incurred medical and dental expenses that meet the IRS guidelines for deductibility must file 2023 publication 503.

How to fill out 2023 publication 503?

To fill out 2023 publication 503, taxpayers need to provide detailed information about their medical and dental expenses, including the amount spent and the nature of the expenses. They may also need to provide supporting documentation such as receipts.

What is the purpose of 2023 publication 503?

The purpose of 2023 publication 503 is to allow taxpayers to claim deductions for eligible medical and dental expenses, reducing their taxable income.

What information must be reported on 2023 publication 503?

On 2023 publication 503, taxpayers must report their medical and dental expenses, including the total amount spent, the nature of the expenses, and any reimbursements received.

When is the deadline to file 2023 publication 503 in 2023?

The specific deadline to file 2023 publication 503 in 2023 will be determined by the IRS and communicated through official channels. It is important for taxpayers to stay updated on the deadline and file their form within the specified timeframe.

What is the penalty for the late filing of 2023 publication 503?

The penalty for late filing of 2023 publication 503 will depend on the specific regulations set by the IRS. Taxpayers who fail to file the form on time may incur penalties, such as fines or an increased tax liability. It is advisable to file the form before the deadline to avoid potential penalties.

How do I edit armed forces tax guide straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing armed forces tax guide.

How can I fill out armed forces tax guide on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your armed forces tax guide. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out armed forces tax guide on an Android device?

Use the pdfFiller Android app to finish your armed forces tax guide and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your armed forces tax guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.