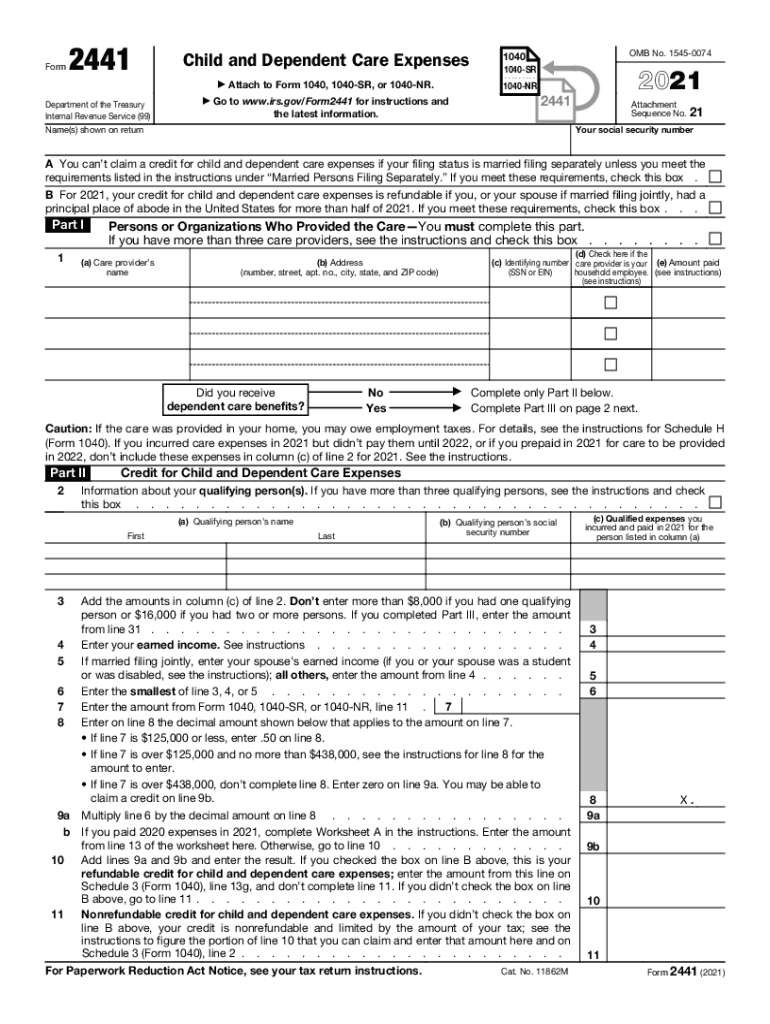

Who Needs Form 2441?

An individual who is employed and pays for the care of a dependent child or other qualified person such as a mentally or physically disabled spouse can fill out Form 2441 Child and Dependent Care Expenses. A dependent child is considered to be a child under thirteen.

What is Form 2441 for?

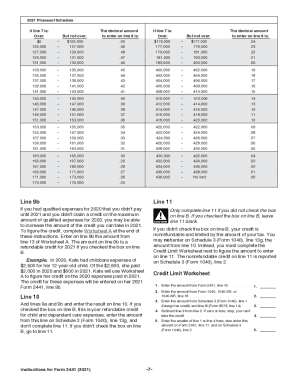

Form 2441 is filled out to get a credit that would cover expenses spent to take care of a mentally or physically disabled dependent. Care for the dependent person implies services that guarantee well-being and safety of the qualifying person. The cost of food, entertainment and clothes isn’t included in the credit. The amount of the credit shouldn’t exceed $3,000 for one disabled person and $6,000 for two or more qualifying individuals. The credit is adjusted based on the person’s income.

Is Form 2441 Accompanied by other Forms?

Form 2441 isn’t followed by additional documents. However, to fill out the form, an individual needs information from Form 1040, Form 1040A or Form 1040NR.

When is Form 2441 Due?

Form 2441 is attached to Form 1040 and is submitted by the 18th of April.

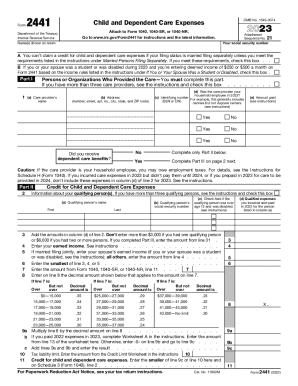

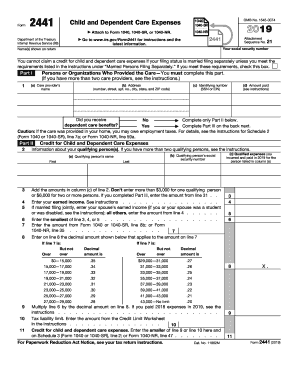

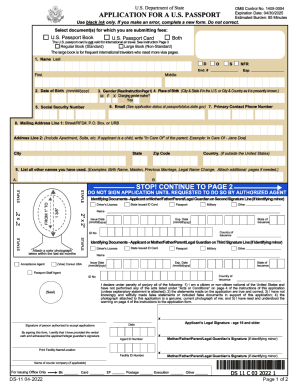

How do I Fill out Form 2441?

The form is two-pages long. It may take some time to fill it out. The whole form is divided into three parts:

- Part 1 is for people or organizations who provided the care. Enter their names, address, SSN or EIN

- Pat 2 contains information about detailed dependent credit and expenses

- Part 3 is dedicated to dependent care benefits

Use the information from the Forms 1040, 1040A, 1040NR to do the calculations.

Where do I Send Form 2441?

Form 2441 is sent to the IRS accompanied by the Form 1040, 1040A or 1040NR.