ID HW0411 2016-2024 free printable template

Show details

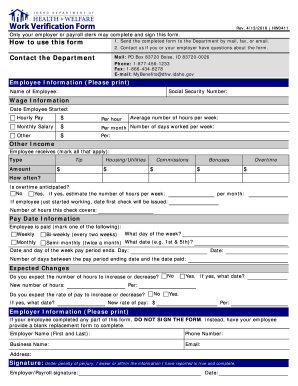

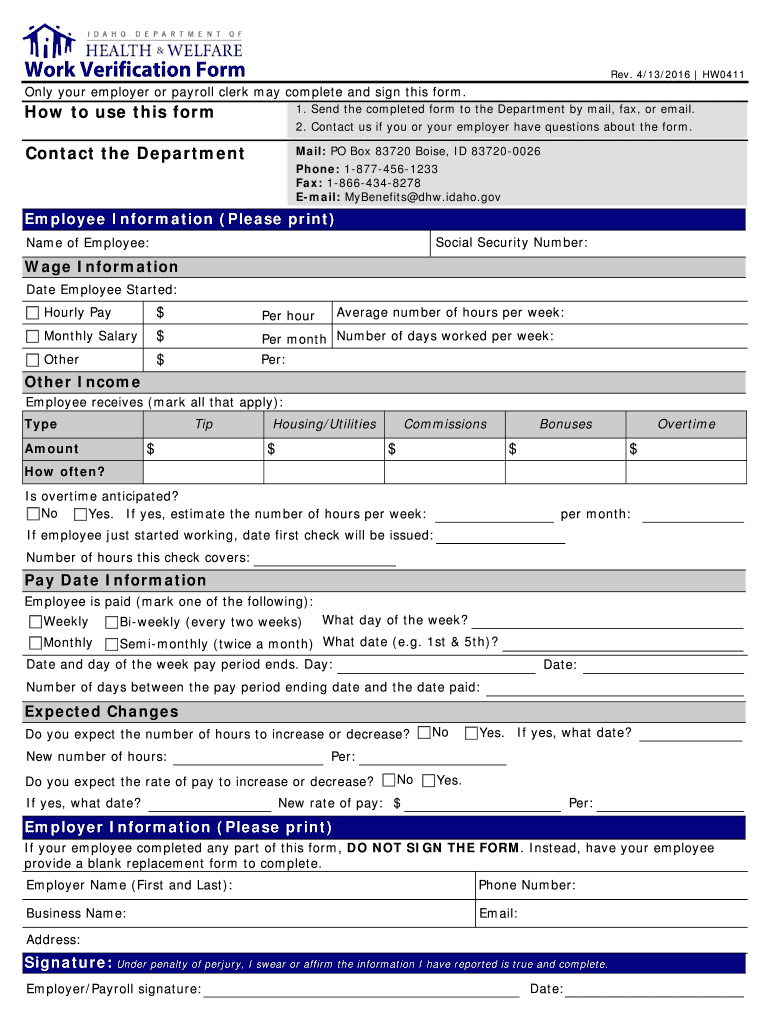

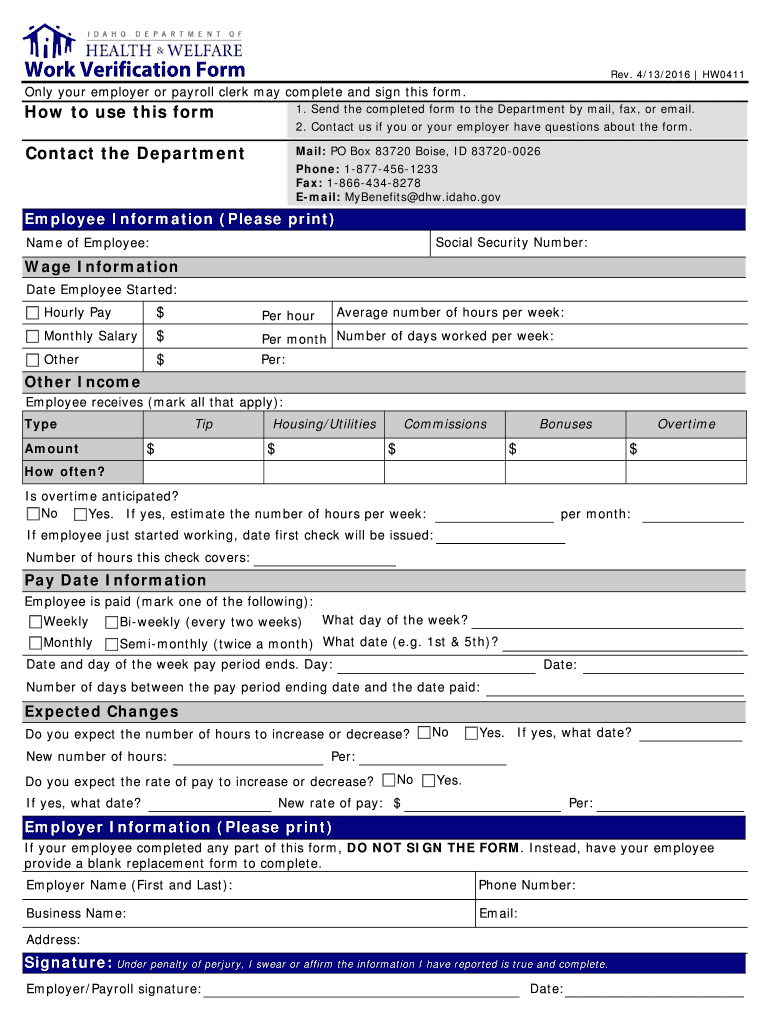

Rev. 4/13/2016 HW0411Only your employer or payroll clerk may complete and sign this form. How to use this form1. Send the completed form to the Department by mail, fax, or email. Contact the Departmental:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your idaho work verification 2016-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idaho work verification 2016-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit idaho work verification online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit work verification form idaho. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

ID HW0411 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out idaho work verification 2016-2024

How to fill out idaho form work:

01

Obtain the Idaho form work from the appropriate source, such as the Idaho Division of Labor's website or local employment office.

02

Carefully read and understand the instructions provided with the form work.

03

Fill in your personal information accurately, including your full name, address, and contact details.

04

Provide your employment history, including your previous employers' names, addresses, job titles, and dates of employment.

05

Fill out the details of your current employment, including your employer's name, address, and your job title.

06

Answer all the required questions on the form work, such as your availability, work preferences, and any restrictions or limitations.

07

Sign and date the form work to certify its accuracy and completeness.

08

Make a copy of the filled-out form work for your records before submitting it to the appropriate authority.

Who needs idaho form work:

01

Individuals who are seeking employment in the state of Idaho may need to fill out the Idaho form work.

02

Employers in Idaho may require their employees to complete the Idaho form work for various employment-related purposes.

03

Certain government agencies or programs in Idaho may also require individuals to fill out the Idaho form work as part of their application or eligibility process.

Fill idaho form work verification : Try Risk Free

People Also Ask about idaho work verification

What is a 967 return?

What is the Idaho form 967?

What is a form 40 Idaho?

How many allowances should I claim in Idaho?

What is Idaho form 910?

What is the form 51 in Idaho?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is idaho form work?

Idaho Form Work is an online document service offered by the Idaho State Tax Commission. It allows businesses to file and pay taxes, register a business, and manage other tax-related tasks. The service is free to use and provides access to all of the forms needed to comply with Idaho State taxes.

Who is required to file idaho form work?

Anyone who is required to pay Idaho income tax must file Form 40, Idaho Individual Income Tax Return. This is true regardless of whether you are an employee, a self-employed individual, or a retiree.

When is the deadline to file idaho form work in 2023?

