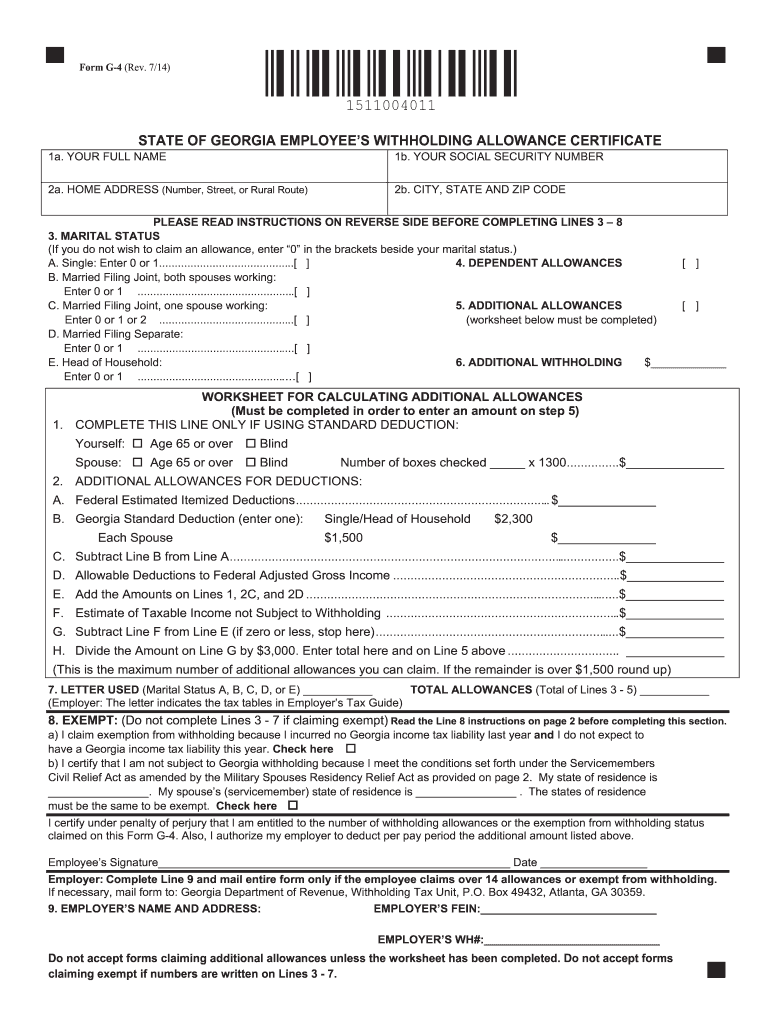

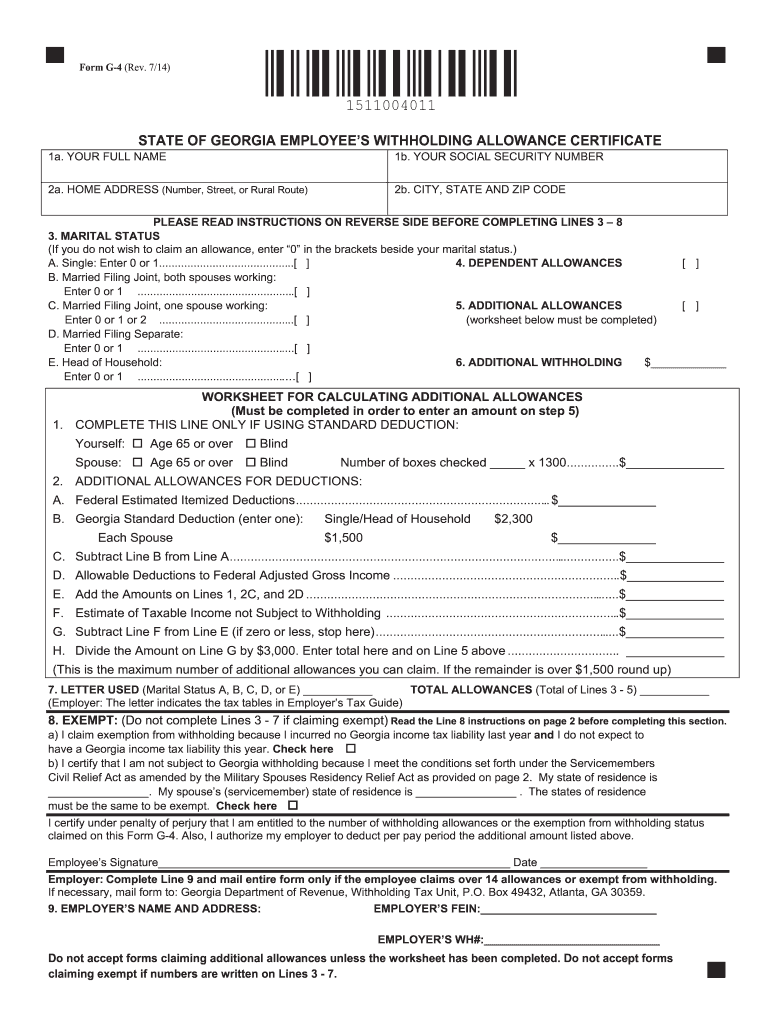

GA DoR G-4 2014 free printable template

Get, Create, Make and Sign

Editing form g 2014 online

GA DoR G-4 Form Versions

How to fill out form g 2014

How to fill out form g 2014:

Who needs form g 2014:

Instructions and Help about form g 2014

Greetings and welcome to step-by-step immigration forms video tutorial for form G 325 a biographic information form this is a very important part of the application for the adjustment of status based on the marriage between US citizen and a non-us citizen and this form is used to give the examiners a background of who you are where you lived where you've worked who your parents are and a bunch of other information that goes pretty much in-depth into each one of your lives now both the husband and the wife are required to fill out this form and as you'll see it's, and it's a complicated form, so we're going to spend some time going line by line and step by step so that you'll be able to prepare it and have it accepted by the Immigration Service first thing I like to say is that what I'm going to be doing is describing to you the questions that are asked on the form, and we'll go over the instruction sheet and I won't be advising you on what you should put down because I don't know you and I don't know your specific situation, so I cannot advise you and for this reason you can't rely on this video tutorial as actually legal advice every day when I'm working as an attorney I hear people's story and I tell them what to put down in these boxes based on what I understand, but I'm not going to be able to do that with you so you cannot rely on this video tutorial as true legal advice however by going through these forms step by step and line by line you'll get some good information about what the Immigration Service means by these questions what they expect you to put in there, and also you'll give information about how it all fits together as one big application so really glad you're here with us, and you're going to learn a lot while going through this forum tutorial believe me, so now I'm going to switch over to a screen capture of the actual video of the forum that we're going to be using the g3 25 a, and we're going to take it step by step and line-by-line ok so here we are at the homepage of the USCIS now we always use the USCIS forms directly from their website when we're doing these video tutorials because we want to make sure you know how to find the most updated forms to do this work these forms change all the time they're constantly being updated so the forms we use today on this tutorial may be out of date by the time you watch it so for that reason we want to take you through the website, so you know exactly where to go to locate this form and also how to read the instructions to know where to file it how much the fees are and all the rest of the important information that may change from time to time so let's here we're here at the home of the home page of the USCIS and this is located at USCIS govt, so we're going to bring that up, and you'll see immigration forms here we're going to click on immigration forms, and we see the immigration forms page here and their numerical order, so we're going to scroll down G 325 a right there...

Fill form : Try Risk Free

People Also Ask about form g 2014

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form g 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.