Get the free tax exempt form

Show details

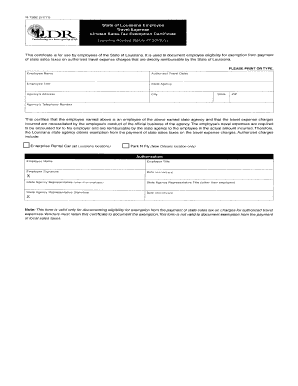

R-1334 (10/09) Commercial Fishermen Louisiana Sales Tax Exemption Application Louisiana R.S. 47:305.20 Louisiana Department of Revenue Special Programs Division P.O. Box 66362 Baton Rouge, LA 70896

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tax exempt form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax exempt form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit printable tax exempt form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

How to fill out tax exempt form

How to fill out tax exemption form:

01

Gather all necessary documentation, such as income statements, proof of residency, and any other relevant documents.

02

Carefully read and understand the instructions provided with the tax exemption form.

03

Start by entering your personal information accurately, including your name, address, social security number, and any other required details.

04

Fill out the income section, providing details about your earnings and any deductions or credits you may be eligible for.

05

Double-check all the information you have entered to ensure its accuracy.

06

Sign and date the form as instructed and attach any required supporting documents, such as W-2 forms or proof of eligibility for specific exemptions.

07

Make a copy of the completed form for your own records before submitting it.

Who needs tax exemption form:

01

Individuals who meet certain criteria or have specific circumstances may need to fill out a tax exemption form.

02

Students who are claimed as dependents on their parents' tax returns may need to complete the form to claim exemption from certain taxes.

03

Non-profit organizations or religious institutions may need to fill out tax exemption forms to qualify for tax-exempt status.

04

Individuals who qualify for certain deductions or credits may need to complete the tax exemption form to claim these benefits.

05

It is advisable to consult with a tax professional or visit the government's official website for more specific information on who needs to fill out a tax exemption form.

Fill form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax exemption form?

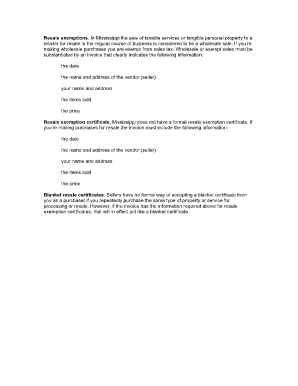

A tax exemption form is a document or form that individuals or organizations can use to apply for exemption from certain types of taxes. This form typically outlines the criteria and requirements for qualifying for tax exemption and may require supporting documentation or evidence to be provided. Tax exemption forms are commonly used for various types of taxes, such as sales tax, property tax, or income tax, and are typically submitted to the relevant tax authority or government agency. Once approved, the tax exemption may provide certain benefits, such as reduced tax liabilities or exemptions from specific tax obligations.

How to fill out tax exemption form?

1. Obtain the tax exemption form: Contact the appropriate tax office or the organization granting the exemption to get a copy of the form. It may be available on their website or can be requested via mail or email.

2. Read the instructions: Before starting to fill out the form, carefully read through the instructions provided. This will help you understand the requirements, eligibility criteria, and any supporting documents needed.

3. Personal information: Provide your personal details, such as name, address, Social Security Number (SSN), or Employer Identification Number (EIN) if you are representing an organization.

4. Eligibility check: Confirm your eligibility for the tax exemption by reviewing the provided criteria. This may include income limits, specific activities, or qualifications.

5. Describe your status: Provide a brief description of the reason you believe you qualify for the tax exemption. This could include details about your religious, charitable, or other exempt organization.

6. Attach supporting documents: Ensure you have any required supporting documents, such as proof of income, non-profit status documentation, or other relevant paperwork. Make copies and attach them to the tax exemption form as instructed.

7. Review and sign: Double-check all the information you provided, making sure it is complete and accurate. Some forms may require a signature from a representative of the organization or a notary public, so ensure you comply with the specific requirements.

8. Submit the form: Send the completed form along with all the necessary attachments to the designated tax office or organization. Follow their guidelines regarding submission methods, such as mailing, hand delivery, or online submission.

9. Retain a copy: Make a photocopy or digital copy of the filled-out form for your own records before submitting it. This will serve as proof of your application and help you in case of any future inquiries or audits.

Remember, the process of filling out tax exemption forms may differ depending on your country, state, or region. Always consult the specific instructions provided with the form and seek professional advice if needed.

What is the purpose of tax exemption form?

The purpose of a tax exemption form is to provide a way for individuals or organizations to claim exemption from certain taxes based on their specific circumstances or activities. This form is used to provide evidence to tax authorities that the taxpayer qualifies for exemption, allowing them to avoid paying the specified taxes. The form typically requires information and documentation to support the exemption claim, such as proof of non-profit status, religious affiliation, or other qualifying criteria.

What information must be reported on tax exemption form?

The specific information required to be reported on a tax exemption form can vary depending on the jurisdiction and the type of organization seeking tax exemption. However, some common information that may need to be reported on a tax exemption form includes:

1. Identification details: The name, address, and contact information of the organization seeking tax exemption.

2. Legal structure: The legal structure of the organization (e.g., corporation, trust, nonprofit association, etc.).

3. Purpose and activities: A description of the organization's purpose, mission, and activities, detailing how they align with the criteria for tax exemption. This may include information about charitable, educational, religious, scientific, or other exempt purposes.

4. Financial information: Details about the organization's finances, such as its income, expenses, assets, liabilities, and sources of funding. This could involve providing financial statements, budgets, or other relevant documents.

5. Governance and structure: Information about the organization's governing board or management structure, including the names and addresses of key individuals and their roles within the organization.

6. Compliance: Any information related to the organization's compliance with applicable laws, regulations, or reporting requirements.

7. Tax-related details: Details about the tax-exempt status being sought, such as the specific tax exemption category (e.g., 501(c)(3) for nonprofit organizations in the United States). This may also involve providing previous tax returns or other tax-related documents.

It's important to note that the specific requirements for tax exemption forms can differ significantly between countries, and even within different states or regions of a country. Therefore, it's always best to consult the relevant tax authority or a qualified tax professional to determine the specific information needed for a tax exemption form in a particular jurisdiction.

What is the penalty for the late filing of tax exemption form?

The penalty for late filing of a tax exemption form may vary depending on specific circumstances and the jurisdiction in question. It is recommended to consult with a tax professional or review the relevant tax laws and regulations of your jurisdiction to obtain accurate and up-to-date information about any potential penalties.

How can I modify tax exempt form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including printable tax exempt form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send tax exemption form for eSignature?

To distribute your exemption paperwork, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I edit tax exempt on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign louisiana tax exempt form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exemption Form is not the form you're looking for?Search for another form here.

Keywords relevant to louisiana sales tax exemption form

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.