The deadline to file Idaho Form Work in 2023 is April 15th, 2023.

What is the penalty for the late filing of idaho form work?

The penalty for late filing of Idaho Form Work is a $50 fine.

How to fill out idaho form work?

To fill out the Idaho Form Work, also known as the Idaho Employer's Report of Industrial Accident, you will need the following information:

1. Employer Information: Provide your company's name, address, phone number, and federal employer identification number (FEIN).

2. Employee Information: Enter the injured employee's name, address, social security number, date of birth, occupation, and employment status.

3. Accident Details: Provide the date and time of the accident, the exact location where it occurred, and a detailed description of how the accident happened.

4. Injury Information: Describe the nature and extent of the employee's injury or illness resulting from the accident. Include the body part affected, type of injury/illness, and any medical treatment provided.

5. Witness Information: If there were any witnesses to the accident, record their name, address, and phone number.

6. Lost Time: Indicate the number of workdays the injured employee has missed or is expected to miss due to the injury or illness.

7. Insurance Information: If your company has workers' compensation insurance, provide the insurance company name, address, and policy number.

8. Additional Information: If there is any additional information that may be relevant to the accident or the injured employee's condition, include it in the designated section.

9. Authorized Representative: The employer or an authorized representative should sign and date the form.

Ensure that all information provided is accurate and complete. Retain a copy of the completed Idaho Form Work for your records and submit it to the Idaho Industrial Commission as required by the state's rules and regulations.

What is the purpose of idaho form work?

Idaho Form Work is a non-profit organization based in Idaho, United States. The purpose of Idaho Form Work is to promote civic engagement, social justice, and community engagement through various activities and initiatives. Their primary focus is on fostering collaboration among individuals, organizations, and communities to address pressing issues and work towards positive change in society.

Idaho Form Work aims to provide a platform for dialogue, education, and advocacy on issues such as poverty, education, healthcare, environment, and human rights. They often organize events, forums, and workshops to facilitate conversations, create awareness, and mobilize resources to address these challenges.

Through its work, Idaho Form Work seeks to empower individuals and communities, amplify marginalized voices, and encourage active participation in the democratic process. They also strive to promote transparency, accountability, and good governance in order to create a more inclusive and equitable society.

Overall, the purpose of Idaho Form Work is to support and facilitate grassroots initiatives, collaboration, and community-driven solutions to make a positive impact on the lives of people in Idaho and beyond.

What information must be reported on idaho form work?

Idaho Form WORK is used to report wages, salaries, and other compensation paid to employees who work in Idaho. The following information must be reported on this form:

1. Employer Information: This includes the employer's name, address, and Idaho withholding account number.

2. Employee Information: The form should include the employee's full name, social security number, and address.

3. Income Information: This section requires reporting the total wages, salaries, tips, bonuses, commissions, and other compensation paid to the employee during the tax year.

4. Idaho Tax Withheld: Employers must also report the amount of Idaho income tax withheld from the employee's wages.

5. Total Idaho Income Tax Withheld: This includes the total amount of Idaho income tax withheld from all employees during the tax year.

6. Excess Idaho Income Tax Withheld: If the total Idaho income tax withheld from all employees is more than the total Idaho income tax liability for the year, the excess amount should be reported on this line.

7. Signature: The form should be signed and dated by an authorized representative of the employer.

It is important to note that Idaho Form WORK is an employer's annual reconciliation form, which means it summarizes the wage and tax information of all employees for the tax year.

Can I create an eSignature for the idaho work verification in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your work verification form idaho and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit idaho work verification form straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing idaho form work verification health welfare right away.

How do I edit idaho form health welfare on an iOS device?

You certainly can. You can quickly edit, distribute, and sign idaho work verification form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your idaho work verification 2016-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Idaho Work Verification Form is not the form you're looking for?Search for another form here.

Keywords relevant to idaho work verification health welfare form

Related to idaho work verification health welfare form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.