MA Schedule HC Instructions 2014-2024 free printable template

Show details

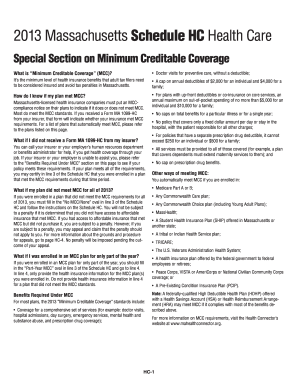

Visit irs. gov for more information about the federal requirement to have insurance coverage. For plans with up-front deductibles or co-insurance on core services an annual maximum on out-of-pocket spending of no more than 6 350 for an individual and 12 700 for a family How do I know if my plan met MCC No policy that covers only a fixed dollar amount per day or stay in the hospital with the patient responsible for all other charges Massachusetts-licensed health insurance companies must put an...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your massachusetts schedule hc 2014-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts schedule hc 2014-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing massachusetts schedule hc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule hc health care form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

MA Schedule HC Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out massachusetts schedule hc 2014-2024

How to fill out Massachusetts Schedule HC:

01

Obtain a copy of Massachusetts Schedule HC from the Department of Revenue website or from your tax preparer.

02

Begin by entering your personal information, such as your name, Social Security number, and address, in the designated fields on the form.

03

Next, report the total number of individuals included in your healthcare coverage for the tax year. This includes yourself, your spouse, and any dependents.

04

Determine your household income and accurately report it on the form. This includes income from all sources, such as employment, investments, and rental properties.

05

Identify whether you had health insurance coverage for the entire year. If you were uninsured for any portion of the year, additional information may be required.

06

Calculate the total amount of premiums that were paid for your healthcare coverage. This information should be provided by your insurance provider.

07

If you or any member of your household received a Premium Tax Credit or an Advance Payment of the Premium Tax Credit, report this information on the form as well.

08

Review the completed Schedule HC for accuracy and make any necessary corrections.

09

Sign and date the form before submitting it with your state tax return.

Who needs Massachusetts Schedule HC:

01

Massachusetts residents who were enrolled in healthcare coverage during the tax year need to complete Schedule HC.

02

Individuals who were uninsured for any portion of the year may also need to fill out Schedule HC to provide additional information.

03

If you received a Premium Tax Credit or an Advance Payment of the Premium Tax Credit, you will need to report this on Schedule HC as well.

04

It is important to consult with a tax professional or refer to the Massachusetts Department of Revenue guidelines to determine if you are required to file Schedule HC based on your specific circumstances.

Fill ma hc form : Try Risk Free

People Also Ask about massachusetts schedule hc

Do I need to file Schedule HC Massachusetts?

What is Massachusetts schedule HC?

What is the 1099-HC form for MA?

Do I need to send 1099 to state of Massachusetts?

Where do I get form MA 1099-HC?

Does MA require a 1099-HC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is massachusetts schedule hc?

Massachusetts Schedule HC is a tax form used by Massachusetts residents to report certain health care expenses that are eligible for deduction on their Massachusetts income tax return. It includes expenses such as insurance premiums, medical bills, prescription drugs, and other health care costs.

When is the deadline to file massachusetts schedule hc in 2023?

The deadline to file Massachusetts Schedule HC in 2023 is April 15, 2024.

What is the purpose of massachusetts schedule hc?

Massachusetts Schedule HC is an income tax form used to report health care coverage premiums paid by individuals, families, and businesses. The form allows taxpayers to claim a premium tax credit for health care coverage costs incurred during the year. The purpose of the form is to help taxpayers accurately report and claim any health care coverage tax credits they may be due.

What is the penalty for the late filing of massachusetts schedule hc?

The penalty for late filing of Massachusetts Schedule HC is $50 per month or part of a month, up to a maximum of $500.

Who is required to file massachusetts schedule hc?

In Massachusetts, taxpayers who have health insurance liabilities or are claiming certain health care exemptions are required to file Schedule HC along with their state income tax return.

How to fill out massachusetts schedule hc?

To fill out Massachusetts Schedule HC, follow these steps:

1. Download the latest version of Schedule HC from the Massachusetts Department of Revenue (DOR) website.

2. Provide basic information: Fill in your name, Social Security number, your spouse's name (if applicable), and your address.

3. Determine your health insurance coverage: Determine if you, your spouse, or your dependents had health insurance coverage for the entire year by checking the appropriate box. If you were not covered for the entire year, you may be subject to penalties or owe additional taxes.

4. Calculate your penalty, if applicable: If you or your dependents did not have health insurance for the entire year, calculate the penalty using the worksheet provided in the schedule. Follow the instructions to determine the amount owed.

5. Calculate your health insurance deduction, if eligible: If you were self-employed or have a Health Savings Account (HSA), refer to the worksheet in the schedule to calculate your deduction.

6. Calculate your Health Connector monthly premium: If you purchased health insurance through the Massachusetts Health Connector, use the worksheet to calculate your monthly premium. Enter the total annual premium paid.

7. Calculate the annual premium contribution: If you received employer-sponsored health insurance, use the worksheet to calculate your annual premium contribution. Enter the total amount contributed by you.

8. Determine your credit, if applicable: If you are eligible for the Health Safety Net Surcharge Credit, complete the worksheet to calculate the credit amount.

9. Complete the Health Care Information Summary table: Provide the requested details about you, your spouse, and your dependents, including SSN, months of coverage, and any exemptions.

10. Sign and date the Schedule HC: Sign and date the form to certify that the information provided is true and accurate.

Make sure to review all instructions and attach any necessary documentation before submitting the completed Schedule HC with your Massachusetts tax return. It is recommended to consult with a tax professional or refer to the Massachusetts DOR website for further guidance.

What information must be reported on massachusetts schedule hc?

The Massachusetts Schedule HC, also known as the Health Care Information Schedule, requires the following information to be reported:

1. The taxpayer's personal information, such as name, Social Security number, and filing status.

2. The total number of months the taxpayer had health insurance coverage during the tax year.

3. The taxpayer's health insurance coverage type (e.g., individual, family, Medicare, MassHealth, etc.).

4. The Social Security numbers of all individuals covered under the taxpayer's health insurance plan.

5. Any exemptions from the individual mandate, if applicable.

6. If the taxpayer received any advance premium tax credits during the tax year.

7. If the taxpayer had any health insurance coverage gaps during the tax year.

8. Any penalties incurred due to lack of health insurance coverage during the tax year.

9. Any additional information or explanations required by the form.

It is important to note that this information may vary slightly from year to year, so it is essential to refer to the most recent version of the Massachusetts Schedule HC for accurate reporting.

How do I modify my massachusetts schedule hc in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your schedule hc health care form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send hc health form for eSignature?

Once you are ready to share your hc health form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit ma hc form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing ma schedule hc form, you need to install and log in to the app.

Fill out your massachusetts schedule hc 2014-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hc Health Form is not the form you're looking for?Search for another form here.

Keywords relevant to mass schedule hc form

Related to massachusetts hc form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.